Powell Lectures The Market

On Friday morning Fed Chair Jerome Powell used his much awaited speech in Jackson Hole, WY to lecture the market like a father whose teenage son took the car without permission. Powell was clearly annoyed by the market’s presumption in rallying on the idea that inflation has peaked and therefore the Fed will slow down. Ultimately – however – I suspect the market will be proven right.

That’s because inflation does appear to be peaking – at least for now. As Justin Lahart pointed out in Saturday’s WSJ, gas prices have continued to fall in August as have used car prices. Retailers are discounting merchandise to unload unwanted inventory and container shipping rates have declined sharply. All of this suggests that the August CPI Report – scheduled to be released on Tuesday September 13 at 8:30am EST – will continue the trend started in July of lower inflation numbers (“Fed’s Tough Talk Could Be Transitory” [SUBSCRIPTION REQUIRED]).

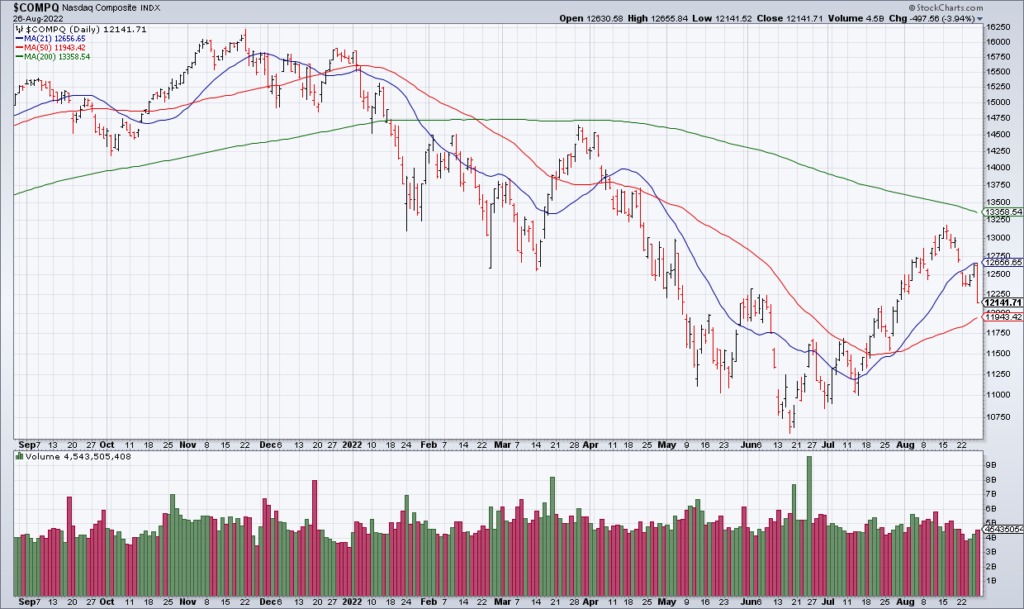

If correct, the Fed will likely raise interest rates by only 50 points at its meeting on September 21 – not 75. And that could be the prelude to a pause in the near future as the Fed evaluates the effects of its previous tightening. It’s just this sort of narrative that the summer rally has been premised on. Therefore while the 2500 point rally in the NASDAQ from mid-June to mid-August priced this in in my opinion Powell’s Jackson Hole speech is not the beginning of a complete unwind of that rally.