Market Fails At ATHs, No Fear, PYPL Earnings

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

I was almost certain the NASDAQ was going to make a new All Time Closing High yesterday. Instead, it dropped nearly 200 points in the last hour and a half to miss by 25 points – a selloff in the last 15 minutes resolved things.

The S&P got within 8 points of its All Time Closing High before the same last hour and a half selloff caused it to close 25 points below it at 3,830. That doesn’t mean it can’t happen today or tomorrow only that supply and demand were not right for it to happen yesterday.

In fact, despite the feeling that everything is back to normal after last week’s heavy selling, none of the major indexes, key ETFs or stocks I like to follow as measures of risk appetite have made new All Time Closing Highs. Consider the following table:

Index/Security ATH (CLOSE) 2/3 (CLOSE)

S&P 3,855 (Mon 1/25) 3,830

NASDAQ 13,636 (Mon 1/24) 13,611

Russell 2,069 (Fri 1/22) 2,060

QQQ $328.50 (Tue 1/26) $326.38

SMH $245.55 (Tue 1/21) $234.22

ARKK $147.11 (Wed 1/20) $146.11

TSLA $883,09 (Tue 1/26) $854.69

In the cases of the S&P, NASDAQ, Russell, QQQ and ARKK, we closed yesterday within 1% of their All Time Closing Highs – but we couldn’t make new ones. Again: That’s not to say we can’t do it today or tomorrow or on Monday but until we do, I do not believe we have technical confirmation for a new leg higher in the market.

Largest 3 Day drop in VIX EVER…. After Wednesday’s [session] we have more evidence that the 1H low is behind us – @fundstrat quoted by Carl Quintanilla Twitter, February 3, 2:05pm PST

