Despite ATHs The Market Is In Serious Trouble, AMAT WDAY PANW INTU Earnings

It’s a crazy thing to say but: Despite the S&P and NASDAQ each closing at new ATHs Thursday, the market is in serious trouble. That’s because breadth has fallen off a cliff and the market is being carried by a few mega cap names that are masking this.

For example, the S&P as a whole was +0.34%. But if you look beneath the surface, the gains were all due to the largest stocks in the market. The S&P 100 (OEF) – the 100 largest stocks in the index – was +0.56% while the Equal Weight S&P (RSP) was -0.37%.

The same kind of thing can be seen on the NASDAQ (+0.45%) where QQQ was +1.04% – led by AAPL (+2.85%), AMZN (+4.14%) and NVDA (+8.25%) – while the popular Ark Innovation ETF (ARKK) – made up of smaller tech stocks – got crushed -2.48%. More to the point, FANGMAN (FB AAPL NFLX GOOG/GOOGL MSFT AMZN NVDA) was +2.61% – and is now 75% above its 200 DMA – as you can see in the chart of the day above by Greg Rieben.

Only 32% of securities on the NYSE + NASDAQ were up on the day. 409 stocks on the NASDAQ closed at 52 week lows – the most ever at an all time high as you can see in the tweet above by Mac10 – compared with only 158 that closed at 52 week highs.

In other words, the market is now completely dependent on AAPL, AMZN, MSFT, GOOG/GOOGL, FB, TSLA and NVDA. They are the ones dragging the indexes higher while most stocks beneath the surface are rolling over. This thin of a market can only persist for so long.

The weakness in important but not leading stocks will likely be on evidence Friday in Applied Materials (AMAT), Workday (WDAY) and Palo Alto Networks (PANW), which all reported earnings Thursday afternoon.

There was nothing terribly wrong with $144 billion semiconductor equipment manufacturer AMAT’s report. Revenue was +31% and EPS +55% compared to a year ago. The stock has just had a huge run and is expensive at 23x FY21 EPS. It is currently (4am PST) -6% in the premarket.

The same can be said about $76 billion enterprise cloud software maker Workday (WDAY). Revenue was +20% and EPS +28% compared to a year ago. But after a huge run and at ~70x 2021 EPS the stock is apparently exhausted. It is currently -7% in the premarket.

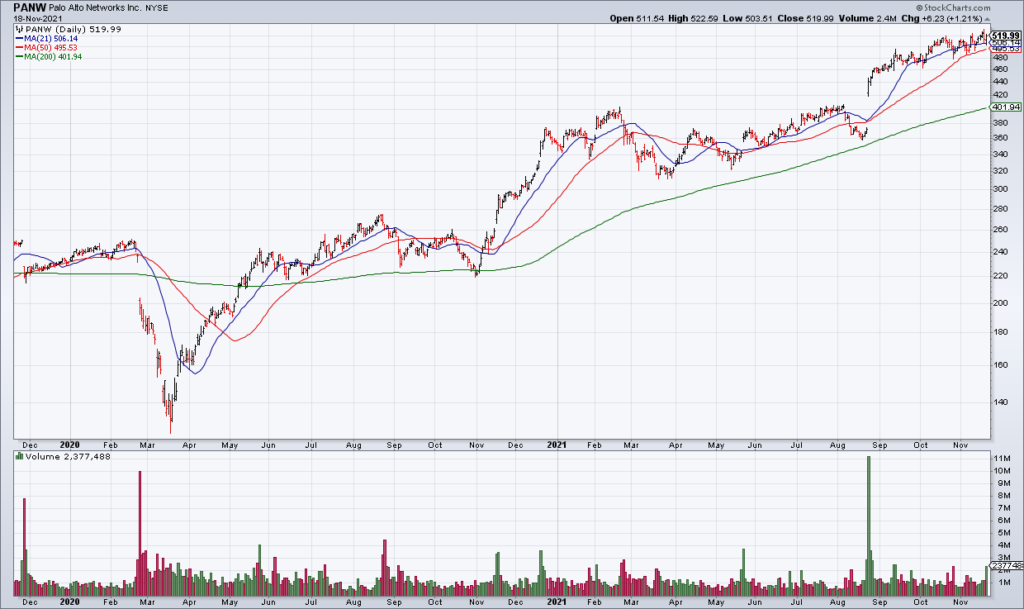

$54 billion cybersecurity software company Palo Alto Networks (PANW) chart and valuation look very similar to WDAY – though it appears set to continue defying gravity tomorrow for the time being. Revenue was +32% but EPS only +1% compared to a year ago. Like WDAY, it’s trading at ~70x its current fiscal year guidance. While it is +3% in the premarket, its high wire act can probably only continue for a bit longer.

One soldier clearly bucking the trend is $174 billion personal finance software company Intuit (INTU). INTU reported 52% revenue and 63% EPS growth compared to the year ago quarter. They also guided current FY revenue growth to 18%-20% excluding Mailchimp and EPS growth to 18%-20% as well. While the stock is currently trading at greater than 50x current FY EPS guidance, it is +14% in the premarket and poised to surge to new all time highs today.

One by one the soldiers are falling by the wayside. When the generals start to as well it will be seen that the emperor has no clothes.