ORCL Earnings And The AI Euphoria

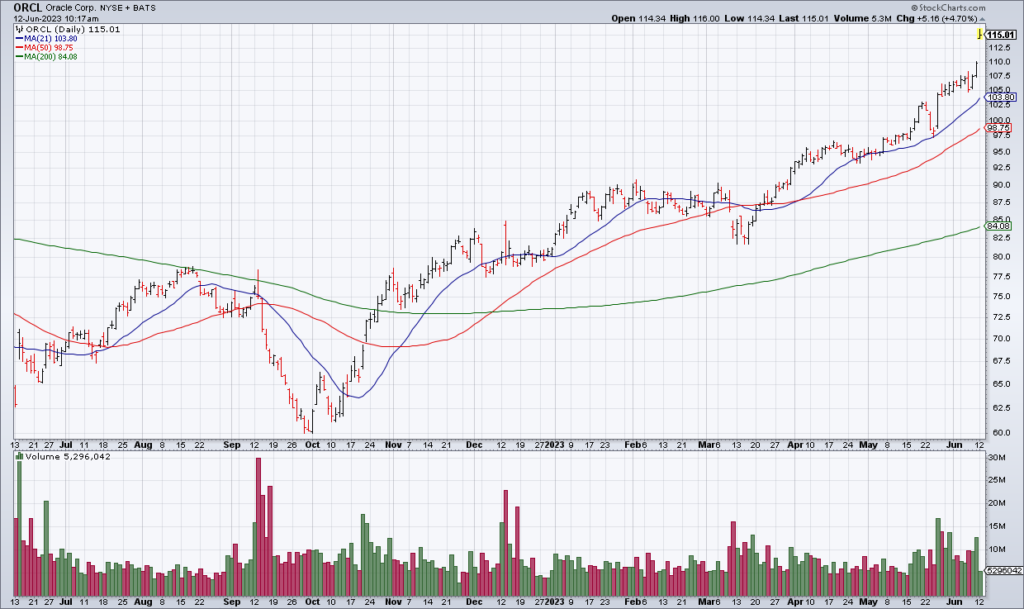

The big event Monday is Oracle (ORCL) earnings after the close. The stock gapped up almost 5% at the open – and it was already at an all time high. The question is: Will ORCL report spectacular guidance like Nvidia (NVDA) – sending the shares further up into the stratosphere – or will it merely be a solid quarter – like Salesforce (CRM) and Broadcom (AVGO) – which likely isn’t good enough given the run up in shares?

I don’t know the answer to that but investors are pricing in the former with ORCL now trading for 23x current year EPS and the stock more than 30% above its 200 DMA. One way to try to profit from the euphoria is to sell calls to investors who want to speculate. I sold a few ORCL $125 Jun16 calls for ~$1.70.

Note: Selling naked calls is extremely risky because theoretically there is no limit to how high a stock can go and so your losses are uncapped. Sophisticated investors only.