Is Value Investing Dead? A Look Back At The Last 15 Years

At the end of his long life, Charlie Munger expressed doubts about the future of value investing:

I think that the modern investors, to get ahead, almost has to get in a few stocks that are way above average. They try and have a few Apples or Googles or so on, just to keep up (quoted in “The Future Of Value Investing” [SUBSCRIPTION REQUIRED], WSJ 1/6/24)

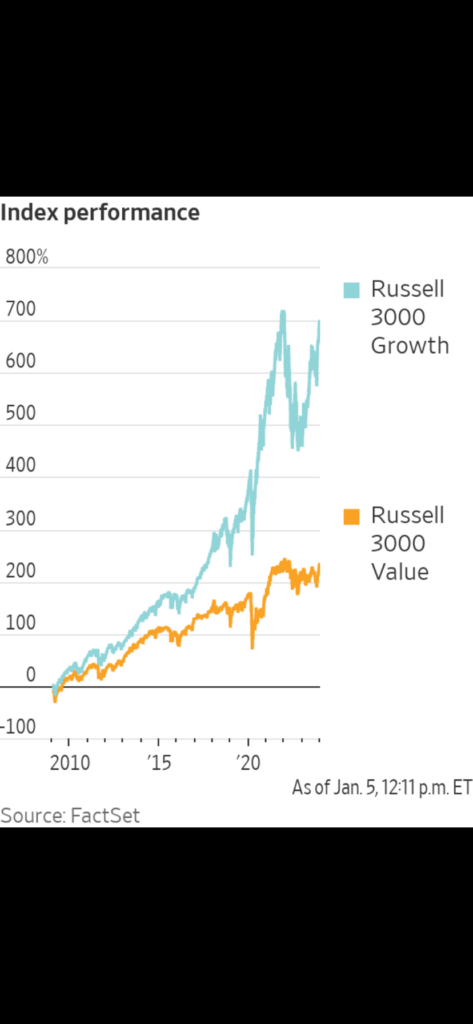

The reason for these doubts is that the Russell 3000 Growth Index has outperformed the Russell 3000 Value Index over the last 15 years, returning 700% compared to roughly 200% for the latter. And traditional valuation metrics have not mattered. The Russell 1000 Growth Index traded at 36x trailing 12 month earnings compared to 19x for the Russell 1000 Value Index as the end of December. This has created a lot of frustration and soul searching for value investors.

Value investors like Rob Arnott of Research Affiliates are staying the course: “If there’s any mean reversion at all, returns for value will have to be stupendous” as the spread between growth and value is “close to unprecedented”. Other value investors have looked for ways to justify or rationalize including traditional growth stocks in the value discipline. “I fall on the side of implementing the value factor in a more industry neutral way, to avoid these unintended biases toward one sector like retail”, said Jason Hus of Rayliant Global Advisors. Much of growth consists of tech which many value investors have therefore underweighted or even neglected.

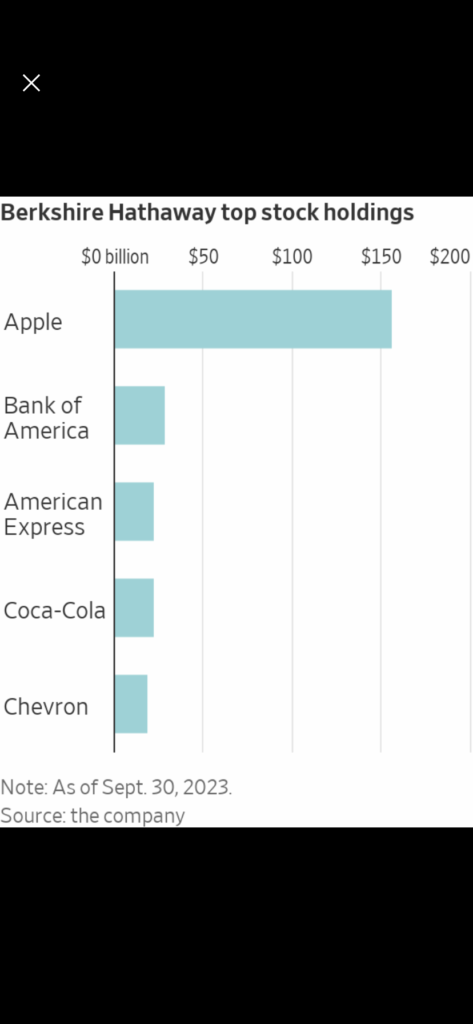

One of the most interesting developments on this front has been Buffett’s purchase and accumulation of a huge position in Apple (AAPL). When Buffett started buying AAPL in 2016, it was a traditional value stock. But over the years, as growth has declined and the multiple expanded, many – including myself – have wondered whether AAPL still fits the mold of a value stock.

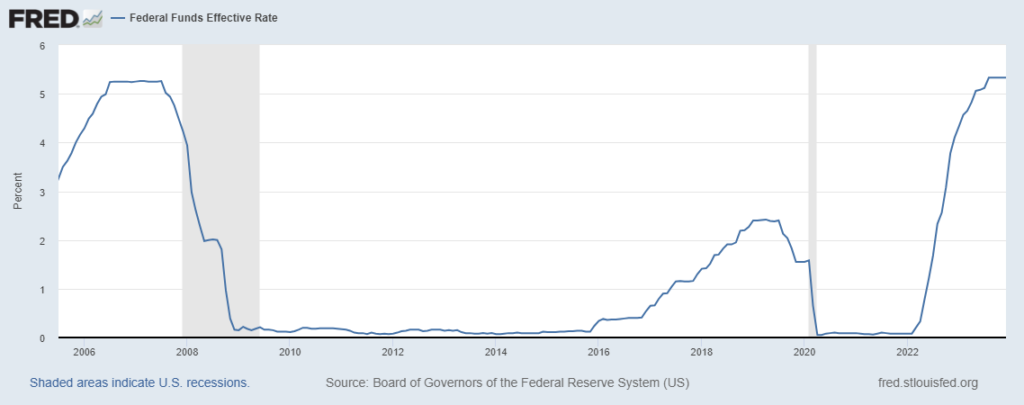

It is widely agreed that the low interest rates of the last 15 years have contributed to growth’s dominance. Theoretically, a lower discount rate increases the value of future cash flows where most of growth’s value lies. Psychologically, low interest rates force investors to take bigger risks to generate the returns they want. Whatever the mechanism, clearly low interest rates have played a big role here.

And so the question arises: Is value investing dead? My contention is that the inflation of the last couple of years has ended the period of permanently low interest rates that Bernanke instituted during the financial crisis in 2008 which will shift the balance somewhat back in favor of value versus growth. While inflation is rolling over – as I have argued many times – I do not believe it will be easy to get it back below 2%. Which means that – while the Fed will likely cut rates this year – they may not cut them as much as the market expects. In fact, last week’s selloff was about the market getting ahead of the Fed in terms of rate cuts. I would be very surprised to see a Fed Funds Rate of 0% for a long, long time. Higher rates going forward will decrease the present value of future cash flows and increase the present value of current cash flows, favoring value over growth. This means the days of making easy money owning the Magnificent 7 and overweighting tech may be coming to an end. Tech will continue to play a dominant role in the global economy going forward but its extreme valuations may come in in the years ahead.