The Bulls Dunk On The Bears

The bulls are winning the fight. A correction is three to six months [away]. There’s so much fear of missing out – Adam Parker, Trivariate Research, quoted in Barron’s The Trader column 3/23 [SUBSCRIPTION REQUIRED]

There’s really no way around it: Last week the bulls dunked on the bears. The S&P surged through 5200 to new all time highs in the wake of a marginally dovish Fed on Wednesday afternoon. More than 20% of S&P components closed at 52 week highs on Thursday – the highest in three years. More than 10% of stocks on the NYSE and NASDAQ closed at 52 week highs on Thursday as well. Micron (MU) added more credence to the AI boom with a monster quarter Wednesday afternoon, sending shares up 18% on the week.

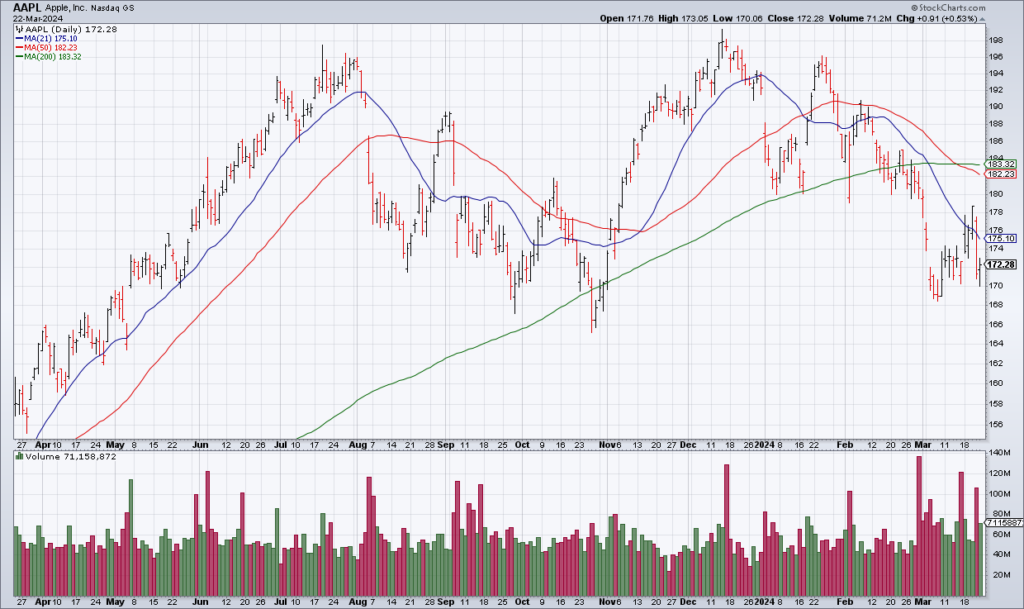

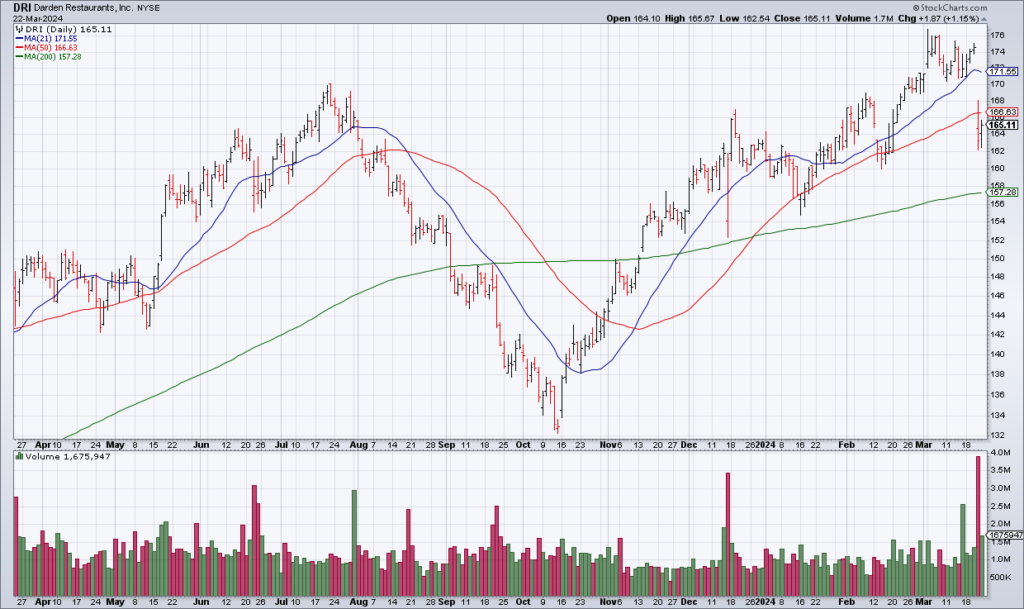

Not every stock is working. Apple (AAPL) is in a clear downtrend. Popular athleisure brand Lululemon (LULU) got torched on Friday (-16%) after weak guidance. LULU expects 2024 revenue to grow only 10% to 11%. The stock still trades at 29x 2024 EPS guidance of $14.00-$14.20. Nike (NKE) is also in the doldrums as they currently are not growing the topline and got hit Friday after earnings as well. Darden Restaurants (DRI) – owner of the popular middle class Olive Tree chain – sold off Thursday after reporting that comps at Olive Tree fell 1.8% in the three months ended February 25, 2024.

But at the end of the day, there is no current fundamental or technical reason to be bearish outside of valuation. The other bearish argument is that monetary policy acts with a lag and this time that lag is particularly long for various reasons. Yet I’m unable to change my mind and flip bullish. And so I’m asking myself: “Am I being stubborn? Am I a permabear?” For me, it’s a moment of existential doubt about what I’m doing.