Navigating The Soft Landing Narrative

There’s an actual chance here the Fed could stick the landing – Dryden Pence, CIO Pence Capital Management (quoted in Karen Langley “Stock Market Shrugs Off Recession Signals As Rally Builds” [SUBSCRIPTION REQUIRED], WSJ B1 Wednesday 7/26)

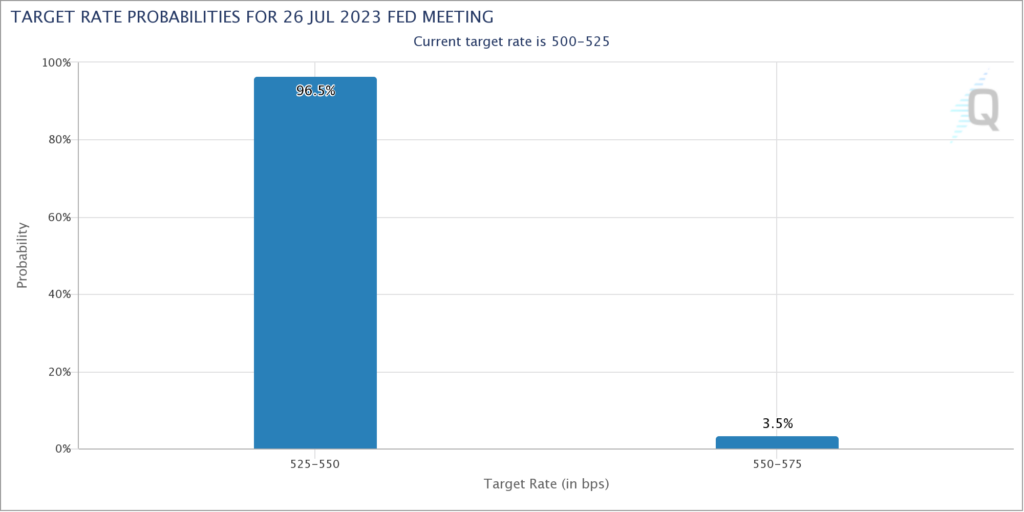

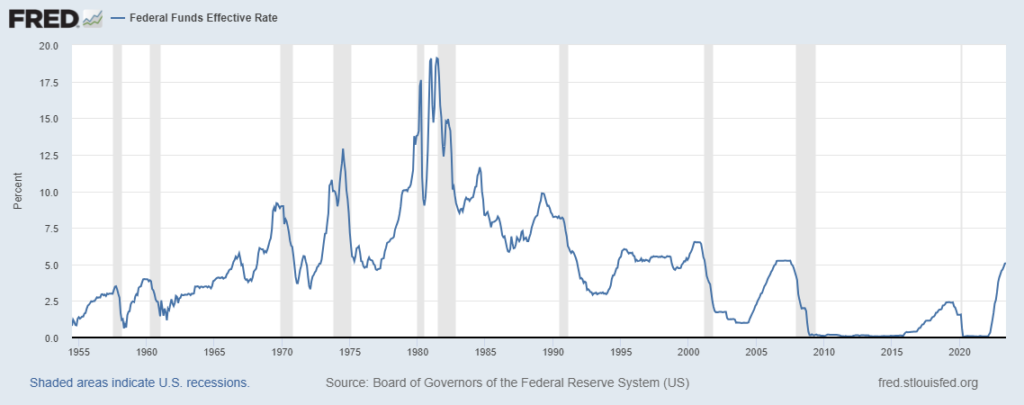

In less than an hour the Fed will raise the Fed Funds Rate a quarter of a point to 5.25%-5.50%. As you can see in the chart above, the last time rates were this high preceded The Great Recession. Prior to that it was The Dot Com Bust. And yet the market continues to believe that this time will be different and the Fed can pull of a soft landing.

Snapchat (SNAP) is getting destroyed again but it’s clearly company specific. While they continue to increase Daily Active Users (DAUs) they can’t monetize them. Revenue declined 4% year over year in 2Q23 and Adjusted EBITDA went negative (-$38 million) for the first time since 1Q21. The company appears to be in a death spiral though I did cover half of my short position at the open.

The reason we know SNAP’s problems are company specific is that Google (GOOG/GOOGL) (I refuse to call it Alphabet!) is doing just fine. Revenue increased 7% and Operating Income 12% in 2Q23.

Next up after the close Wednesday is Facebook (META) (I refuse to call it Meta!). META has had a torrid rally this year and I suspect it’s overdone. I have them earning a bit more than $9/share in 2023 which means the stock is trading for more than 30x current year earnings. I sold some July28 $325 Calls this morning for about $3.

