My Problem Stocks: CLX, GILD, MO

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

Since the beginning of my investment career, I’ve had an affinity for Value Traps. Value Traps are stocks that appear cheap based on quantitative metrics but are justifiably so due to low quality, deteriorating underlying businesses. Warren Buffett had this problem for the first 20 years of his career and was helped by Charlie Munger to realize that Quality is more important than Price. It was only when he made this transition that Warren Buffett became a great investor.

Therefore, I’m always asking myself: “Is this stock cheap for a reason? Is this a low quality company?” With that in mind, let’s take a look at my three problem stocks: Clorox (CLX), Gilead (GILD) and Altria (MO). While each of these companies have strong brands and I do not believe them to be paradigmatic examples of Value Traps, my concern is that they share an affinity with that dreaded category of stocks.

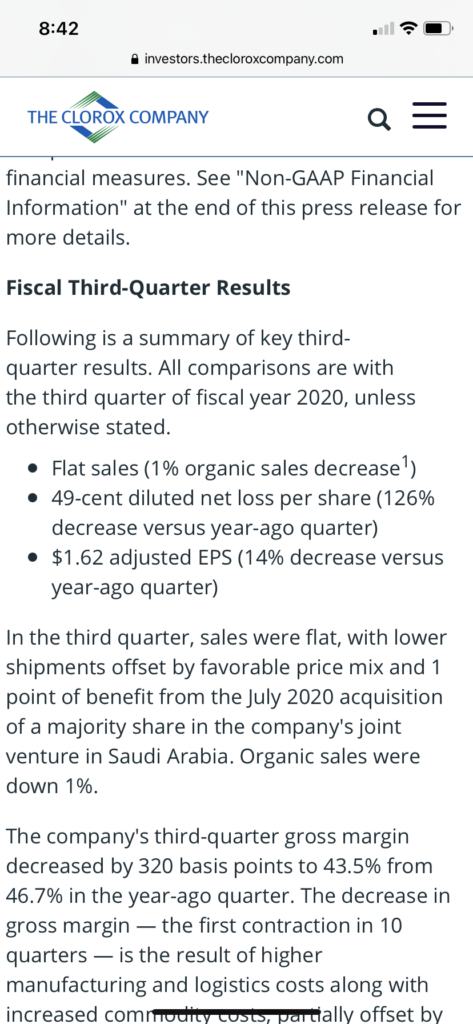

Let’s start with Clorox (CLX) which reported 1Q21 earnings Friday morning. After quarters of 26%, 27%, 22% and 17% Organic Revenue Growth in 2020, CLX reported a dud yesterday morning with Organic Revenue Growth of -1% resulting in a 14% decline in Adjusted Diluted EPS. One interpretation is that with COVID on the wane, demand for CLX’s portfolio of cleaning products will decline correspondingly. However, it is worth noting that CLX faced a really tough comp of +17% from 1Q20. In that context, -1% might not be that bad as it held onto most of those sales gains from a year ago.

Nevertheless, the perception appears to be that the days of CLX’s business being the pandemic sweet spot are over. I can’t disagree that the waning of the pandemic will have an inverse effect on CLX’s sales but my thesis has been that COVID will permanently alter consumer’s cleaning habits to some extent going forward. I’m not convinced this quarter disproves that thesis. All the same, there is some truth to the perception, CLX is not cheap at 24x Adjusted EPS Guidance of $7.45 to $7.65 for the fiscal year ending 2Q21 and the stock is acting terribly.

