LMT Earnings Were Underwhelming But Ukraine Is A Game Changer For Defense Stocks

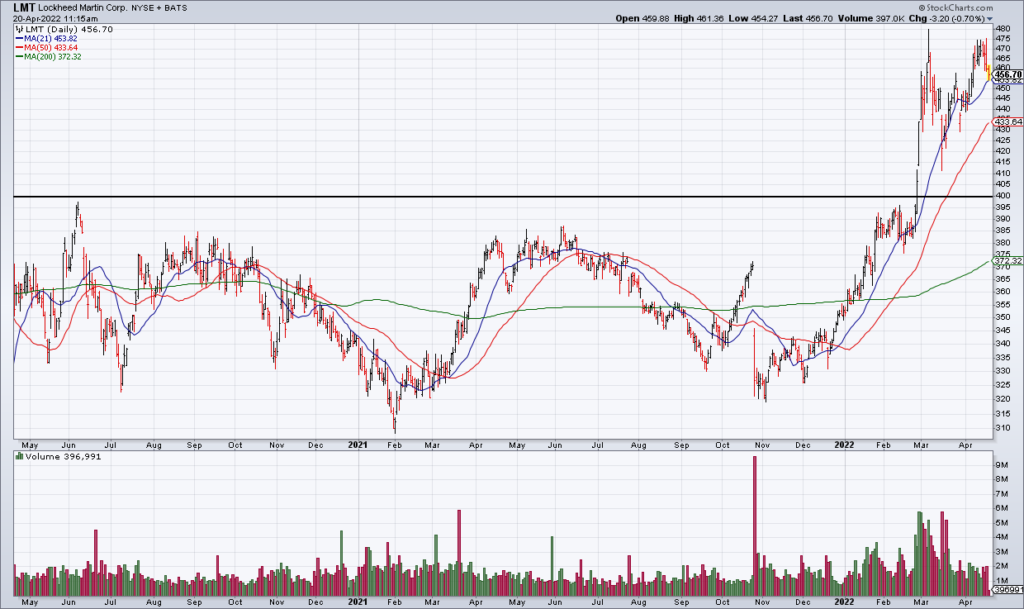

In the wake of Lockheed Martin’s (LMT) underwhelming 1Q22 earnings report Tuesday morning, WSJ Heard on the Street columnist Jon Sindreu argued in Wednesday’s paper that defense stocks may be at “the peak of the wave” after a nice post-Ukraine run and should be handled with care (“Defense Stocks’ Ukraine Premium Needs Handling With Caution” [SUBSCRIPTION REQUIRED]).

Sindreu points out that defense stocks have jumped in the wake of every big military conflict in the last 20 years – only to give back their gains after the immediate sense of danger dissipates. He suggests that the same may well happen this time around.

In my opinion, however, this time is different because Russia’s invasion of Ukraine marks the beginning of a new period of heightened geopolitical conflict. That’s because it’s not only about Russia: the bigger global threat is China and its aspirations to takeover Taiwan. Were China to make a move in that direction it would be the start of a second Cold War. While I’m no geopolitical expert, the heightened climate of danger triggered by Putin’s gamble warrants some exposure to defense stocks.

Sindreu also notes that LMT’s 1Q22 revenue declined 8% and it did not raise 2022 guidance from that given before Ukraine. The latter is noteworthy but defense spending is going up in the US and Europe going forward and that will eventually make its way onto LMT’s bottom line. Sindreu additionally notes that LMT is at its highest valuation since 2018 at 17x forward guidance. Personally, 17x doesn’t concern me given the new geopolitical uncertainty and defense spending climate. (Northrop Grumman (NOC) at 19x pre-Ukraine 2022 EPS guidance doesn’t worry me either. (NOC reports 1Q22 earnings next Thursday morning (4/28))).

So while defense stocks may take a breather as Ukraine stops being front page news, they’re still going higher longer term in this brave new world.