Small Caps Break Out, Powell May Try To Talk The Market Down, Buffett’s One Weakness

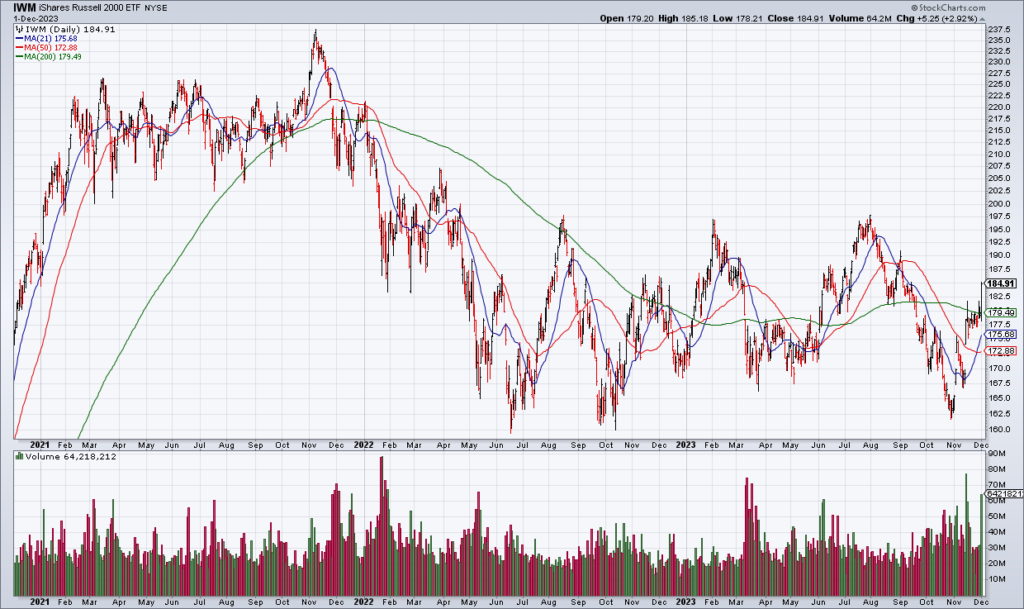

Friday was an interesting day in which smaller stocks outperformed mega cap tech – the opposite of what’s happened so far this year. The Russell 2000 (IWM) was +2.92% while the Nasdaq 100 (QQQ) was up only 0.29%. IWM broke decisively above its 200 DMA. This is important because the most persuasive bearish technical argument has been the lack of breadth. On the other hand – if you want to be stubborn – you can argue small caps have still gone nowhere for about 18 months.

Taking a look at the S&P, it’s right up at the 4600 level that I targeted last weekend for year end. It’s hard to imagine it making a new all time high in the next four weeks given the light news flow but perhaps it can get into the range between 4600 and 4800. However, that would be a selling opportunity IMO.

One thing to keep on your radar is the Fed Meeting on Wednesday December 13. While the Fed will not change the Fed Funds rate, Powell might try to poor cold water on the massive moves we’ve seen in stocks and bonds over the last month. As far as we know, the Fed is still saying “higher for longer” and Powell may not like all this loosening in financial conditions.

On Wednesday I reflected on the death of Charlie Munger and his important influence on Warren Buffett’s investment philosophy. To repeat, Munger convinced Buffett to abandon his Ben Graham, deep value, investment style in favor of buying high quality companies that could compound earnings over long periods of time.

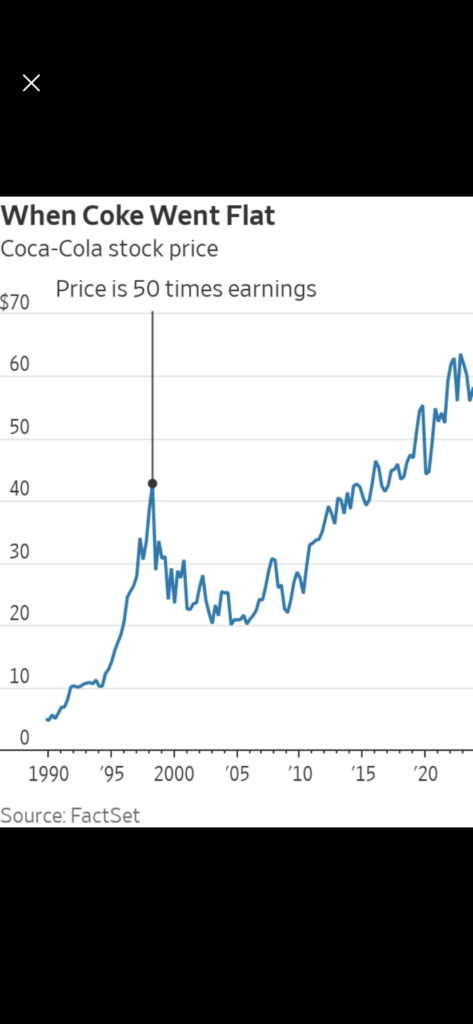

The one weakness in Buffett’s investment temperament – however – may be his failure to sell big winners that have become overvalued. In 1998, he held onto Coke despite its trading at 50x earnings – and it took 13 years for it to get back to those levels (“Why It’s So Hard To Copy Charlie Munger’s Secret Sauce” [SUBSCRIPTION REQUIRED], James Mackintosh, WSJ 12/2). I believe he is currently making the same mistake with Apple (AAPL). AAPL has been Buffett’s biggest coup in recent years but the fundamentals no longer justify the stock price in my opinion (see my “An Open Letter To Warren Buffett Re: AAPL”, August 3).