Inflation Is Dead, The Fed Is One And Done, And Stocks Only Go Up

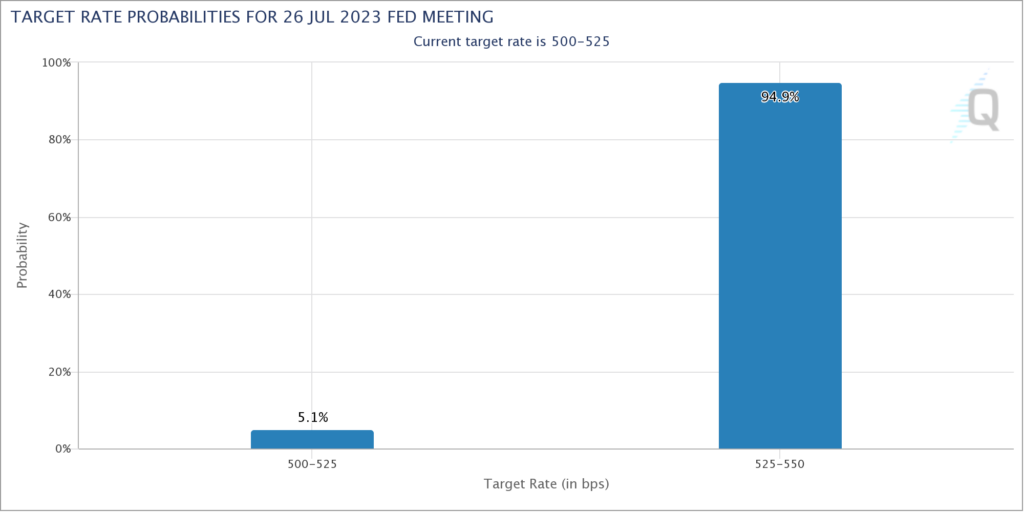

The June CPI Report came in below expectations Wednesday morning resulting in another rally in stocks. Headline CPI was 3.0% and Core 4.8%. For some reason the Fed feels the need to hike rates one more time in two weeks – but that should be it.

All these Fed rate hikes were expected to drive the economy into a recession by now – but it hasn’t happened. Therefore, most investors can’t think of a reason not to be bullish and the NASDAQ is up nearly 40% from its October 2022 lows.

I’m in the minority but I find it hard to believe that hiking rates from 0% to 5.5% isn’t going to significantly contract the economy at some point. The market clearly disagrees with me but basic economics suggest otherwise.

Therefore, I’m still bearish and prefer defensive stocks like Pepsi (PEP) – which reports earnings tomorrow morning. Even in hard times consumers will buy PEP’s soft drinks and snacks. For 2023, PEP expects to deliver 8% organic revenue growth and 9% core constant currency EPS growth. The latter assumption works out to $7.27 EPS this year. While PEP won’t benefit much from Artificial Intelligence or the Metaverse, people will drink Pepsi and Gatorade and eat Lays potato chips for the foreseeable future.

If you’re a tennis fan and can get away from work, flip on ESPN to watch 27-year old American journeyman Chris Eubanks versus Daniel Medvedev (3) in the quarterfinals of Wimbledon. Eubanks played in the minor leagues of tennis for years before breaking out this year. The match is currently tied at 1-set apiece and Eubanks is up a break in the 3rd set.