March Rate Cut Not Likely, AAPL Earnings: The Emperor Has No Clothes

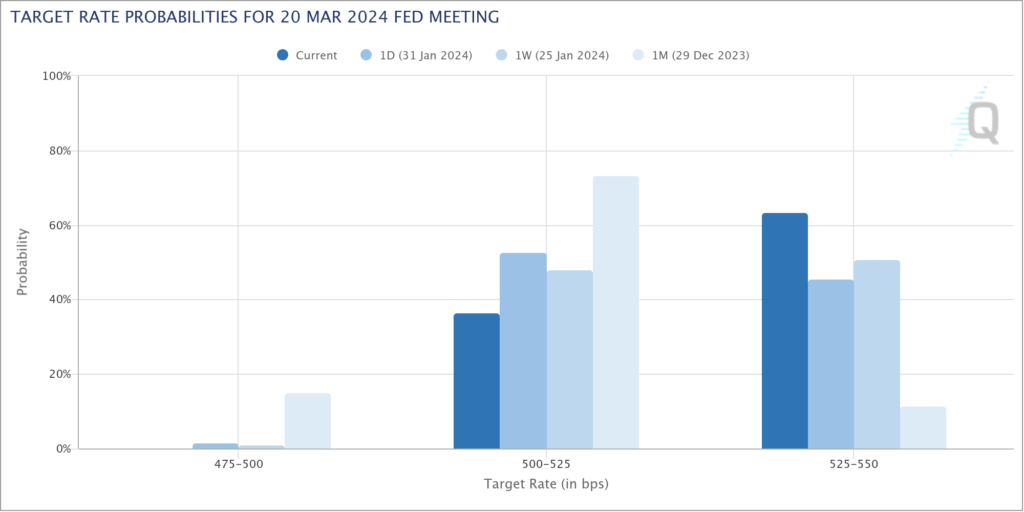

Fed Chair Jerome Powell was significantly more hawkish than expected in his post Fed Statement press conference Wednesday resulting in a selloff in stocks. Powell said he didn’t think a March rate cut was likely pushing up the odds of another pause on March 20 by 20% in the futures markets. The Fed now risks staying too tight for too long and causing the economy to rollover (“Fed Shouldn’t Take Too Long To Declare Victory On Inflation” [SUBSCRIPTION REQUIRED], Greg Ip, WSJ 2/1).

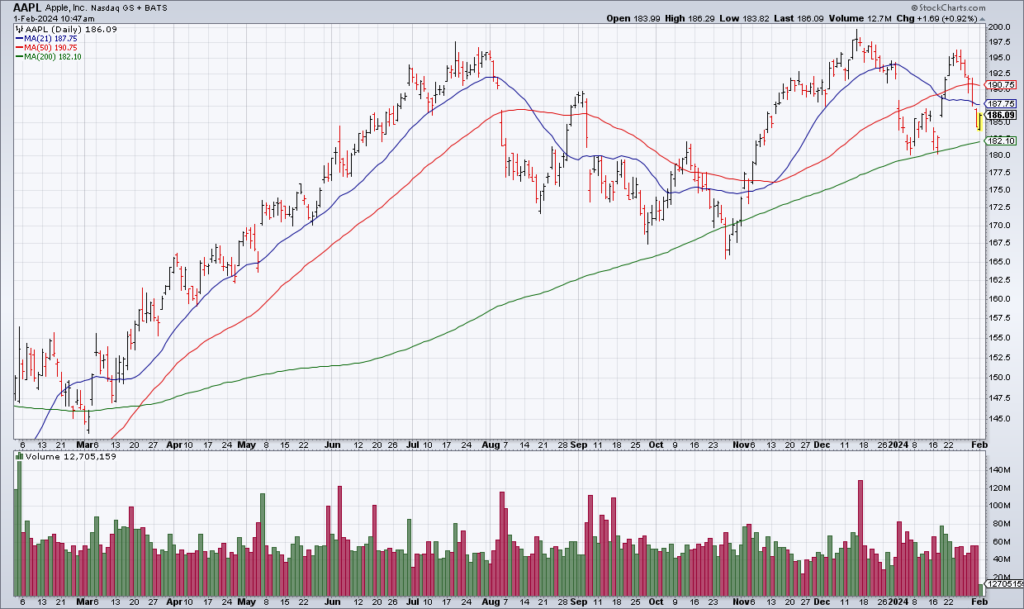

This presents an interesting setup heading into Apple (AAPL) earnings this afternoon. Most investors seem unaware that AAPL is no longer growing. In FY23 ended September 30, 2023, AAPL revenue declined from $394 billion to $383 billion and net income from $100 billion to $97 billion. (EPS edged up to $6.13 from $6.11 only because AAPL bought back about 500 million shares). Of the five categories into which AAPL divides its business, only Services grew its top line in FY23 (+9%). And yet AAPL shares still trade like a growth stock with huge opportunities ahead of it with a multiple of around 30x. Unless AAPL has an ace up its sleeve, it’s only a matter of time before investors realize that the emperor has no clothes.