Recession Fears Seep Into Fed Expectations

On Wednesday afternoon the Fed Minutes for the June meeting were released and they were quite hawkish. For example, on the front page of today’s WSJ Nick Timiraos – The Fed Whisperer – wrote an article titled “Fed Takes Stricter Stance In Speeding Rate Rise: Several Officials Since June Meeting Signaled Support For Another 75 Point Increase” [SUBSCRIPTION REQUIRED]. And yet stocks have rallied hard since the minutes were released. What gives?

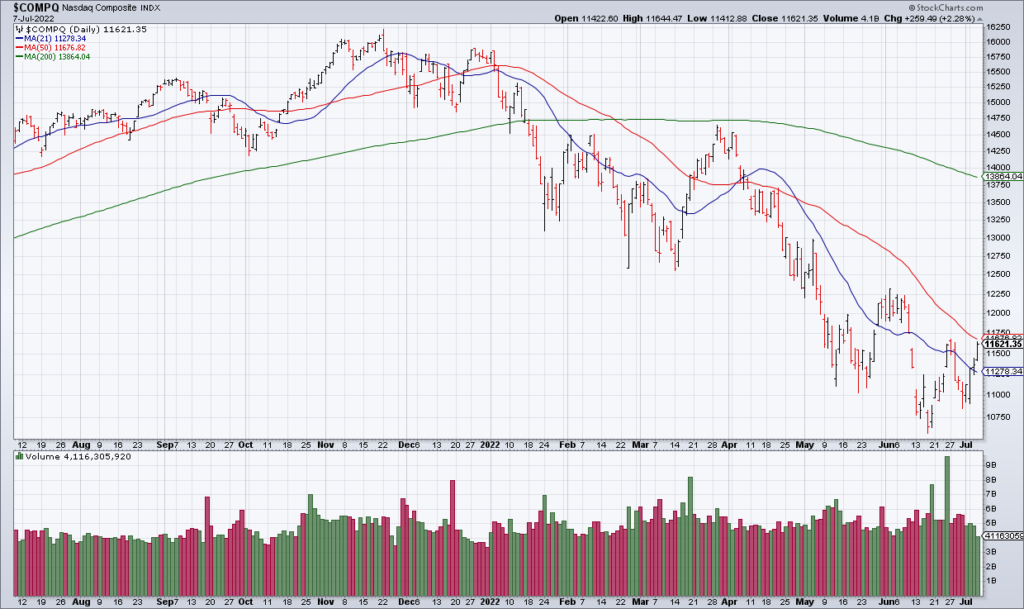

I believe that investors are starting to realize that the Fed simply isn’t going to be able to raise rates as high as they previously thought because the economy can’t take it. In other words – even though the Fed is still talking hawkish as all get out – recession fears are starting to seep into expectations about Fed policy. As I wrote on Tuesday, my expectation is that a decent June CPI number will give the Fed cover to raise only 50 points as opposed to the expected 75 – and that could ignite a second half stock market rally.