LULU Is A Great Company But Now Is Not The Time

Athletic apparel maker Lululemon (LULU) is a great company but now is not the time for the stock. LULU reported a solid 3Q22 with comps +22% and EPS of $2.00. However the stock is -6% in the premarket as 4Q22 guidance was a little light compared with Wall Street’s expectations.

There are two problems for LULU in my opinion that together make it a sell: the macro environment and valuation. With inflation and a weak economy squeezing consumers LULU sells exactly the kind of discretionary products that they can do without. While LULU caters to a higher end clientele they are still not immune from the macro forces in play. As I’ve said many time before: In this economic climate you want companies that sell necessities not luxuries.

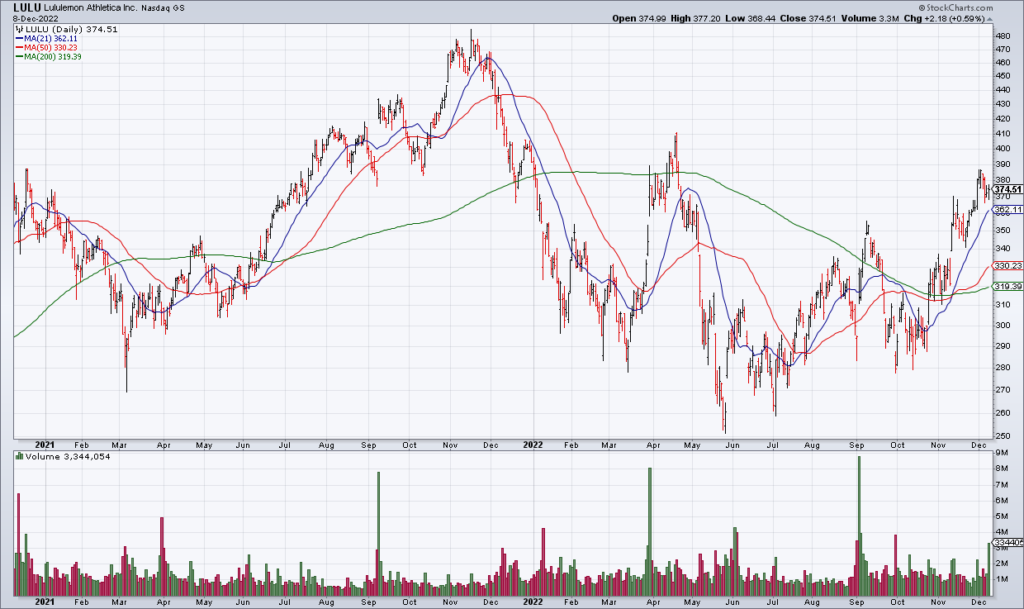

In addition to the macro climate LULU is too expensive. They are guiding full year EPS to $9.87-$9.97. That’s 38x based on Thursday’s closing price of $374.51. That valuation leaves a lot of room for the stock to come in – especially if the business performance isn’t stellar which I suspect it won’t be because of the macro climate.

I never want to discourage women from buying spandex but I’m bearish on LULU stock for the time being.