PG And The Investment Lesson You Must Learn

It must be noted that your Chairman – always a quick study – required only 20 years to recognize how important it was to buy good businesses. In the interim, I searched for “bargains” – and had the misfortune to find some. My punishment was an education in the economics of short line farm implement manufacturers, third place department stores, and New England textile manufacturers – Warren Buffett, 1987 Letter To Shareholders

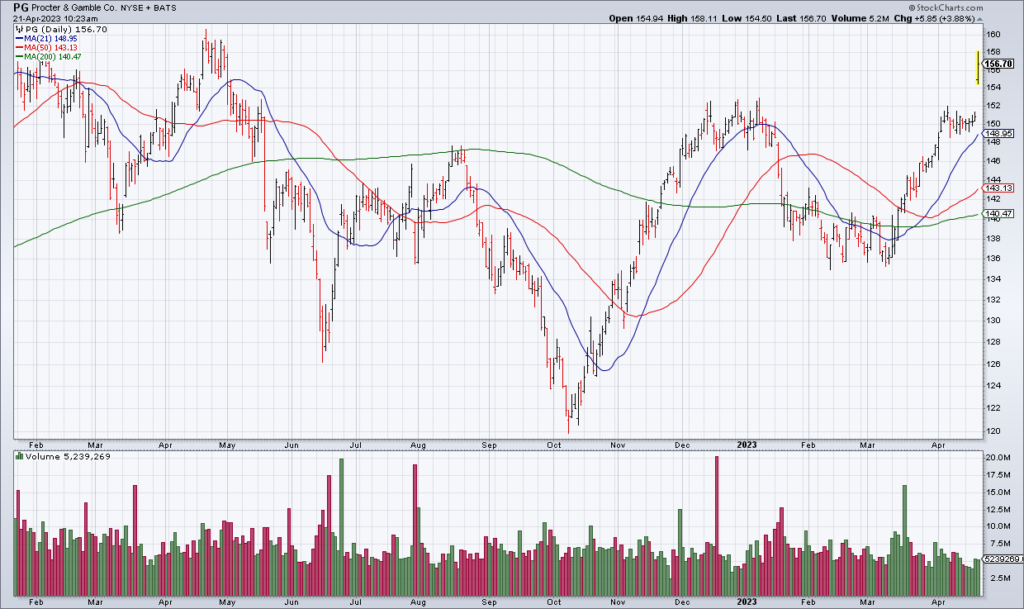

Consumer staples giant Procter & Gamble (PG) – one of my favorite and largest holdings – reported earnings Friday morning before the open. Organic sales were +7% and PG raised FY23 guidance to +6%. Volume was actually down 3% but PG was able to gain 10% through pricing. Why? Because PG has the leading consumer brands in so many categories: Tide washing detergent, Crest toothpaste, Old Spice deodorant and anti-perspirant, etc… (“PG Has Pricing Power”, Top Gun Financial, April 18, 2022). PG shares are up ~4% and approaching 52-week highs on the report.

I wouldn’t buy PG for many years because I thought it was too expensive, always trading for ~25x earnings. It’s only when I realized that it’s worth it to pay up for quality – and frequently disastrous to buy extremely cheap stocks – that I entered my maturity as an investor. Which brings me to the lesson it took me far too long to learn: The key to great long term investment performance is buying high quality companies and holding them for the long term.

In fact, this is the lesson of the great Warren Buffett’s career. Buffett went from a Ben Graham-style deep value investor – looking to buy extremely cheap stocks – to a realization that high quality companies are the way to go. Buffett summed this up in his great aphorism: It’s better to own a wonderful company at a fair price than a fair company at a wonderful price. It’s only when Buffett learned this lesson that he became Warren Buffett.

The sooner you learn this, the better.