LYFT: What Do Investors Want?

Ride hailing company Lyft (LYFT) reported 3Q22 earnings after the close Monday and shares are getting dinged to the tune of 13% in the after hours at the moment. But I can’t figure out why.

Active Riders came in at 20.3 million compared to 18.9 million a year ago. Apparently Wall Street was expecting higher but it’s not a terrible number. Revenue increased 22% to over $1 billion and 4Q22 guidance was solid.

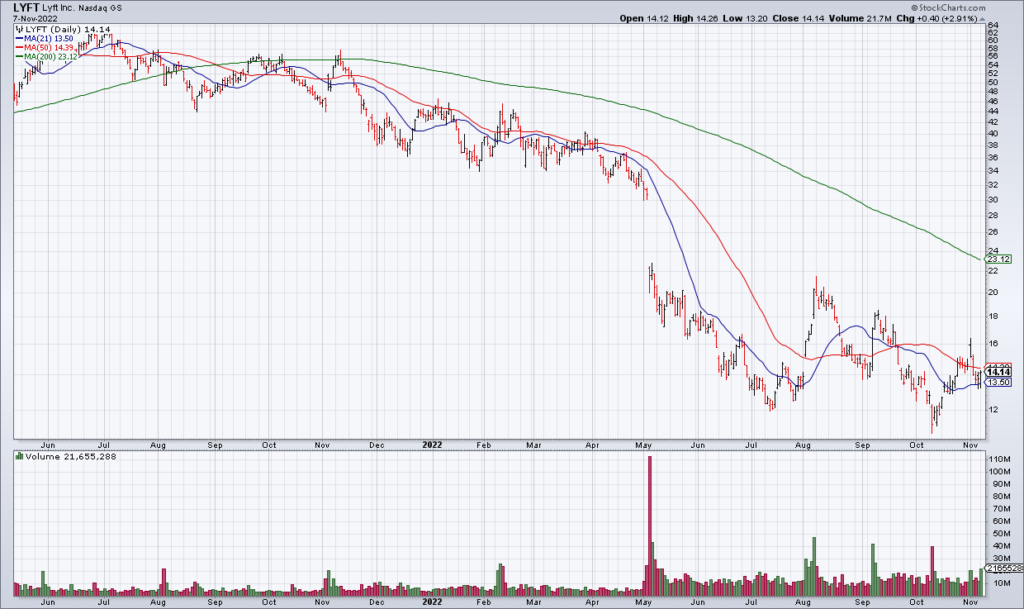

It seems like nothing satisfies investors right now. Despite being down nearly 80% from its all time highs last year and with results that show the company is still chugging along investors are dumping shares.

I don’t want to get too bullish as long as the Fed is maniacally raising interest rates but some of these values are just too good to resist. At some point the Fed will ease off the gas in its fight against inflation and we will see a tremendous relief rally. I want to have some positions in my portfolio to profit from that.