The Market Is Correctly Starting To Price In A Recession And The Magnificent 7 Are Played Out

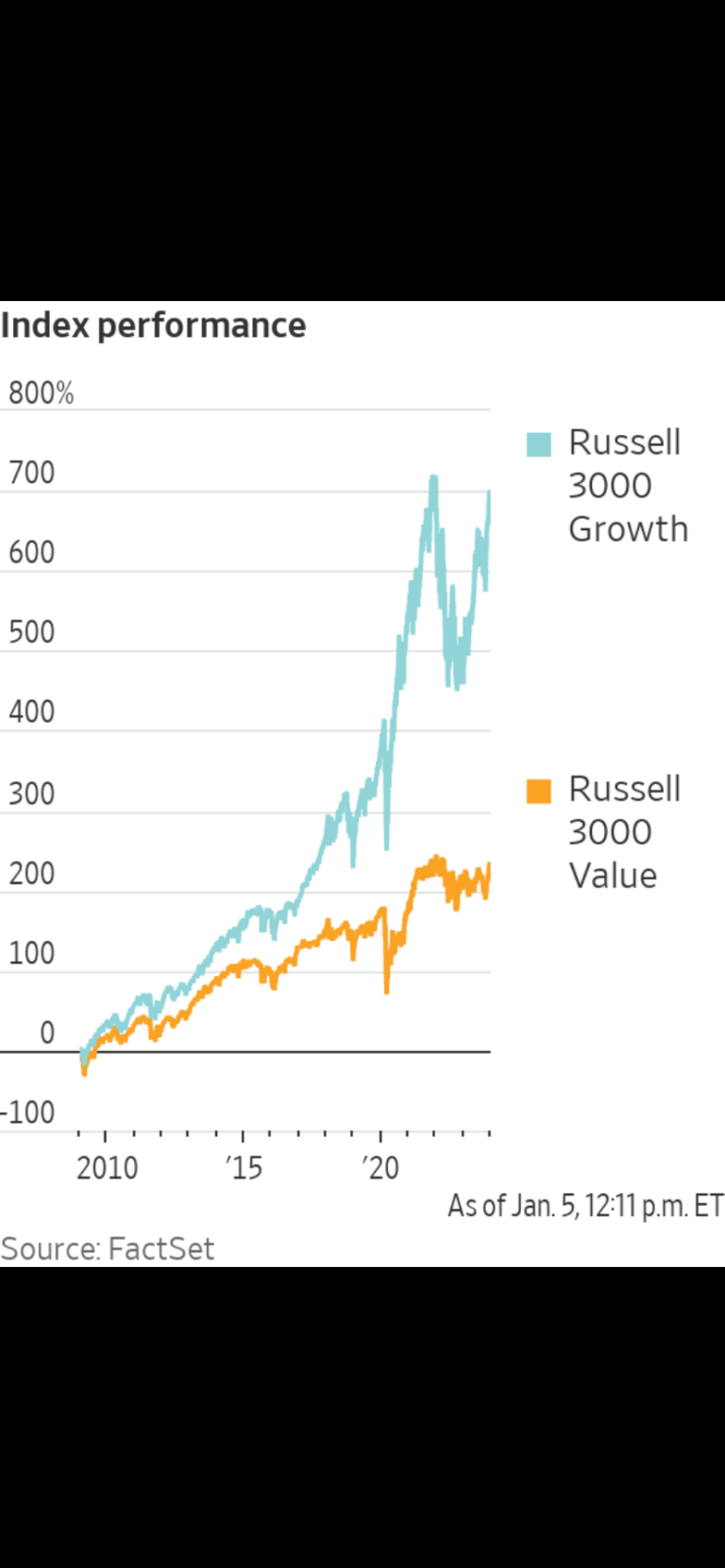

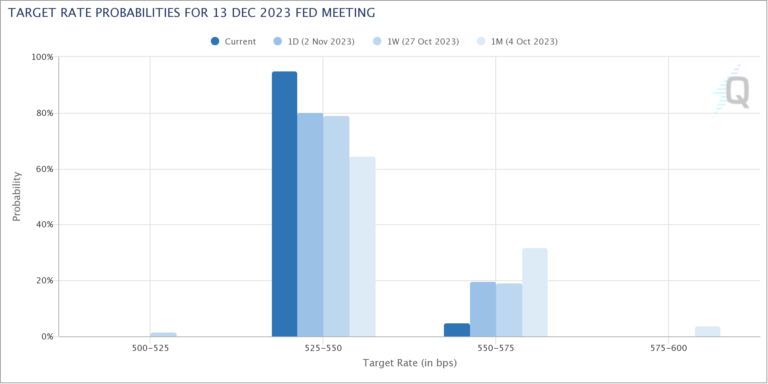

The narrative over the last few weeks has been that the defeat of inflation will allow The Fed to cut rates in September has resulted in a rotation out of Mega-Cap Tech (QQQ) and into Small Caps (IWM) which will…