Euphoria Reigns As Investors Price In Soft Landing

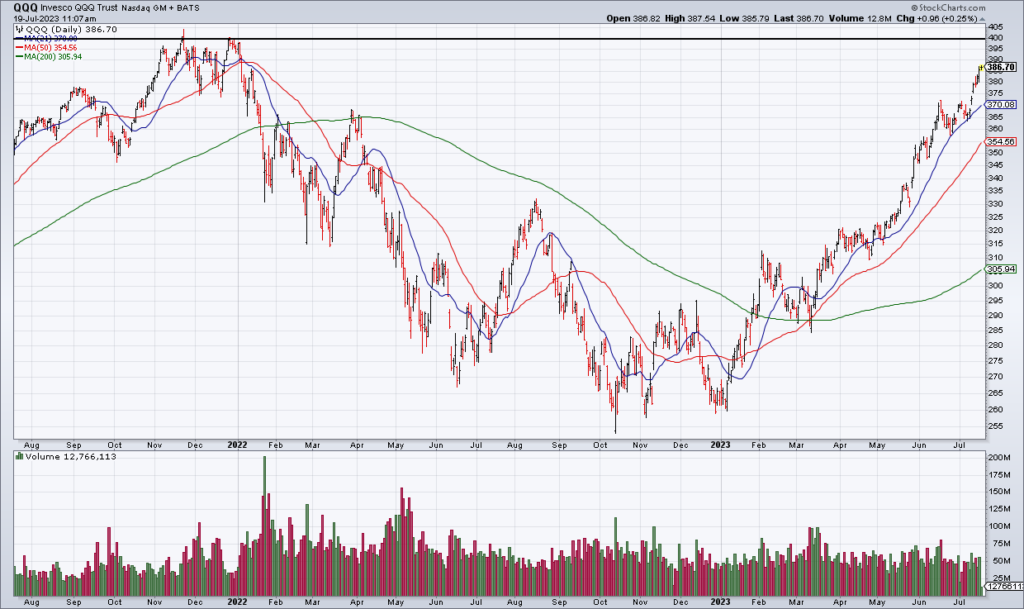

The stock market rally so far this year is only picking up speed. Last week’s benign June CPI Report has led investors to believe that the Fed will end its hiking cycle next week without pushing the economy into a recession. In other words, a soft landing is being priced in (see Akane Otani, “Markets Appear Convinced The Fed Can Pull Off A Soft Landing” [SUBSCRIPTION REQUIRED], Monday July 17, WSJ B1). As you can see in the chart above, the NASDAQ-100 ETF (QQQ) is almost back to all time highs.

There are two arguments that push back against the soft landing scenario. The wonky one argues that inflation won’t come down much further without the labor market softening and thereby decreasing services inflation. Therefore, the Fed will have to tighten more than just one more time. The second argument is that all the previous tightening the Fed has done is still working its way through the system and has not been fully felt yet by the economy. Even if true, bears like myself are feeling the heat right now.

