Stocks Drift Higher And Interest Rates Rise Surreptitiously With November CPI Looming

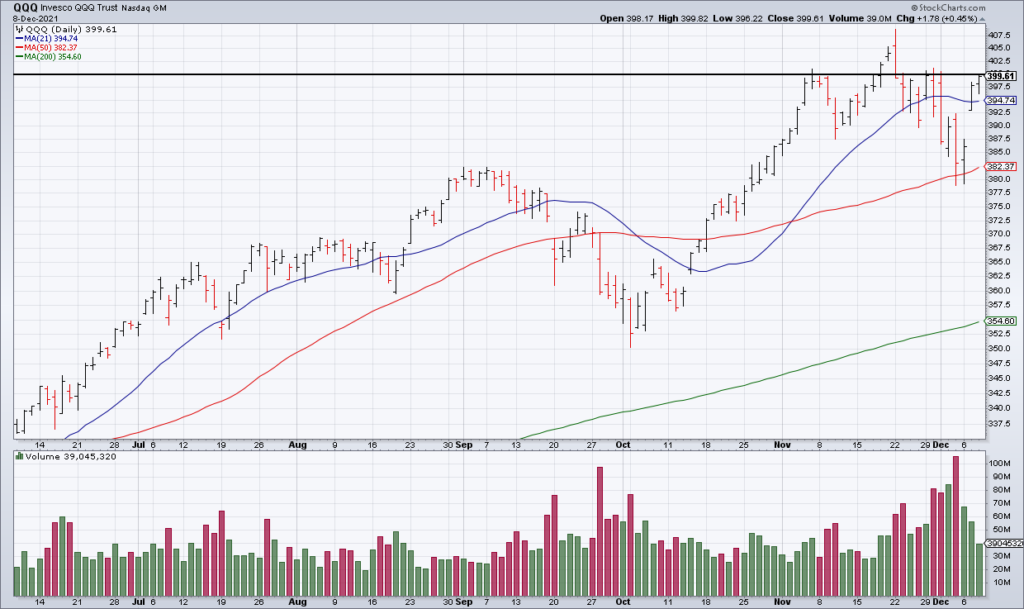

Stocks drifted higher on low volume Wednesday. The S&P was +0.31%, the NASDAQ +0.64% and the Russell +0.80%. NYSE + NASDAQ Advancers to Decliners were 5,141 to 2,883 and volume of 8.8 billion was light relative to what we’ve seen of late. QQQ closed just below the key $400 level at $399.61 – on very light volume as you can see in the chart above. Thursday’s session seems likely to be a low volume snoozefest ahead of the key November CPI Report Friday morning.

While there’s not a lot to say about the stock market Wednesday, the bond market was another story. Bonds sold off hard with TLT -1.73% on strong volume. In fact, it’s looking like TLT might have experienced a false breakout last week similar to the one in IWM – though neither are confirmed yet.

This is important because rising interest rates are a headwind for the expensive tech stocks that dominate the stock market. That’s because most of their earnings are in the future and higher rates mean those earnings have to be discounted at a higher rate as well, reducing their present value. While the move in bonds this week has gotten little attention, the stock market will take notice soon if it continues. The November CPI Report Friday morning will be important for bonds as well.