XLU PCG: Defense Wins Championships

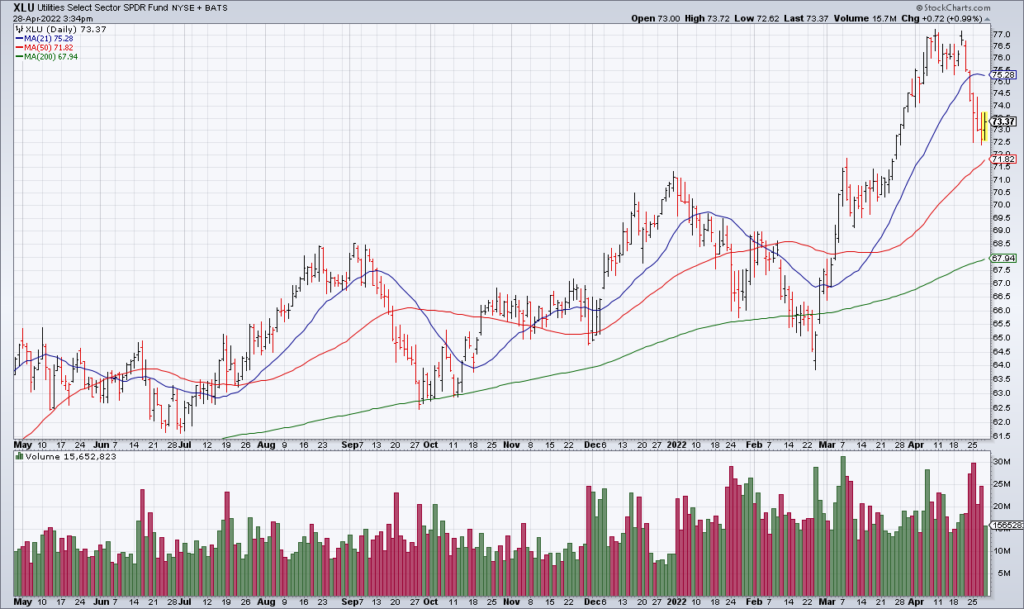

The only two S&P sectors in the green this year are Utilities (XLU) and Consumer Staples (XLP) – two of the most defensive sectors along with Healthcare (XLV). The best way to play utilities is to get broad exposure via XLU. However, PG&E (PCG) – the troubled Northern California utility – is an interesting turnaround play for those who want to take a little more risk for a little more potential reward.

PCG stock has been decimated in the last five years due to liability from fires their equipment has caused. In fact, the company went into bankruptcy in that timeframe. However, the company appears to be turning things around under new CEO Patti Poppe. The stock is up about 50% in the last 9 months and they reported a solid 1Q22 this morning.

EPS of 30 cents compared to 23 cents a year ago and they maintained full year 2022 guidance of $1.07-$1.12. While PCG does not pay a dividend – unlike most utilities because of their financial troubles in recent years – the company is inexpensively valued, has a captive and attractive market in Northern California and therefore a lot of upside if management can right the ship.

In good times or bad, people need electricity i.e. demand is inelastic. If you think we’re headed for a rough patch and want to tilt your portfolio defensively like me, consider XLU and even PCG.