Losing Patience With PYPL; Looks Like A Value Trap

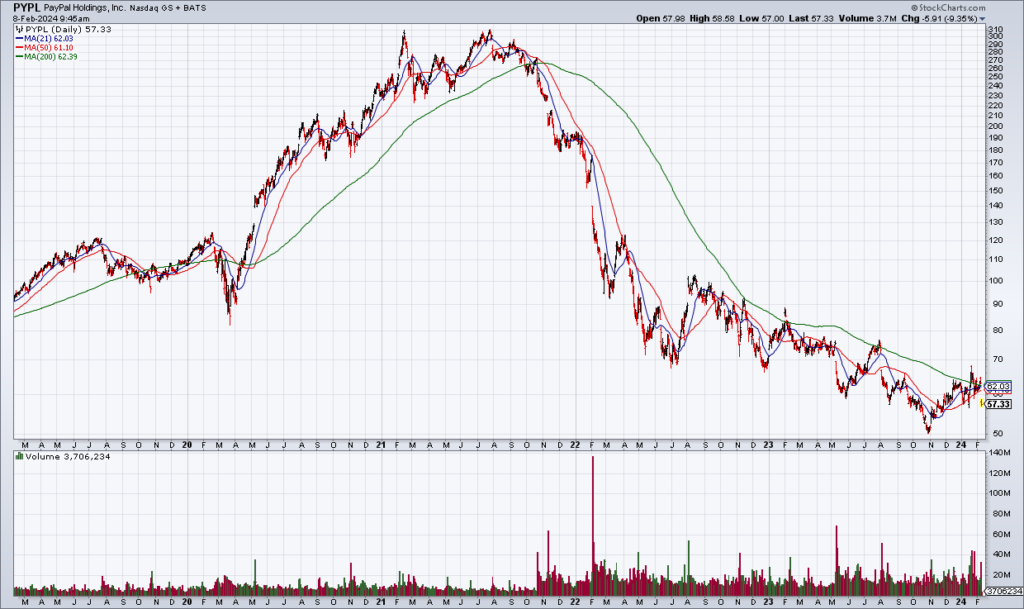

One of the pitfalls that investors – including myself – are prone to is dumpster diving. Take PayPal (PYPL) for example. Less than 3 years ago the stock traded for $300 so it’s hard not to think it’s a bargain today at $60. But I’m losing patience with the stock after accumulating a big position over the last year.

The stock is currently -9% after another disappointing quarter Wednesday afternoon. The problem is that the growth seems to be gone making me suspicious that PYPL has become a dreaded “value trap”. That’s a stock that looks cheap based on superficial quantitative metrics but really isn’t upon deeper analysis.

PYPL guided 1Q24 revenue growth to only 7% and full year 2024 EPS is expected to be flat with 2023 at $5.10. That’s just not going to move the needle.

One of the hardest things to do in investing is selling a loser. Why? I actually think it’s not so much losing the money as admitting that you were wrong. Our egos get in the way and we hold on, hoping that the stock will bounce and validate our original thesis. But once you learn to own up to mistakes, sell losers and move on, it frees you psychologically and prevents you from holding on to stocks that are going nowhere fast.