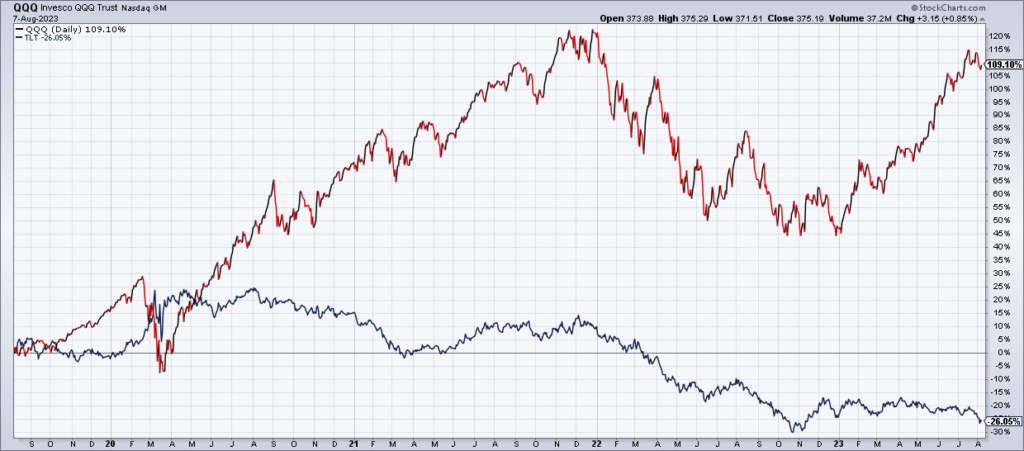

Long TLT, Short QQQ

The market has now priced in a soft landing based on the idea that the Fed can get inflation under control without causing the economy to roll over into recession. As a result, investors have piled into QQQ and completely lost interest in TLT. Personally I’m of the opposite view: All the Fed’s tightening is still working its way through the economic system and will eventually cause the economy to roll over into recession. In addition, Big Tech is now mature and will have to be repriced from growth stocks to value stocks, putting significant pressure on the indexes (for more on this point see “Apple Zero And The Maturation Of Big Tech”, Top Gun Financial, August 5). If I’m correct, this creates one of the best contrarian trades I’ve seen: Long TLT, Short QQQ. TLT closed Monday at $95.58 while QQQ closed at $375.19. My 18-month price targets are TLT $135 and QQQ $280.