Markets Rip On Belief Fed Is Done, Apple Zero, UBER Earnings

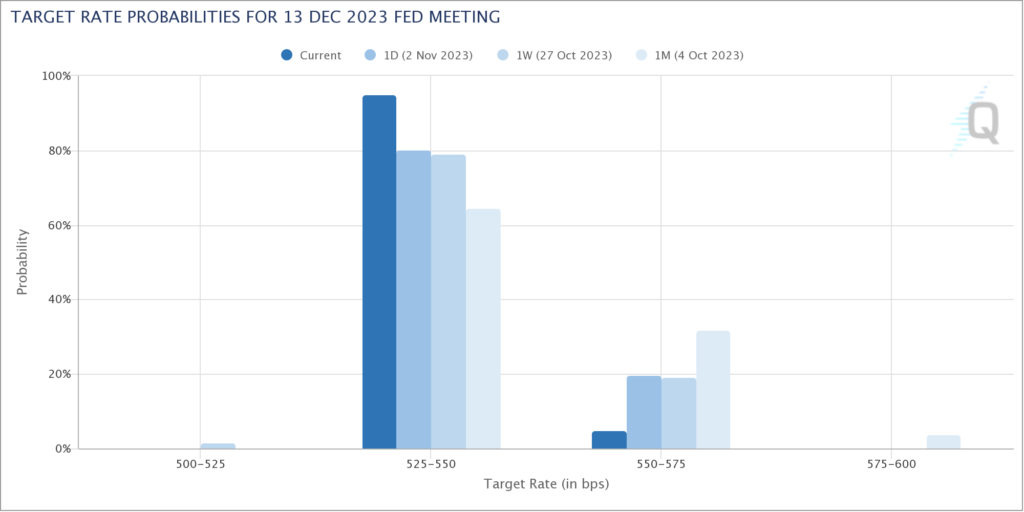

Stocks ripped higher last week – with the S&P and NASDAQ each gaining about 6% – after the Fed meeting Wednesday as investors concluded that the Fed is done hiking rates for this cycle. You can see this in the chart above in the change in the forecast of the likelihood of the Fed hiking one last time in December over the last month. A month ago, markets were pricing in about a 35% likelihood the Fed would hike on December 13th. A week ago that was down to 20%. And by the end of the week that probability was reduced to a mere 5%.

While I think the market is correct and the Fed would be wise to quit hiking now if it wants any chance of a soft landing, I don’t think this is the resumption of a bull market. While we could very well get a year end rally, I still expect the weight of the Fed’s previous tightening to crush the economy and markets in 2024. Therefore, I continue to endorse the strategy outlined Thursday evening in “Short QQQ, Long TLT”.

If Apple remains in no growth mode for much longer, you have to wonder if the stock can sustain its lofty forward multiple – Eric Savitz, “Apple Isn’t Growing” [SUBSCRIPTION REQUIRED], Barron’s November 4

The two best tech journalists for stock investors are The Wall Street Journal’s Dan Gallagher and Barron’s Eric Savitz. In this weekend’s Barrons, Savitz makes the case that I’ve been making for a long time: AAPL has no growth and the stock should be revalued accordingly from a growth to a value stock. In fact, AAPL had no growth in 4 of its 5 segments in the fiscal year ended September 30: iPhone, Mac, iPad and Wearables. Only the Services segment is still growing. I believe that AAPL has seen its permanent high and it is my biggest single stock short.

While my portfolio is mostly defensive, one growth stock I continue to like is Uber (UBER). UBER appears to have turned the corner into profitability and seems set to send Lyft to its grave. I see no reason not to expect another excellent quarter when it reports Tuesday morning. I remain long the stock and will be looking at the UBER $50 November 10 Calls which closed Friday just below $1 as well.