RH: Great Value

Despite our record financial performance in the first quarter, we have experienced softening demand trends which began at the time of the Russian invasion of Ukraine and have further slowed during the market disruption over the past several months – Restoration Hardware (RH) Shareholder Letter, June 2

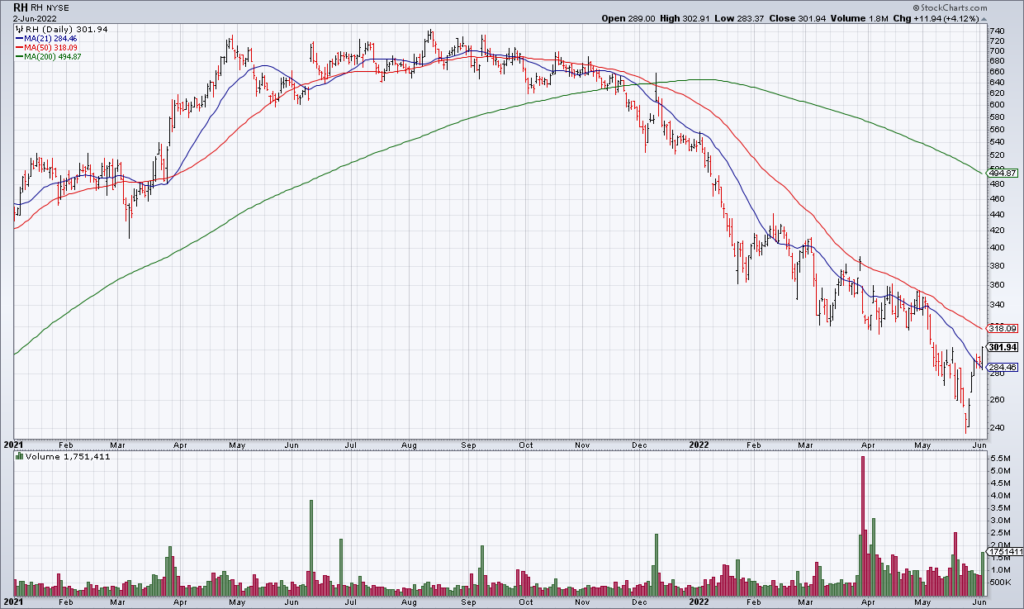

Luxury home furnishings retailer Restoration Hardware (RH) is under pressure as the housing market cools and risk assets roll over. After initiating weak 2022 guidance three months ago, RH lowered guidance even further this afternoon. They are now guiding to only 0% to 2% revenue growth and operating margins of 23-24%. Despite the weak outlook, RH shares are only -2% in the after hours since they’ve already lost 60% of their value in the last ten months.

RH is a high quality company and shares now represent great value. Berkshire Hathaway picked up 2.17 million shares in 1Q22 (an almost 8% stake) – at higher prices. RH earned $26.12/share in 2021. I estimate they’ll earn $22/share in 2022 – and I don’t expect trough earnings to be much below $20/share. At a closing price Thursday of $301.94, that’s a 14x forward multiple for a great company with a long growth runway. One day RH shares will hit $1000 in my opinion and they’re due for a bounce now as well.