“I will buy The Hamptons”: TSLA, Bitcoin, Call Options, Microcap and Penny Stocks

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

When the capital development of a country is subject to the whims of a casino the job is likely to be ill done – Keynes, The General Theory

There’s no other way to put it: The stock market has become worse than a casino. I’d rather take my money and play poker than invest in some of things investors are piling into. I know my expected return is much higher.

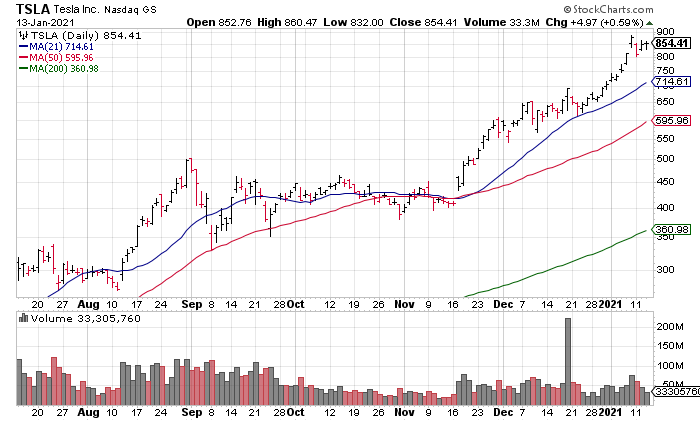

Let’s start with The Everything Bubble’s poster boy stock: Tesla (TSLA). At Wednesay’s close of $854.41, TSLA had a market cap just shy of $950 billion. That gives it a trailing P/E of 465x – and it’s worse than that. TSLA makes a lot of its money by selling Automotive Regulatory Credits, not cars. If you exclude the money they make from selling those credits to other car manufacturers and just include the money they make selling cars to consumers, the trailing P/E is 951x. That means TSLA would have to grow its earnings from selling cars by 10x just to have a 95x trailing P/E – which would still be high!

Another way of looking at TSLA’s insane valuation is to take its market cap and divide it by the number of cars it sold in 2020 (~500k). Doing so gives the you the value investors are placing on each car TSLA sold. That number is currently just shy of $1.9 million! Obviously, it doesn’t make sense to value a company that sells a product with an average selling price below $100k at almost $2 million per unit. Nobody ever said the stock market had to make sense though.

What’s crazy is that TSLA is starting to look like one of the better speculative investments in this market as investors move into more and more speculative corners of the market.

I’ve talked a lot about Bitcoin so I’ll keep this brief. Bitcoin recently pierced $40k and is currently around $38k and I don’t think most people, even those investing in it, have the slightest clue what exactly it is. I’m not 100% sure but this could very well be a contemporary version of Tulip Mania.

As if buying stock at these prices weren’t speculative enough, investors are piling into call options like never before. Over the last 5 days, an average of 27 million call contracts have traded hands, an all time record, according to Sentimentrader (Chart Source: Sentimentrader, “More than 1 trillion served”, January 13).