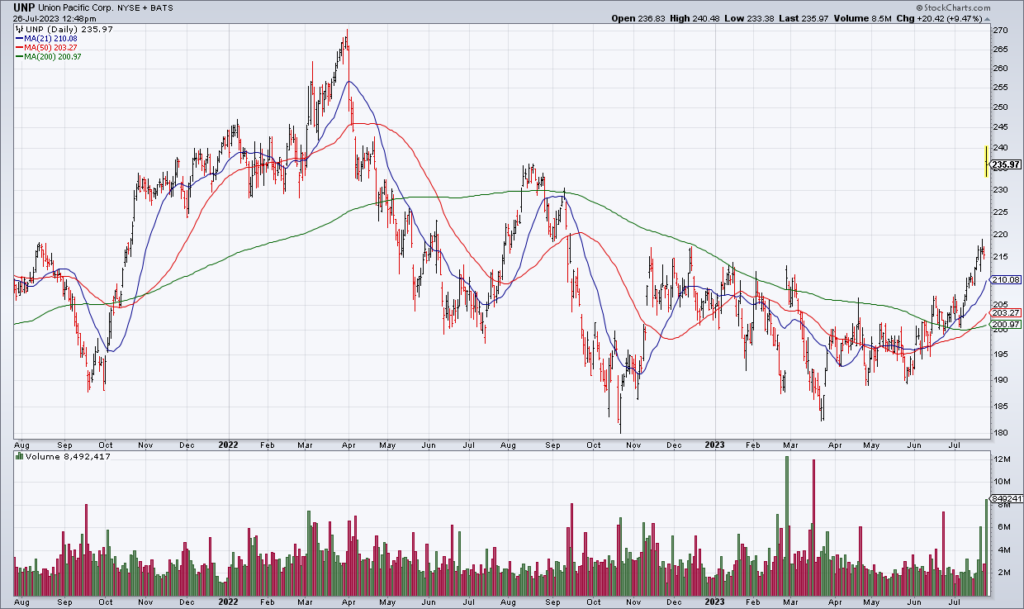

It’s worth pointing out that a couple of economically sensitive stocks – leading railroad Union Pacific (UNP) and leading hotel conglomerate Hilton (HLT) – appear to be doing just fine. UNP’s volume and pricing were down year over year in 2Q23 – but the stock is up nearly 10% today. HLT Revenue per Available Room (RevPAR) increased 12% in 2Q23 and they are guiding full year RevPAR to +10% to +12%. These reports are supportive of the soft landing narrative.

If it’s all too much for you, you may want to consider some weed and a quarter pounder. The marijuana stocks have been pounded and my foray into them early last year didn’t turn out well. But I dipped my toe in again yesterday with a small position in Tilray (TLRY) ahead of earnings and that turned out to be right. Revenue was +20% in their just completed quarter and they guided FY24 Adjusted EBITDA to $68-$78 million. Marijuana is increasingly culturally accepted here in the US and worldwide and that trend will continue. I added some of the Marijuana ETF (MJ) to my TLRY this morning.

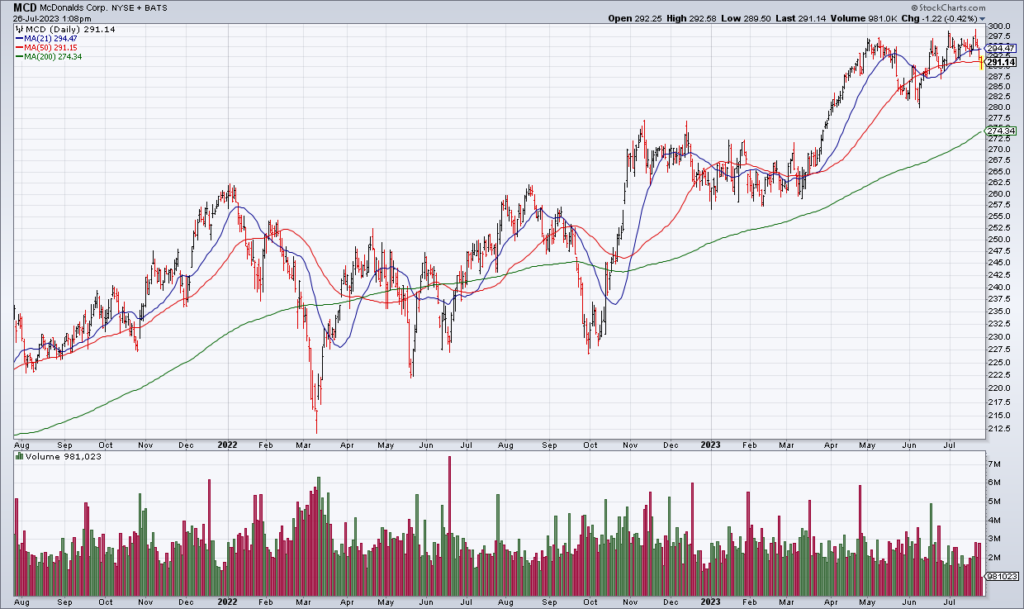

If you do take a hit be prepared to get the munchies. While I prefer In-N-Out, McDonald’s (MCD) continues to dominate in fast food. One key reason for this is their digital savvy. Digital sales in their largest markets are around 40% of total revenue according to the WSJ’s Spencer Jakab (“McDonald’s Extends Its Lead On America’s Smartphones” [SUBSCRIPTION REQUIRED], Wednesday 7/26). Not only does their app streamline ordering and paying and reduce labor costs but it gives MCD valuable data about its customers. In a couple of Heard on the Street pieces, Jakab has convinced me that MCD is ahead of the curve in digitization and that is catalyzing their business. I added to my position this morning ahead of their 2Q23 earnings report Thursday morning.