SBUX Is Priced For Perfection

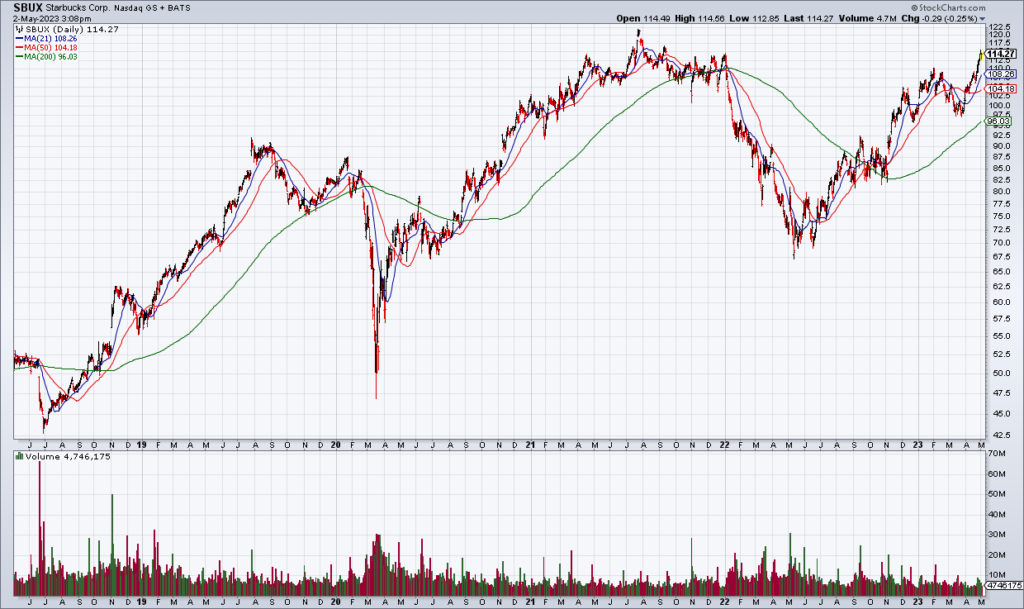

Starbucks (SBUX) has been on a tear for the last year heading into earnings this afternoon. My concern is that at more than 30x current year EPS guidance shares are priced for perfection.

Last quarter, SBUX guided FY23 global comps to the high end of 7-9% and EPS to the low end of up 15-20%. SBUX earned $2.96/share in FY22 so they’re guiding to ~$3.50/share this year which is 32-33x the current price of $114.

While I have no position in SBUX and like to hold great companies for the long term, this is a spot where I might take half off.

UPDATE (Wed 5/3, 7:00am PST):

SBUX reported an excellent quarter after the close Tuesday with global comps +11%. They also maintained FY23 guidance. However – as was my concern – shares are off 7% Wednesday morning simply because the stock was “priced for perfection” heading into the report. If you did take half off, I wouldn’t hesitate to add them back this morning.