WMT Is Crushing It

It’s been a good week for Top Gun as Home Depot (HD) reported a bad quarter on Tuesday morning and Walmart (WMT) just reported an excellent one. (Last week was a different story as PayPal (PYPL) disappointed).

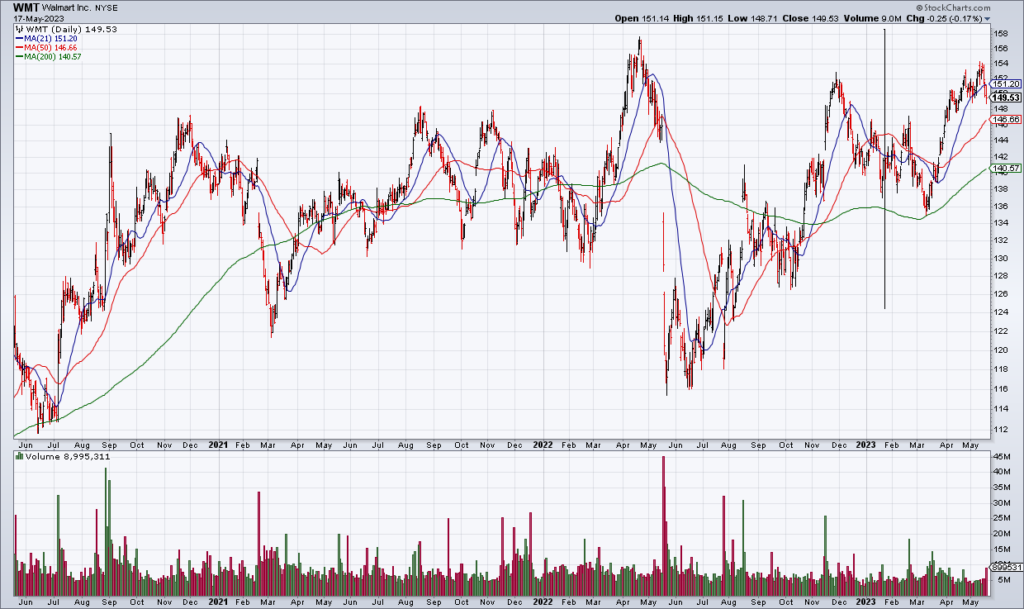

In “WMT Earnings Preview” on Sunday, I said that while I didn’t see a great edge in WMT at the moment, I did expect it to continue chugging along with total returns in the 10-12% annually. But based on this morning’s report, perhaps WMT can deliver 15-20% in the next 12 months.

WMT US Comps excluding fuel increased an impressive 7.4% in the quarter ended April 30, 2023. Note the contrast with a more discretionary retailer like HD whose comps declined 4.6% over the same period. As a result, WMT increased its full year EPS guidance to $6.10-$6.20 from $5,90-$6.05. WMT shares are currently +2% in the premarket. I’m expecting new all time highs later this year.