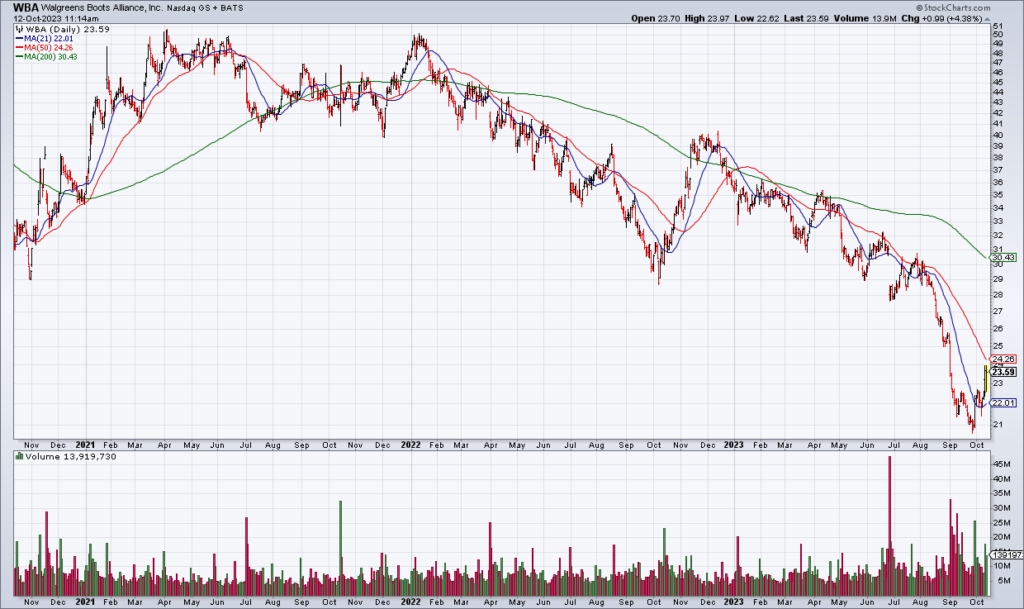

WBA May Be Bottoming

It has been a terrible two years for Walgreens (WBA) with shares losing 60% from their peak. And I have been wrong on the stock for a year and a half now (“Time To Buy WBA”, April 2, 2022, Top Gun Financial). But I think their announcement of 4QFY23 earnings early this morning in which they appointed a new CEO and provided acceptable guidance for FY24 may be the catalyst for a bottom in the stock.

I don’t know anything about new CEO Tim Wentworth but I’m okay with the FY24 guidance they provided. WBA expects revenue of $141-$145 billion, adjusted operating income of $3.4-$3.7 billion and adjusted EPS of $3.20-$3.50. These are not great numbers given the company’s past performance but at least we can be reasonably confident in them since a new CEO is unlikely to set targets he can’t reach. In other words, this is a good start. Now let’s see if they can execute.

The case for the stock is that WBA is an excellent pharmacy brand and the stock is extremely cheap. In the US, Walgreens and CVS (CVS) are the two leading pharmacies in what is essentially a duopoly. Most of us have shopped at both I assume. In addition, if you take the current share price ($23.50) and divide it by the midpoint of the current guidance ($3.35) you get a forward P/E of 7. These two reasons are enough for me to hold onto my position and for others to initiate one if they haven’t already IMO.