IWM And RSP Lead Post Fed Breakout, QQQ $445

Wednesday at 2pm EST the Fed released its policy statement explaining its March rate decision and forward outlook. At 2:30pm EST Chair Powell held a press conference. In the wake of the Fed’s maintaining its outlook for three interest rate cuts this year and the sense that the first one will be in June, the S&P broke out above 5200 to new all time highs.

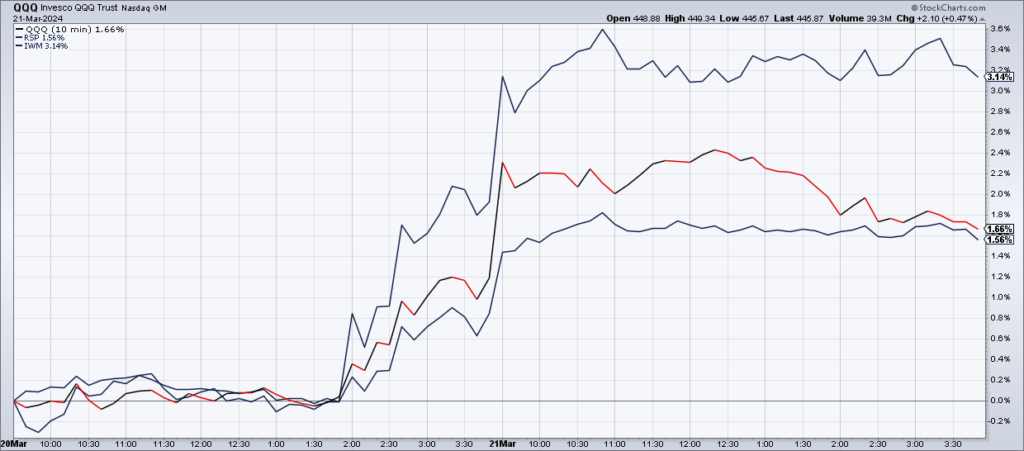

But the character of the rally has been different from what came before. The Magnificent 7 which dominate the S&P, and especially the QQQ, and have driven the bull market have performed fine but small caps (IWM) and the equal weight S&P (RSP) have been the stars. IWM was +3.14% Wednesday and Thursday compared to QQQ +1.66%. RSP at +1.56% also held its own. 803 stocks out of a total of 7342 (11% of the total) made new 52 week highs on Thursday. Only 73 made new 52 week lows.

Bulls and bears alike have noted the narrowness of the rally with bulls expecting it to broaden out and bears expecting The Magnificent 7 to peter our sooner or later. With IWM and RSP taking the lead, clearly the bull thesis is being validated in the wake of the Fed.

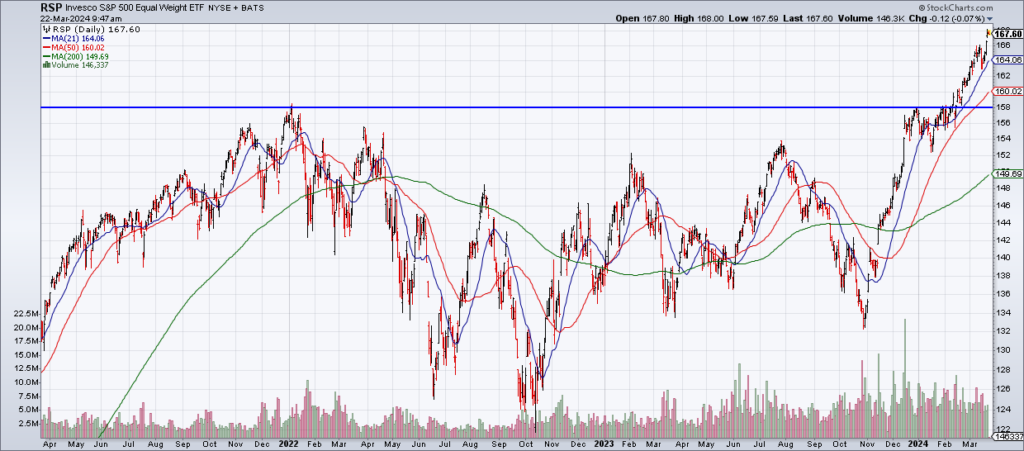

But I’m not entirely convinced. Clearly participation is broadening in the S&P 500 as RSP has broken out to new all time highs above $158 from two years ago. The problem is that these stocks are too small relative to the size of The Magnificent 7 to mask weakness there and push the market cap weighted indexes higher on their own.

QQQ is struggling with $445 and unless we get another leg higher there, even with the broader participation, the broader indexes will come under pressure. Perhaps it is just a rotation for now as the QQQ consolidate for the next leg higher. If so, we are likely to have only a correction within the bull market. But if The Magnificent 7 are truly exhausted, the S&P is very close to topping out for a long time.

In other words, The Magnificent 7 are still the name of the game because their overwhelming size dominates the market cap weighted indexes. Broadening participation within the S&P is bullish, but the major indexes will only go as high as the Mag 7 take them.