Tech Breaking Down, Gold Breaking Out

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

Many technicians are starting to note that Tech stocks are breaking down. I have been all over the false breakout in the QQQ so I’m simply going to update the chart through Thursday and point out that we’ve now closed three straight days below the February 12 close of $336.45.

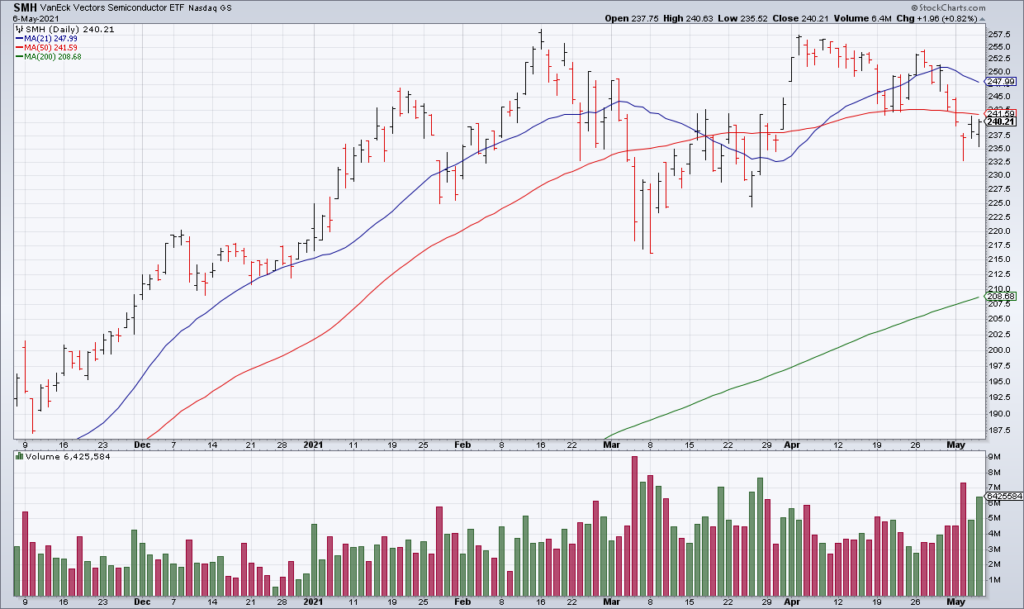

The second most important Tech ETF is probably the Semiconductors (SMH). Not only has the SMH closed below its 50 DMA all four days this week but, as Brian Shannon points out in his tweet above, the 50 DMA itself has now rolled over which, according to him, is even more more important.

The third most important Tech ETF is probably the Ark Innovation ETF (ARKK). Yesterday morning I pointed out that ARKK had closed right on its 200 DMA and was “on the precipice”. During the session, ARKK was -$3.21 or -2.88% to $108.34 on about 1.5x average volume and closed below its 200 DMA for the first time since early April 2020.

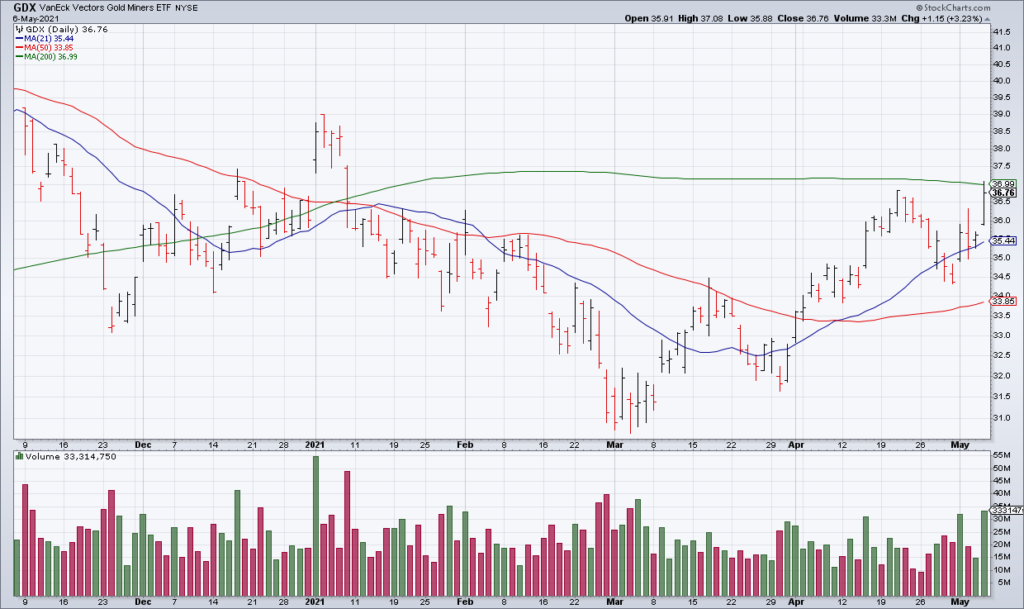

On the other side of the coin, many technicians are noting the breakout in gold and gold stocks. The Gold ETF (GLD) was +$2.79 or +1.67% to $170.06 yesterday as gold futures powered through $1800/oz. The Gold Miners ETF (GDX) was +$1.15 or +3.23% to $36.76 and is now coming up against its 200 DMA. A breakout above that would likely pull in even more technically oriented investors.