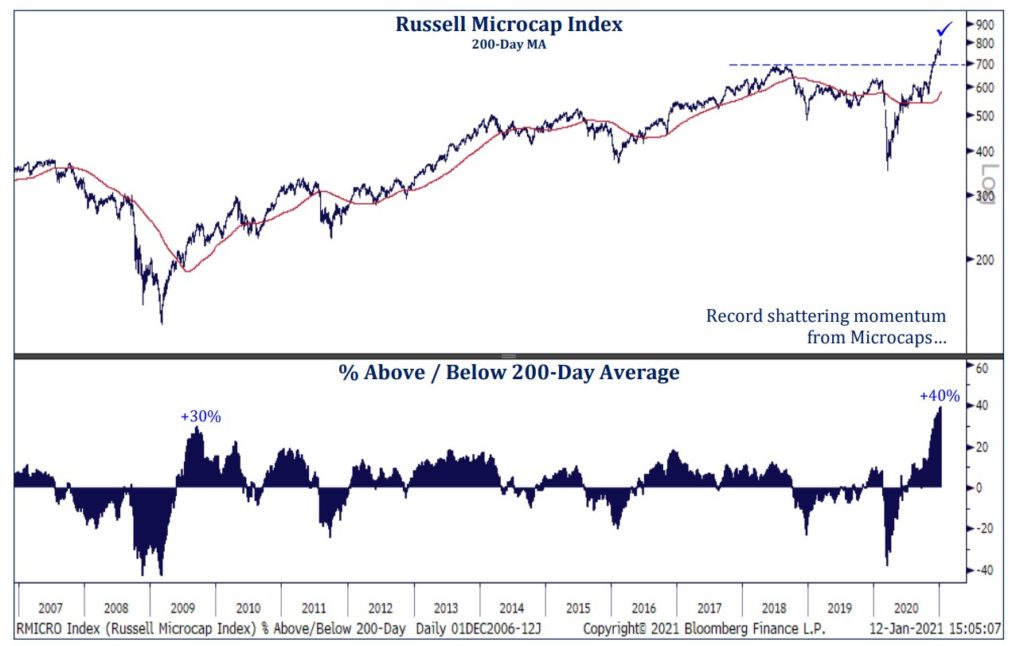

Investors are also venturing into Microcap and Penny Stocks. The Russell Microcap Index is 40% above its 200 DMA! In their tweet accompanying the following chart, Strategas wrote “This earned a ‘wow’ from us” (Chart Source: Strategas Twitter, January 13, 6:08am PST).

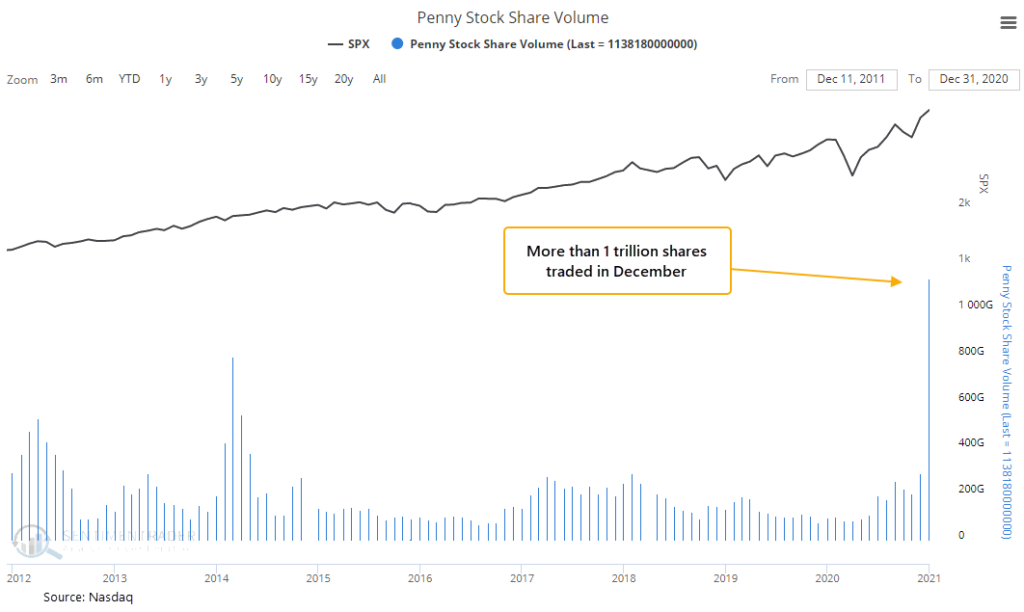

Microcaps have a market cap between $50 million and $300 million and are still generally risky but legitimate companies. Penny stocks are a whole different story. You really have no idea what you’re buying here in most cases as it’s hard to even get reliable information about most penny stocks. Nevertheless, investors are piling in with more than 1 trillion shares of penny stocks trading hands in December, according to Sentimentrader (Chart Source: Sentimentrader Twitter, January 13, 6:47am).

What’s disappointing is that many professional investors managing tens of billions of dollars are buying into this madness. For example, Cathie Wood and Ron Baron are two examples of Uber TSLA bulls.

It’s more understandable for a fraud like Chamath Palihapitiya to call for TSLA to “double and triple again” from these levels and for Bitcoin to hit $150k. This tweet from Chamath is one of the most hilarious things I have come across in my life:

When $BTC gets to $150k, I will buy The Hamptons and convert it to sleepaway camps for kids, working farms and low cost housing (Chamath Palihapitiya Twitter, December 30, 2020, 7:38am).

You can’t make this stuff up!

Last come The Kiddie Technicians like JC Parets, Ian McMillan, Aaron Jackson and Patrick Dunuwila who believe, based on the price action, that we are at the very start of a global mega bull market. You can’t really do more than chuckle as they are just children.

If Keynes, who has some of the greatest quotes on economics and investing ever, thought the Roaring 1920s stock market was a casino, I would love to hear how he would have characterized what’s taking place right now.