Bulls Take Back Control Though My Bias Is Still Lower

Bulls took back control of the stock market Tuesday with a massive relief rally that sent the S&P +2.07%, the NASDAQ +3.03% and the Russell +2.28%. This is more than a bounce at this point and the bulls have the ball. Can they run with it?

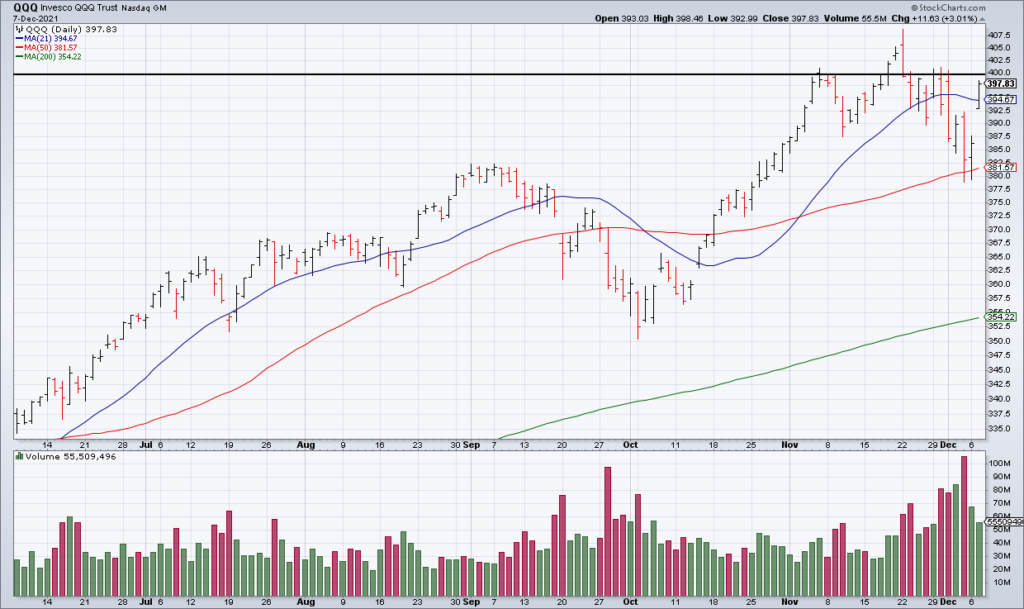

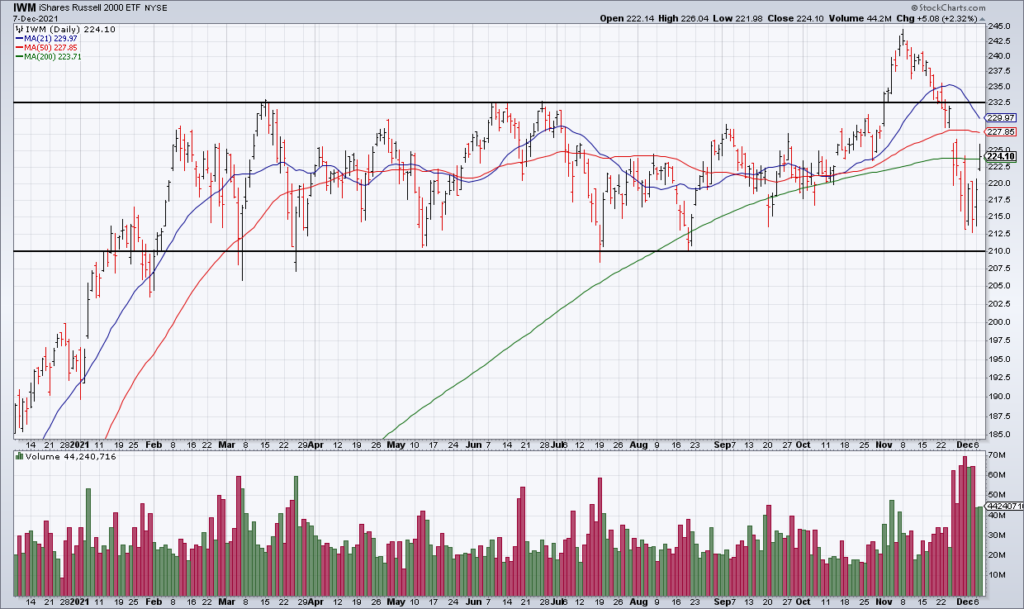

NYSE + NASDAQ Advancers to Decliners were 6,308 to 1,786 though volume was somewhat light compared to recent sessions at 9.6 billion shares. Indeed – as you can see in the charts above – volume was also light in the important QQQ IWM and ARKK ETFs.

There was no news besides a vague sense that Omicron might not be as bad as feared. Therefore, my bias is still lower though a NASDAQ close > 16,000 and QQQ > $400 would negate my bear market call.

One of the reasons I remain bearish is that there are so many broken charts out there. $2 billion market cap clothing service Stitch Fix (SFIX) reported earnings Tuesday after the close and their guidance was disappointing. The stock is currently -22.5% in the premarket (7:10am EST) at ~$19. That means it’s down more than 80% from its high at the beginning of the year. SFIX is not an important stock but there are others with similarly ugly charts (PTON and ZM are two examples).