Interest Rates & The Fed, 3Q Earnings, Israel-Palestine

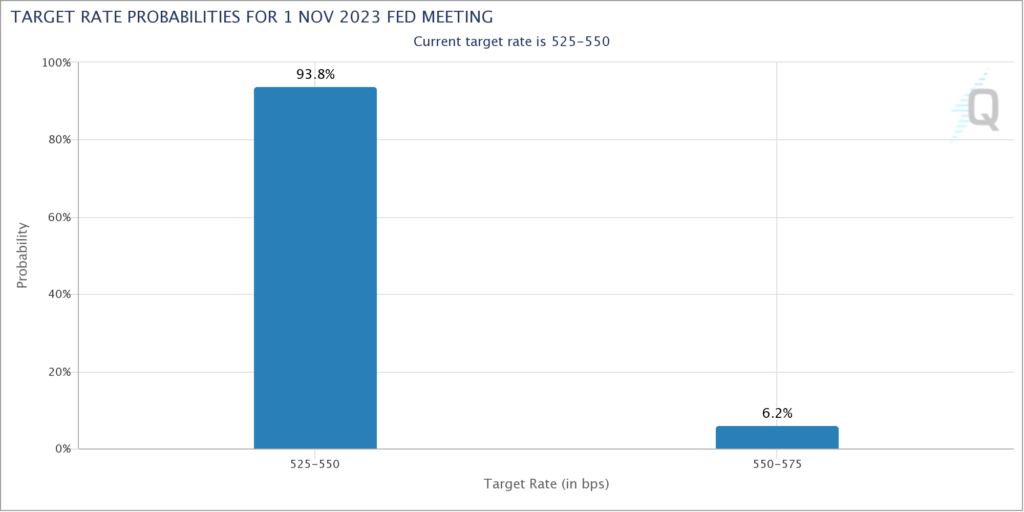

One result of the relentless rise in interest rates – which reversed a bit last week – is that the Fed is now on pause and likely done with its rate hiking campaign. Fed Futures are pricing in a 94% probability that the Fed will pause again at their next meeting on Wednesday November 1. The reason for that is that rising rates are doing the Fed’s job for it by tightening financial conditions without them having to do anything. That’s what it wants but the effect on the economy is yet to be seen.

As I wrote on Monday, investors appear to be leaning bullish heading into 3Q earnings season, expecting flat or even marginally positive year over year earnings growth for the S&P. My thesis is that tightening economic conditions will make themselves felt in earnings sooner rather than later. Will it be this quarter? While three of the big banks kicked off earnings season on Friday, it will really get into full swing next week with the focus being on Tesla (TSLA) and Netflix (NFLX) on Wednesday afternoon. I have 1% short positions in both stocks.

The last thing to mention is the war in the Middle East. Again as I wrote on Monday, investors seem to be looking past this war but it may be a bigger deal than they expect. Everything I have read says that Israel is determined to permanently end Hamas this time. With Iran supporting Hamas and Hezbollah to the north in Lebanon, there is the potential for escalation. As I’ve been saying for a year and a half now, in an increasingly dangerous geopolitical environment, I think at least a small position in defense stocks like Lockheed Martin (LMT) and Northrup Grumman (NOC) makes a lot of sense.