Market Bounces As Expected But It Won’t Last

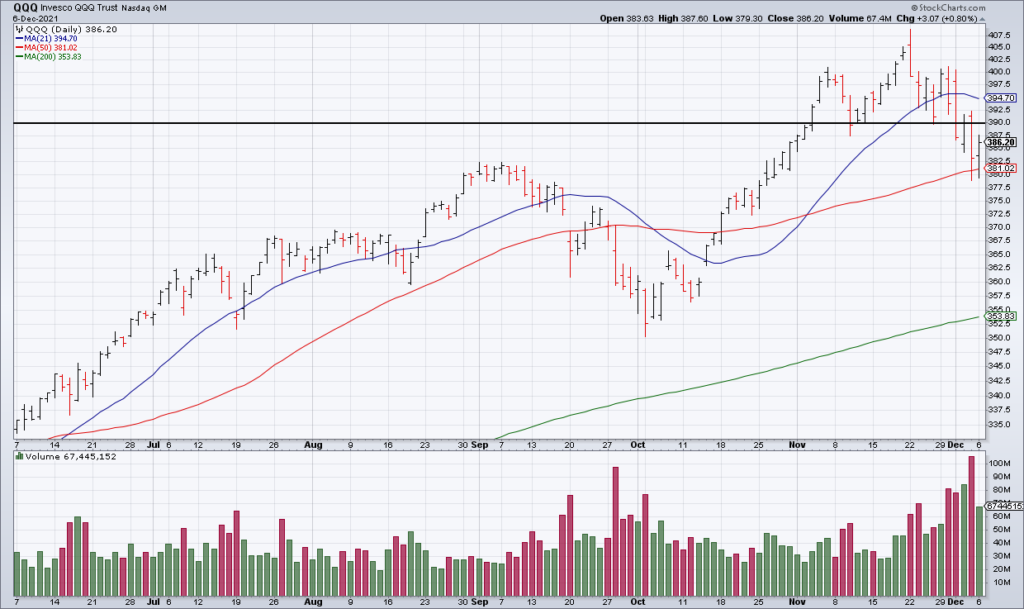

I do expect bulls to make a stand next week – perhaps as early as Monday morning. While everything else is technically broken, the QQQ has not cracked yet. While QQQ did take out $390 last week, it found support at its 50 DMA on Friday. That seems like a natural spot for bulls to buy. However – if so – this will only be a brief respite in a new bear market – Top Gun Financial, Saturday 12/4

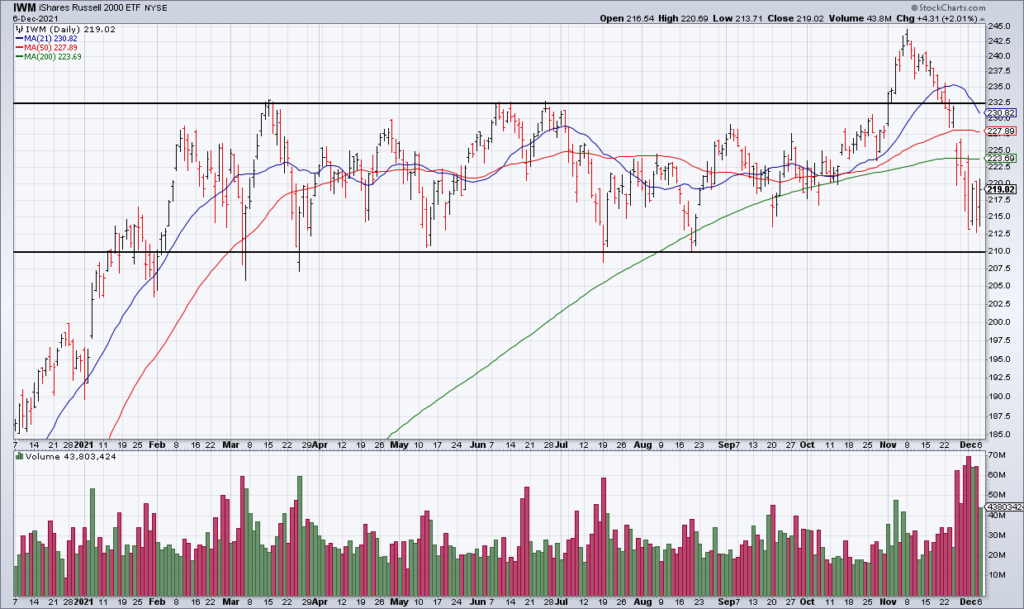

As I surmised it would late Friday night, the market bounced Monday as bulls made a stand at QQQ’s 50 DMA. The S&P was +1.17%, the NASDAQ +0.93% and the Russell +2.05%. NYSE + NASDAQ Advancers to Decliners were 5,522 to 2,609. Volume of 10.0 billion was solid but nothing to write home about compared to what we’ve seen lately.

Technically, no significant levels were taken out by the QQQ or IWM as you can see in the above charts – though bears still have work to do in these securities as well. Therefore, it can only be characterized as a bounce at this point. I would characterize the tepid move in ARKK – which is technically broken – as a dead cat bounce.

Nevertheless, bulls are likely to see in it confirmation that the bottom is in which should lead to more strength Tuesday morning. However, my guess is that sellers will step in as the QQQ approaches $390. That means Tuesday morning strength is a selling – or even a shorting – opportunity depending on your investment style.

Looking ahead, Friday is by the far the most important day this week. AVGO ORCL COST & LULU – which represent about $800 billion in market cap – report earnings Thursday afternoon and the November CPI Report comes out Friday morning at 8:30am EST. The November CPI Report will be especially important in determining the Fed’s decision in its upcoming meeting next Tuesday-Wednesday December 14-15.