NVDA: Technicals Vs Fundamentals: Another Test Of The Competing Narratives

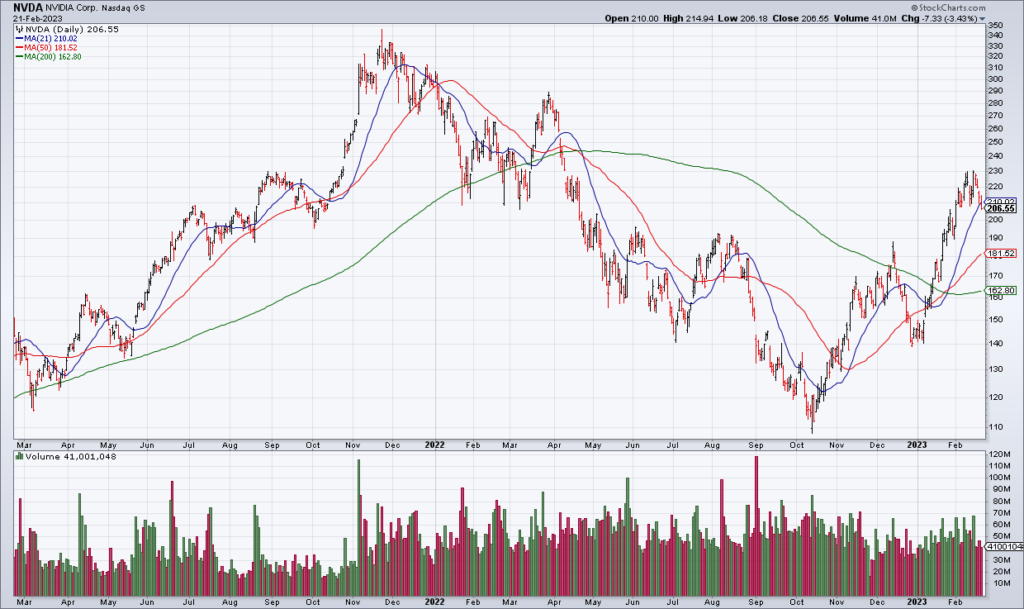

While not quite as well known as The Big 5, semiconductor manufacturer Nvidia (NVDA) – with a $500 billion market cap – is one of the most popular and important stocks in the market – and it reports 4Q22 earnings Wednesday afternoon. It feels like another important test of the competing narratives. After losing about two-thirds of its value from Nov21 through Oct22, NVDA has staged a powerful rally over the last four months with the stock doubling. It is well above its 200 DMA and – if you were to go just based off the chart – it looks like a new bull cycle has begun for the stock.

However, the fundamentals tell a different story. Three months ago NVDA guided 4Q22 revenue to $6 billion which would be down 21% compared to a year ago. They did forecast gross margins to firm up at 63.2%-66.0% compared to 56.1% and 45.9% in the last two quarters, respectively. The real kicker is valuation: NVDA’s 4Q22 guidance works out to full year earnings of $3.24 which results in a trailing P/E of 64x. This valuation is not sustainable without an impending improvement in the fundamentals. Is it at hand? Or is NVDA stock about to roll over?