Speculating On The October CPI

WARNING: The trade recommended in this blog is highly speculative. You could lose all your money. If you choose to take it keep that in mind and invest only a small amount of money.

I usually like to save my gambling for the poker table but today I’m making an exception. The market is extremely pessimistic after Fed Chair Powell beat down an incipient rally again last week. I myself even mused last Thursday on Twitter: “If the Fed doesn’t want the market to go up how can it?” But there is a catalyst that could spark a momentous relief rally: the October CPI Report scheduled to be released Thursday November 10 at 8:30am EST.

Despite Fed Chair Powell’s continual insistence that it’s too early to pivot at some point soon the Fed will. The Fed is not stupid; they know that continually hiking interest rates in 75 point increments risks an unexpected meltdown. They want to slow the economy not tank it. The risks between inflation and the economy are more evenly balanced after all the hiking the Fed has already done.

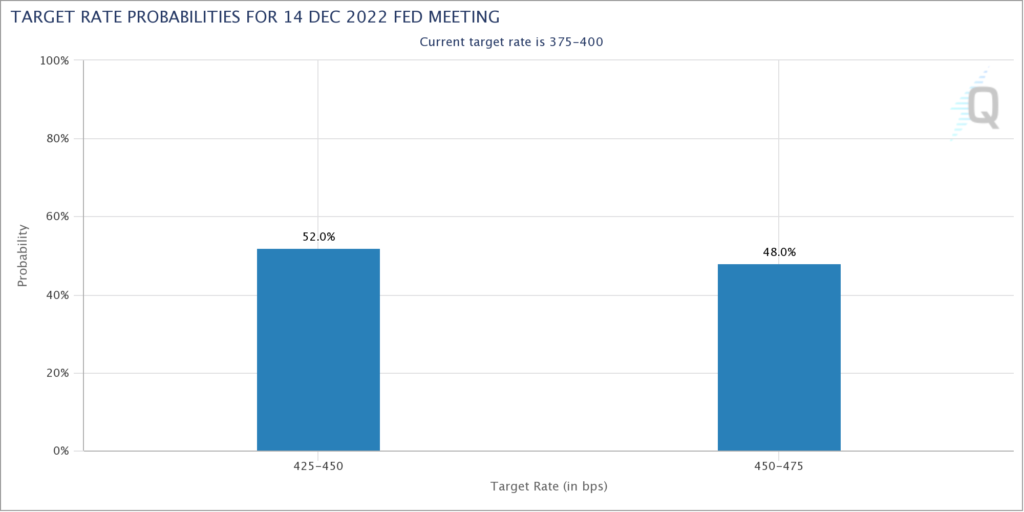

Despite being continually bitten by being early in predicting a Fed Pivot the Fed Futures are split between a 50 point and 75 point hike in December. The October CPI Report could be the determinative data point.

If the October CPI comes in below 8.0% I think the market could be positioned for a massive relief rally. With everybody positioned bearishly, many stocks exhibiting real value and everybody afraid of the Fed, such a print may catch everyone off guard and result in furious short covering and repositioning. It would throw a monkey wrench in a lot of investor’s expectations.

An aggressive way to play such an event is ARKK calls. Yes that’s right: I am buying November11 $38 ARKK calls which can currently be had for about 15 cents. Interestingly enough a surprisingly large amount of these calls traded Monday: 31,311. Somebody else may have the same idea.

When you combine the market’s extreme pessimism overall with the even greater pessimism toward Cathie Wood and ARKK you have the potential for a very big move. I don’t think $40 is out of the question in which case the calls would be worth $2 – or 13x their current price. It’s a gamble I’m willing to take.