Marginal Fluctuations: December CPI, KBH Earnings

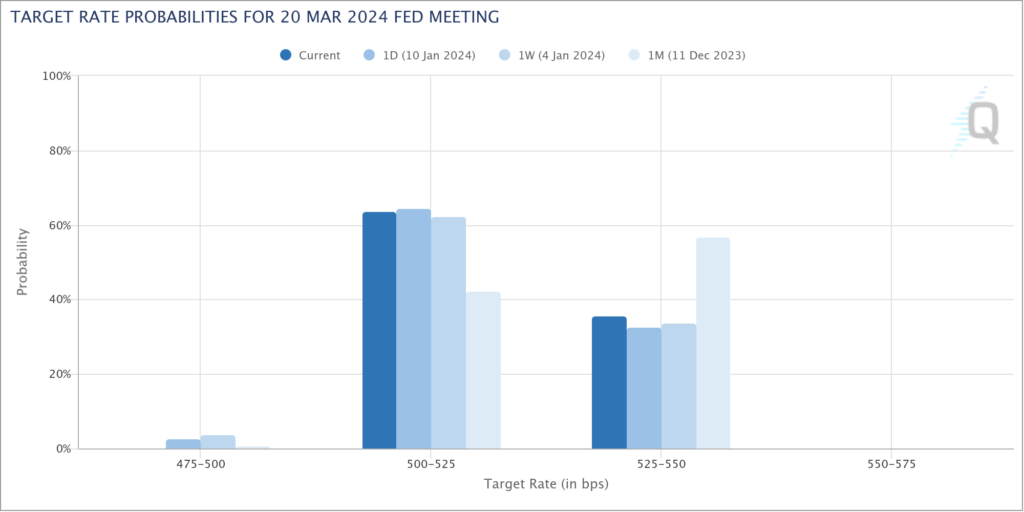

The December CPI came in a little hotter than expected this morning. However, one of the main reasons for this is that the Shelter component – which is heavily weighted – is a lagging indicator. It doesn’t just measure newly signed leases but leases that were signed a while ago. Therefore it is missing the reality of real time falling rents and instead says that they increased 0.5% in December from November. At any rate, this has caused the Fed Futures to marginally increase the probability that the Fed will hold rates steady in March. And that in turn has resulted in a slight selloff in the stock futures.

On the earnings front, KB Homes (KBH) reported 4Q23 earnings this morning. I think new orders of 1,909 were a bit lighter than bulls were hoping though KBH said that they have experienced a “meaningful sequential increase in our net orders for the first five weeks of our 2024 first quarter”. The stock is currently -4.6% in the premarket.