Standard & Poors Revises UK Debt Outlook To Negative

We have revised the outlook on the U.K. to negative due to our view that, even assuming additional fiscal tightening, the net general government debt burden could approach 100% of GDP and remain near that level in the medium term. We base our opinion on our updated projections of general government deficits in 2009-2013. These projections reflect our more cautious view of how quickly the erosion in the government’s revenue base may be repaired, the extent to which the growth in government spending can be curtailed, and consequently the pace at which historically high fiscal deficits are likely to narrow.

– Standard & Poor’s credit analyst David Beers

It raises the question of exactly how concerned investors should be about the state of U.S. finances as the government piles up spending amid shrinking GDP. Will the U.S.’s triple-A rating be next under the microscope?

– Matt Phillips, “With U.K. AAA Rating In Jeopardy, Is U.S. Next?”, MarketBeat, May 21

Really interesting report out of S&P this morning that is rattling markets. They downgraded the outlook on Britain’s AAA rated debt from “stable” to “negative”. That means they are considering a downgrade over the next 2 years.

As you can read in the quote, the reason is that they believe UK debt could approach 100% of GDP by 2013 due to the deteriorating economic environment and the increased spending associated with the government’s response.

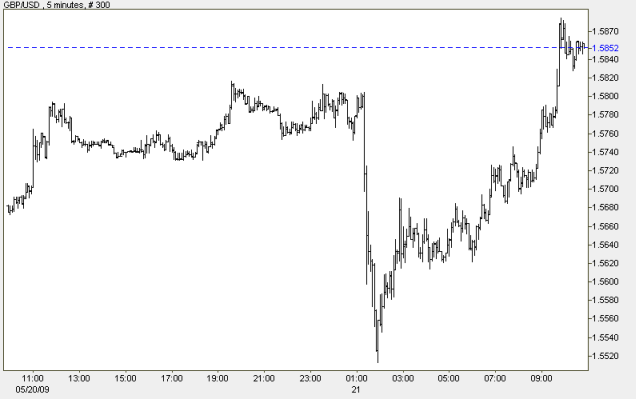

The report resulted in a selloff in the pound and the FTSE.

Obviously the same kind of analysis can be applied to the US. We have $11 trillion debt and GDP around $14 trillion. So debt is already 80% of GDP and it’s going higher.

Overall, we’re just seeing how incredibly strained governments all around the world are. From England, to the US to the state of California.

On this subject also see:

David Walker, “America’s Triple A rating is at risk”, Financial Times, May 12

Peter Morici, “Uncle Sam’s F-rated bonds”, Statesman Journal, May 20

Barron’s wrote a cover story on just this issue last weekend, “US Blues” (subscription required – e-mail me for a link).

Disclosure: Top Gun is long the ProShares UltraShort Treasury 20+ Year ETF (TBT).