NOTE: Every week or two I wrote a Client Note for my clients. I post the notes to my blog but with a time delay usually between 1 day and 1 week. To receive the Client Notes at the same time as my clients, sign up in the box in the right hand corner of the website.

*****

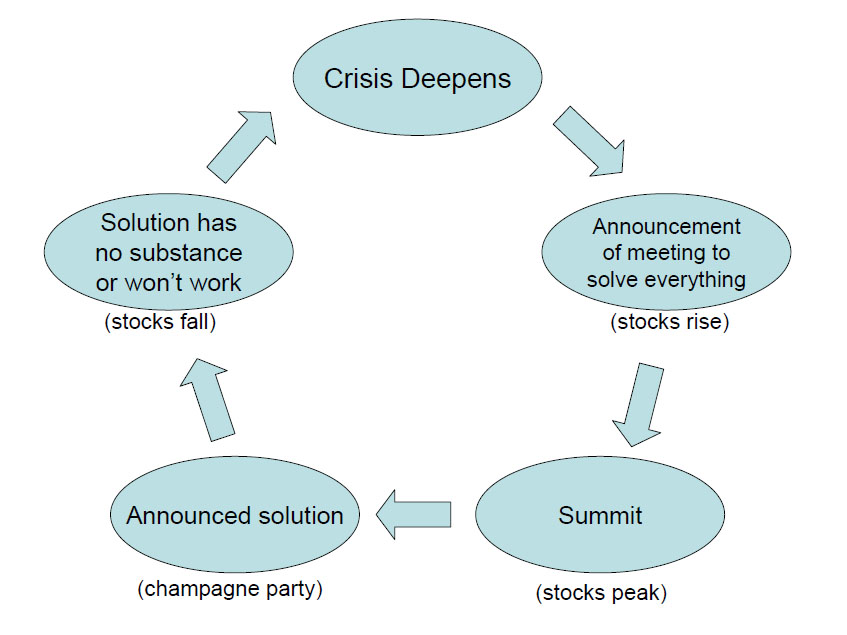

There is a cycle that seems to be repeating itself in the financial markets the last few years. First, the crisis deepens and risk assets fall. Second, risk assets start to rise as investors anticipate a bailout. Third, government officials and regulators deliver on investor expectations leading to a blowout day. Fourth, the euphoria is short lived and the new bailout is soon met with a sell the news reaction. Risk assets fall and the cycle begins again.

Most recently, this cycle played out last October and November (see

“After Euro-Phoria”, October 31, 2011) and it is playing out again right now. The euphoria in response to the €100 billion Spanish bank bailout reached over the weekend (

“Latest Europe Rescue Aims to Prop Up Spain”,

The Wall Street Journal, June 11, A1) was especially short lived as US investors rained on the rest of the world’s party by selling the news almost immediately Monday morning.

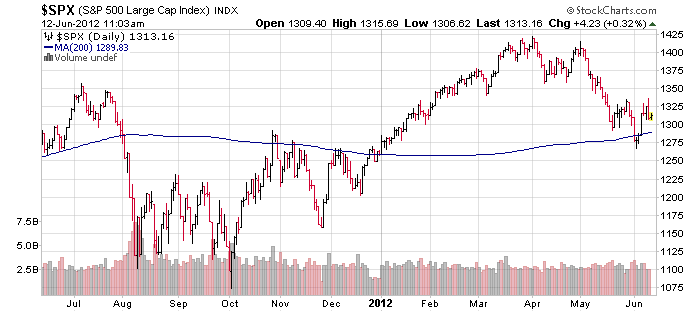

Technically, what we’ve seen over the last two months is best characterized as a severe correction. The S&P 500 is down about 10% from peak to trough. Notably, we saw a bounce last week off of the 200 day moving average.

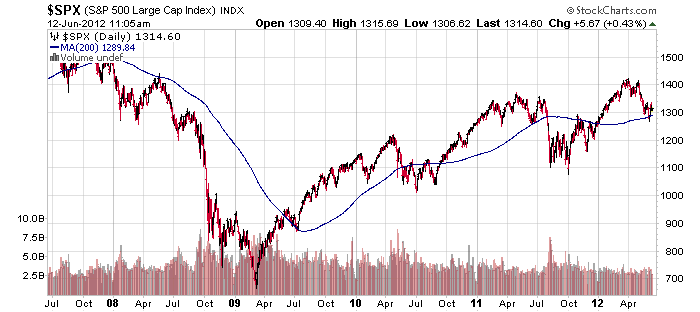

The 200 DMA is probably the most fundamental technical indicator because it is the most widely followed. Conventionally, when the 200 DMA is trending up and the market is above it, stocks are considered to be in a bull market. Conversely, when the 200 DMA is trending down and the market is below it, stocks are considered to be in a bear market. A look at a 5 year chart of the S&P with its 200 DMA shows that it continues to be a good guide for staying on the right side of the market. It is a Wall Street rule of thumb that has stood the test of time.

What all this means is that while investors are quite concerned, experience has taught them to count on the authorities to come to the rescue with another patchwork of bailouts that will keep Europe and the global economy afloat and sustain the bull market for at least a little while longer. Of immediate concern are the Greek Elections this Sunday and the Fed Meeting next week. Some way, somehow, investors are hoping that something will be done to keep the party going. The fate of the markets in the next few months depends on if that hope is validated or disappointed.

Greg Feirman

Founder & CEO

A Registered Investment Advisor

9700 Village Center Dr. #50H

Granite Bay, CA 95746

(916) 224-0113

CALL NOW FOR A FREE INITIAL CONSULTATION!