The Fed Should Pause

There is a tremendous amount of uncertainty and disagreement about what the Fed will and should do on Wednesday. Nick Timiraos provided an excellent overview in an article on the front page of Tuesday’s Wall Street Journal (“Fed’s Interest-Rate Decision Gets Extra Tricky” [SUBSCRIPTION REQUIRED]).

On the one hand are the economists who point to the persistence of high inflation in the recent economic reports and think the Fed should raise 25 basis points. On the other hand are those who point to the failure of Silicon Valley Bank and continuing fear about regional banks (i.e. First Republic) as a reason to pause.

Personally I fail to understand why the Fed shouldn’t be prudent and not risk further igniting the banking crisis by hiking right into it. After all – if things blow over – they can go ahead and raise at their next meeting on May 3. Why must they raise right now with so much fear and uncertainty surrounding the banking situation? It makes no sense to me.

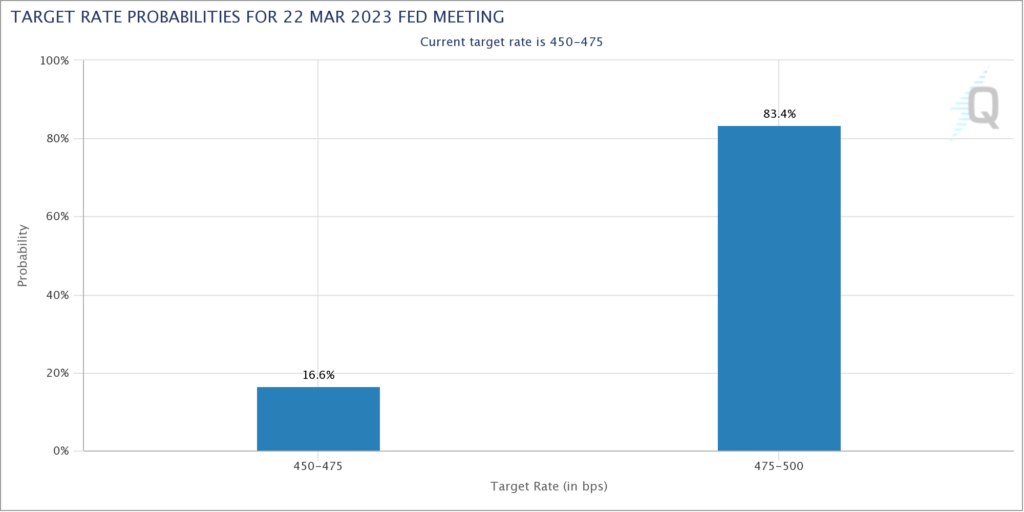

Nevertheless – as you can see in the Fed Futures chart at the top of this blog – markets are placing a 5/6 probability that the Fed will raise by 25 basis points.