Turo: The AirBnB Of Rental Cars – And How To Play It

On New Year’s Eve, the roads in San Carlos were flooded and I banged up my Jeep Grand Cherokee. It was undrivable and I wanted to go out that night. The rental car agencies were closed so I found a Mercedes SUV on Turo only a block away from my apartment. The platform was intuitive and the process a breeze. It wasn’t cheap but I loved the car and it put Turo on my radar.

Turo is the AirBnB of rental cars. Just like AirBnB allowed homeowners to monetize spare rooms and second homes – disrupting the hotel industry – Turo is doing the same for car owners. In a column in Monday’s WSJ, Ben Eisen wrote about Turo – and Getaround – and mentioned that Turo is expected to IPO (“Rental Cars Are The New AirBnB” [SUBCRIPTION REQUIRED]).

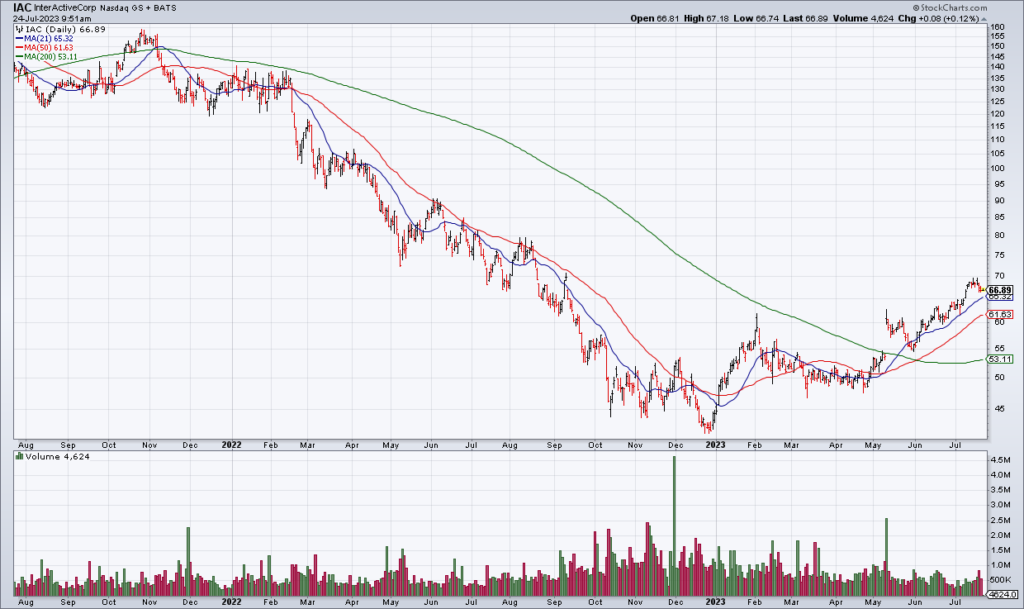

The only way to play Turo via the public markets is Barry Diller’s conglomerate IAC which owns a 31% stake plus warrants. I first wrote about IAC in November 2022 when I read a WSJ Heard on the Street article by Laura Forman. The stock is up by 1/3 since then but I still think there’s a lot of hidden value.

In his most recent shareholder letter, IAC CEO Joey Levin included Turo’s annual income statement from its most recent amended S-1 at the time. (An S-1 is the form companies that want to go public file with the SEC). In 2022, Turo had $747 million revenue, $80 million Adjusted EBITDA and $155 million Net Income. Revenue is growing exponentially, from $469 million in 2021 and $150 million in 2020. In other words, Turo may really be the next AirBnB and owners of IAC could be handsomely rewarded as its IPO gets on investors’ radar.

Disclosure: Top Gun is long shares of IAC.