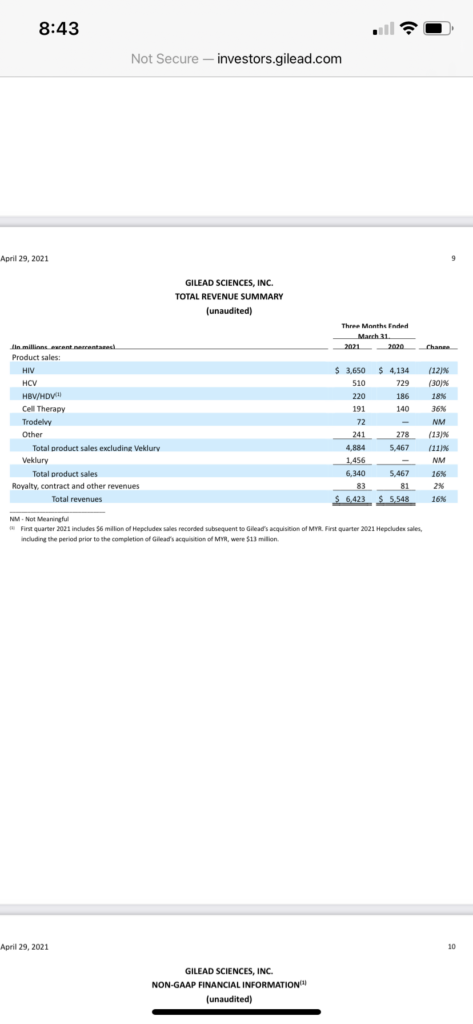

Next let’s take a look at Gilead (GILD). On Thursday afternoon, GILD reported a 12% decline in the sale of its core HIV portfolio of drugs. The stock got sold hard at the open though it rallied back for the rest of the day Friday to finish down only 0.58%. GILD is extremely cheap at 9x 2021 Non-GAAP Diluted EPS Guidance of $6.75 to $7.45, has tremendous Free Cash Flow and a dividend yield of 4.47%. In addition, I also have a sentimental attachment to Gilead because my father owned an apartment building near its headquarters in Foster City, CA that I visited many times when I worked for him part time in 2016 and 2017. Regardless, if the decline in their HIV drug portfolio continues and they can’t replace it with new drugs from their pipeline, despite its cheapness GILD is a declining business.

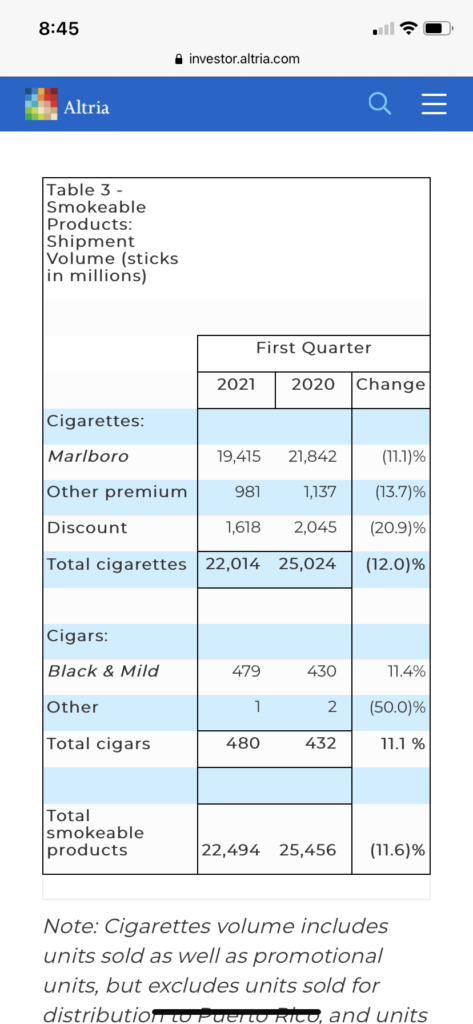

Last, let’s take a look at MO. MO had been killing it this year and I was very happy with the stock until it came out two weeks ago that the Biden Administration was looking at banning menthol cigarettes and reducing the allowable nicotine content in cigarettes in general. Obviously, this regulation would have a catastrophic impact on MO’s business and the stock got hit hard though it has since stabilized. MO has long traded at a steep discount due to this regulatory risk and cigarette stock investors have gotten a stark reminder of our worst nightmare. As if that weren’t enough, MO reported a 12% decline in cigarette shipments on Thursday morning.

I’m attached to MO as well because it’s been working, sells an addictive product, has a cheap valuation at 10.5x 2021 Adjusted Diluted EPS Guidance of $4.49 to $4.62 and pays a fat 7.20% dividend. Nevertheless, the proposed regulation would suck the life out of its business. I don’t know how to quantify this regulatory risk but it’s obviously a huge overhang for the stock going forward until it gets resolved.

With my natural inclination towards Value Traps, I have to be on constant guard that I’m not slipping back into some form of the old error. These are the stocks that are currently giving me anxiety that I might be.