The Subjectivity Of Technical Analysis

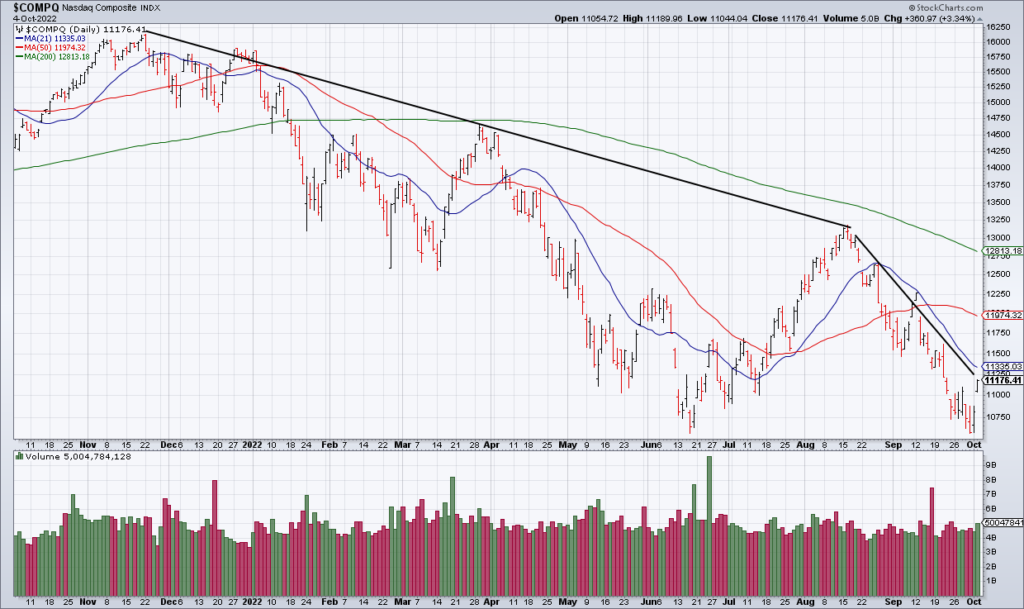

The technicians never cease to amaze me. The fundamental principle of Technical Analysis is: Don’t Fight The Trend. And as you can see from the trendlines I’ve drawn on the NASDAQ above: the trend is clearly down. And yet – after only two up days – many technicians are flipping bullish once again.

Shane Murphy just put up a tweet showing that the slope of the 50 DMA – while still negative – is diverging positively from price similar to 2001-03 and 2008-10. I’ve never seen this analysis before. David Zarling put up a tweet this morning suggesting that today’s action creates some sort of island on which bears are now stranded. JC Parets – one of the most popular technicians on Twitter – went on Bloomberg today to say that sentiment is washed out and this is a “historic buying opportunity”.

What gives? Why are so many technicians so ready to go against Technical Analysis’s fundamental principle? The answer is that you can draw the trend lines, moving averages, Fibonacci retracements and assorted technical indicators to support any conclusion you want. Technical analysis is completely subjective. It works to the extent that market participants follow it creating a sort of self fulfilling prophecy. And with markets having done nothing but go up for so long many technicians – who slant young – can’t imagine that we could be in for an extended downtrend. And so they’re doing exactly what Technical Analysis preaches most loudly not to do: Fighting The Trend.