Psychoanalyzing The Market

On Tuesday afternoon, I experienced a wave of anxiety over my market positioning. I own long term treasuries, consumer staples and other defensive stocks and am short many of the large tech stocks that have been powering the market higher this year. And it finally got to me. “Am I wrong?” I asked myself. “Should I cover my short positions?” I wondered.

How does one go about rationally answering these questions in an environment of radical uncertainty like the stock market? For me, it comes down to being mindful of my process.

One thing I know about myself is that I am a very independent thinker which can bleed into stubbornness. The paradigmatic example of my stubbornness was in 2020 when I held onto – and added to – my short positions into the post-COVID melt up. “Am I doing it again?” I thought to myself yesterday afternoon.

This is where a concept from psychoanalysis comes in handy. Transference refers to projections from his past that the patient puts onto the analyst. Instead of seeing the analyst clearly, the patient unknowingly projects onto him relational dynamics from his past. But the analyst does the same thing. This is called countertransference. The experienced and skilled analyst – however – understands this and analyzes his reactions to the patient. He distinguishes between his own projections and reactions that are responses to the patient’s actual behavior in the present.

What does this have to do with the stock market?

Because I’m a very independent thinker, if I’m experiencing anxiety about my bearish positioning than almost every other bear is likely to be as well. In fact, most bears have probably already capitulated to the market action. The one exception is permabears who are bearish at all times and will never change their minds or adjust their positioning. To connect the dots, my countertransference to the market action is telling me that I’m close to the point of needing to change my mind.

One thought I had was to simply cover all my short positions during Wednesday’s trading session ahead of Tesla (TSLA) and Netflix (NFLX) earnings to avoid any further losses. Upon further reflection – however – I decided that that would be impulsive. I decided to see what the market reaction would be to TSLA and NFLX earnings given their extended run into earnings. And – as I hoped – each stock sold off in the after hours after their reports.

Where does that leave me?

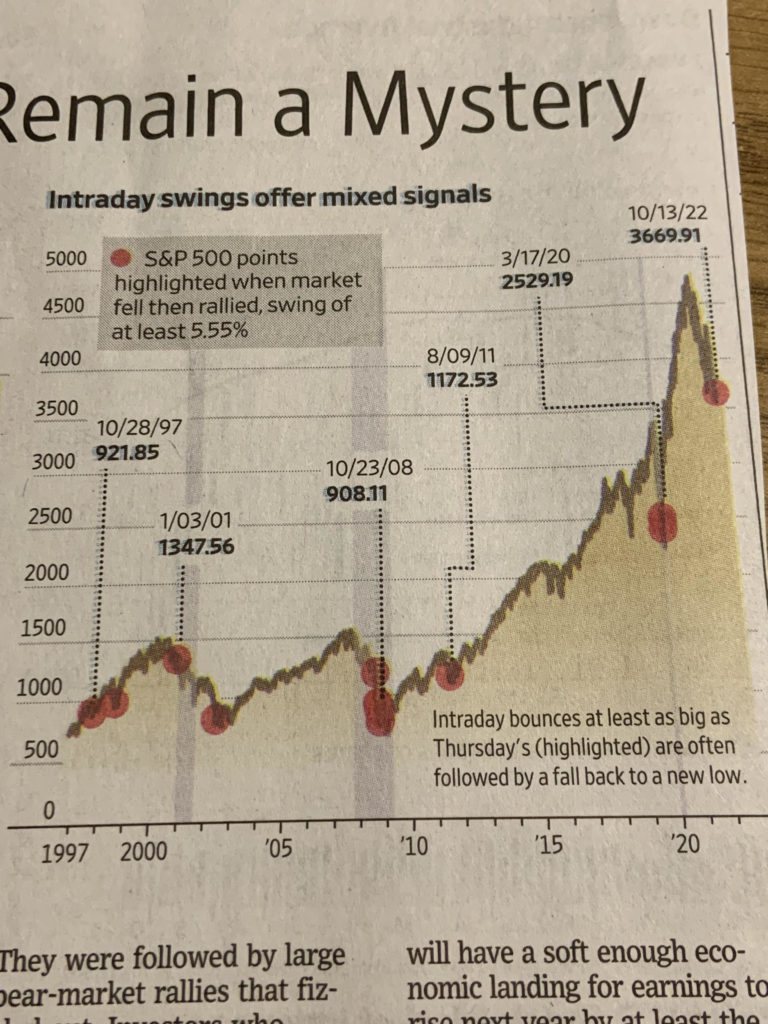

I am by no means declaring victory or completely reaffirmed in my bearish positioning. This afternoon’s action has simply caused me to give my positioning a little more room to work. As you can see in the tweet above by @MacroCharts, the S&P has gone 37 days without a 1% decline for the time since the top in November 2021. The futures are currently down only marginally on TSLA and NFLX but we’ll see how things develop overnight and into the morning. A 1% down day would allow me to take a deep breath and give me more margin to let my positions work. But we’ll see.

As the rest of The Big 7 technology companies report over the next couple of weeks, I’ll be anxiously watching to see the market reaction. And I will be making my decision about whether to abandon my short positions based on what happens. I’m determined not to get run over again like I did in 2020. On the other hand, I don’t want to prematurely abandon the positioning that my analysis persuades me is correct. This is how you balance stubbornness with flexibility.