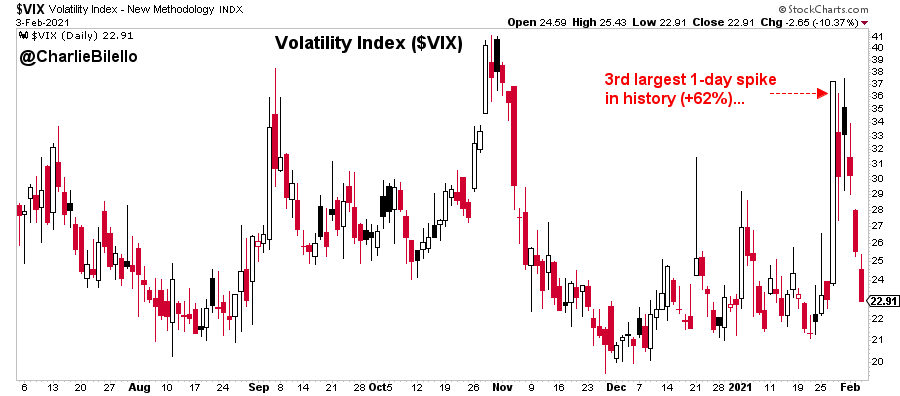

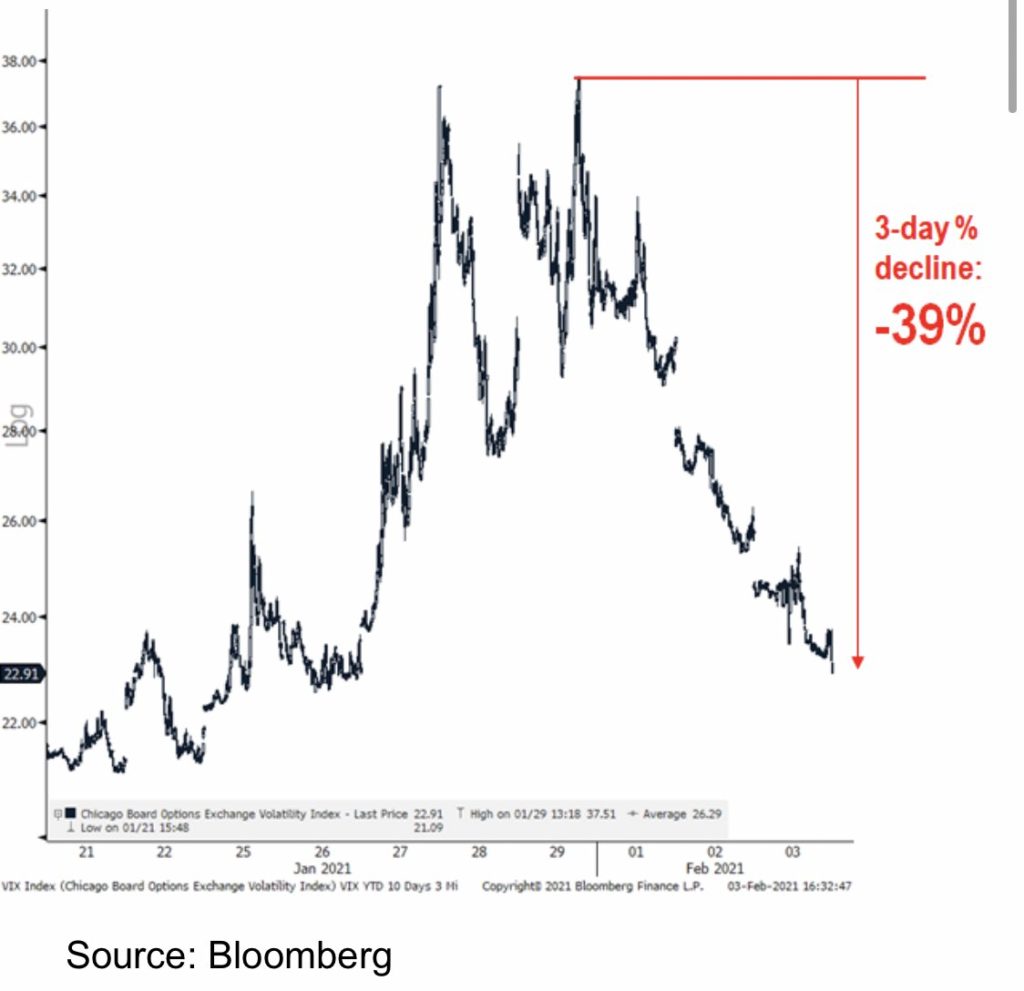

Despite this fact, investors have returned to a condition of No Fear with the VIX dropping the most ever in a three day period so far this week after its third biggest one day spike in history last Wednesday. It even dropped 10% yesterday despite the nasty selloff in the last hour and a half. It’s almost like a football player on a breakaway celebrating and prematurely discarding the ball at the 1 yard line. We’ve all seen that! (Chart #1 Source: Charlie Bilello Twitter, February 3, 1:52pm; Chart #2 Source: Carl Quintanilla Twitter, February 3, 2:05pm PST).

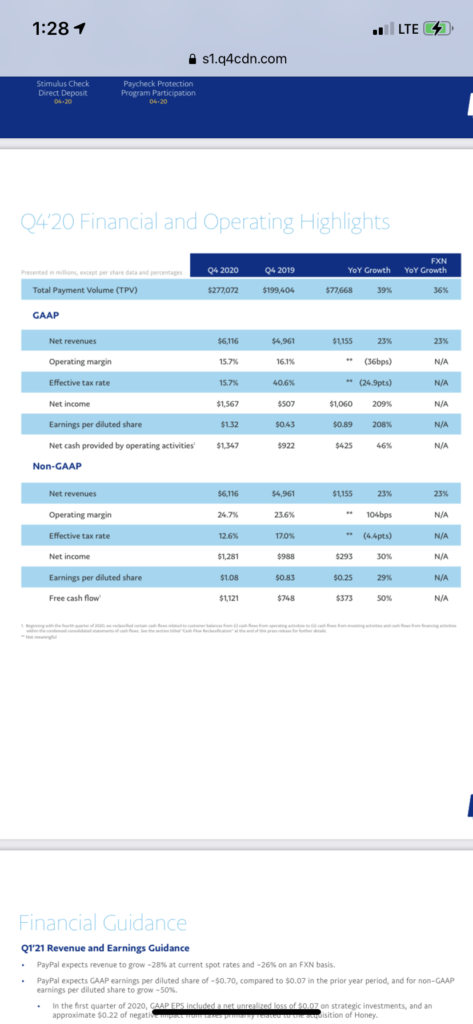

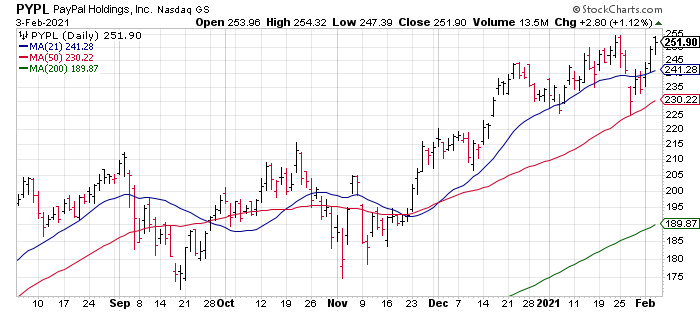

Now let’s turn to PayPal (PYPL, market cap $315 billion) earnings which they reported yesterday afternoon. Total Payment Volume was +39%, Revenue +23% and Non-GAAP Diluted EPS +29%. They also guided 2021 revenue growth to +19% and Non-GAAP Diluted EPS growth to 17%. It was a solid quarter but I don’t think it justifies the 5% move higher in the premarket right now from ATHs at these valuations.

Backing out PYPL’s net cash and using their 2021 guidance of 17% higher Non-GAAP diluted EPS, the stock is trading at 56x forward earnings! That’s not expensive; that’s bubble territory. Like Amazon (AMZN) and Alphabet (GOOG GOOGL) Tuesday afternoon, PYPL’s fundamentals are stellar but it’s more than priced in.