Revisiting The Garbage Stocks In The Wake Of WM Earnings

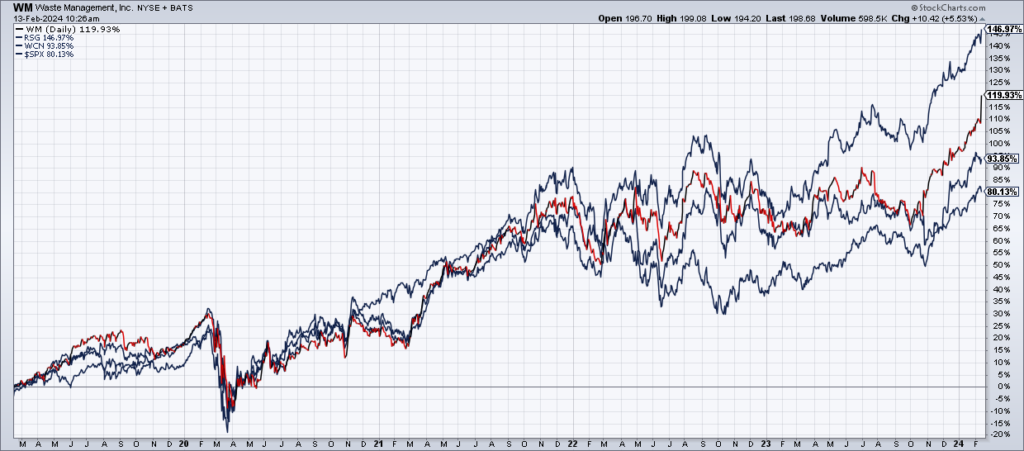

A year ago I put 2% of the portfolios into the garbage stocks: Waste Management (WM), Republic Services (RSG) and Waste Connections (WCN) – and the basket is +25% since then. What I like about these businesses is that they are necessities and monopolies. That is, garbage disposal is needed no matter what and these companies have no competition in their respective territories. While the stocks are traditionally expensive for these reasons, they continue to perform.

WM reported 4Q23 earnings Monday night. What stood out to me – and perhaps the market with shares +5% Tuesday morning – was the strong 2024 guidance. WM expects full year revenue growth of 6-7% based on core pricing increasing 6.0%-6.5% and volume growth approaching 1%. As a result, Adjusted Operating EBITDA is projected to increase about $450 million at the midpoint of their guidance of $6.275-$6.425 billion. WM expects to repurchase $1 billion worth of shares in 2024 and increased its quarterly dividend to 75 cents (from 70 cents) as well.

WCN reports Tuesday afternoon.