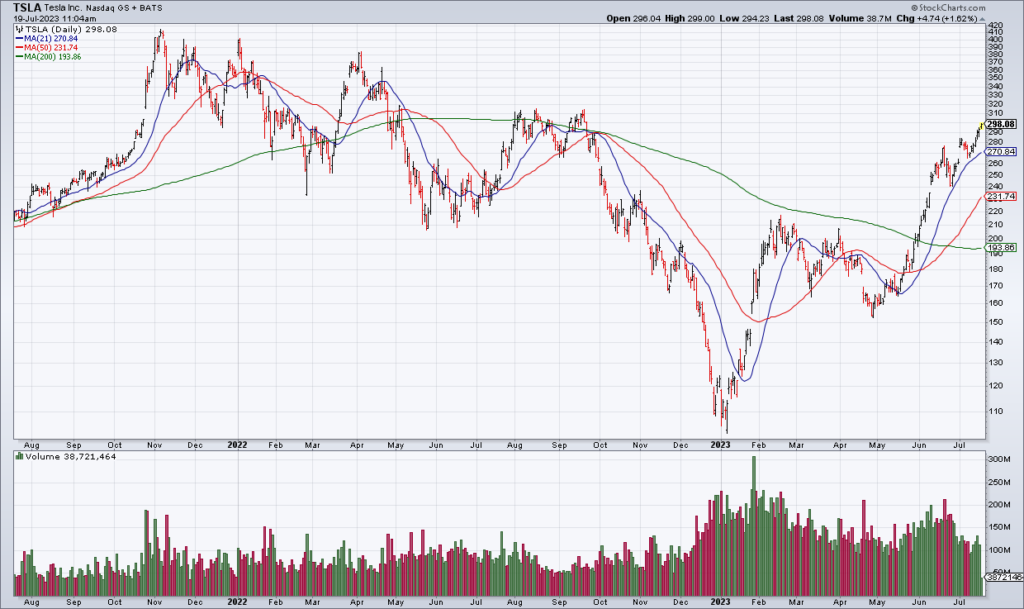

2Q23 earnings season is beginning in earnest today with Goldman Sachs (GS) reporting this morning and Netflix (NFLX) and Tesla (TSLA) reporting after the close. While GS’s quarter was unimpressive – revenue -8%, EPS -60% – the stock is actually up marginally. More interesting will be the reaction to NFLX and TSLA earnings because both stocks have had enormous runs so far this year and their valuations are stretched. I’m fading both reports by selling some Jul21 $500 calls on NFLX and Jul21 $325 calls on TSLA. Hopefully I don’t get my face ripped off.

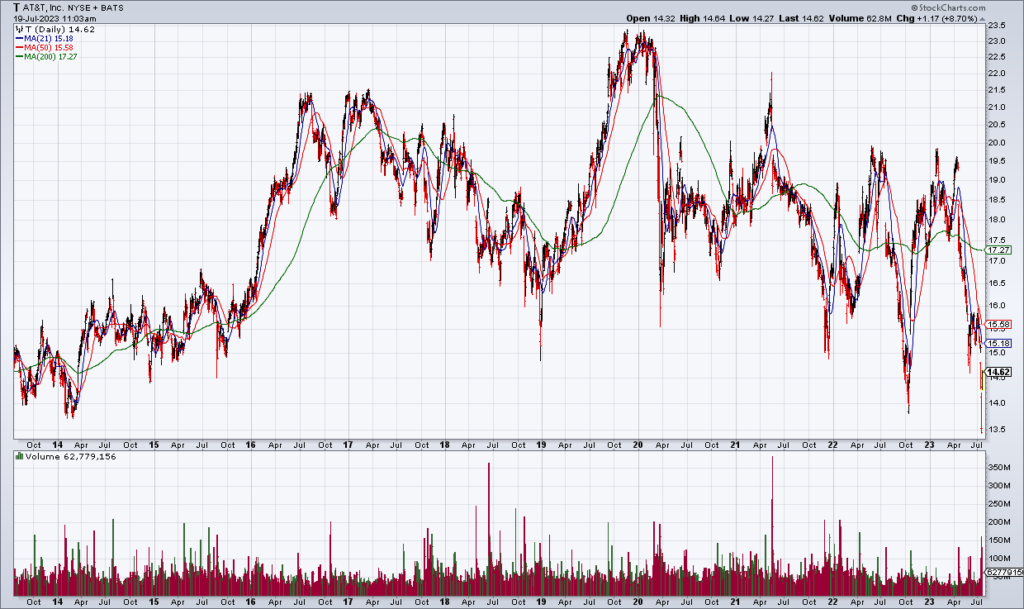

I’m also keeping an eye on the wireless carriers AT&T (T) and Verizon (VZ) whose shares have been bruised in the wake of a WSJ investigative report that detailed the risks from copper cables sheathed in lead that are remnants of the old Ma Bell network. While both stocks are getting a bounce today, each is essentially at 10-year lows. (See Dan Gallagher’s overview in today’s WSJ: “Lead Cables Will Be Dead Weight For Telecom Carriers” [SUBSCRIPTION REQUIRED]).

Top Gun holding Lockheed Martin (LMT) reported solid earnings Tuesday morning. LMT raised the midpoint of its full year revenue guidance by a billion dollars to $66.5 billion and the midpoint of its full year EPS guidance by 35 cents to $27.10. Surprisingly the stock is down ~4% since the report providing an entry for investors who want exposure to the defense industry.