Boom Or Bubble? TSLA Earnings

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

The US economy is poised to grow at its fastest pace in decades, carried along by a wave of pent-up demand built during the pandemic and the trillions of dollars of support the government has provided over the past year.

But what that boom will look like – how long it will last, what it might do for employment, how much inflation it might generate – isn’t clear. The grab bag of history doesn’t offer many periods in living memory when gross domestic product grew as quickly as forecasters expect for this year, and those past experiences came about when the composition of the economy was very different from today.

Economists surveyed by IHS Markit estimate on average that real, or inflation-adjusted, GDP will be 6.7% higher in the fourth quarter of 2021 than it was a year earlier. That would mark the strongest year of growth since 1983, when the economy was, as it is now, taking off out of a deep recession. Even that could prove to be conservative, as there is still a measure of caution in the current forecasts, reflecting the possibility that the COVID-19 crisis could flare up again – Justin Lahart, “History Only Hints At Boom To Come” [SUBSCRITPION REQUIRED], WSJ Heard on the Street, April 26

This is very different to any other bubble we’ve had ever. All of the previous bubbles occurred when economic conditions looked nearly perfect. This has been quite different because the market started its incredible surge in a rather wounded economy – Jeremy Grantham quoted in “Wild Market Ride Lifts All Assets” [SUBSCRIPTION REQUIRED], Akane Otani and Michael Wursthorn, WSJ B1, April 26

The art of economics consists in looking not merely at the immediate but at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups – Henry Hazlitt, Economics In One Lesson

There is a debate among economists about whether we are on the verge of one of the greatest economic booms in history or whether the current market rally is the bubble of all bubbles. The consensus view reflected in market prices is the former. The latter is the correct one in my opinion.

Unfortunately, almost no economists on Wall Street understand Austrian Economics. Going back to The Theory of Money and Credit (1912) and most famously in Human Action (1949), the Austrian School’s most illustrious exponent, Ludwig von Mises, explained the nature of the artificial booms created by central bank money creation.

While the QE-fueled “boom” we are undergoing is something von Mises had no experience with and did not anticipate, the insights of Austrian Economics can easily be applied to it. The charts of the Fed and ECB Balance Sheets in the above tweets by Holger Zschaepitz contain the answer to the riddle. The Fed has infused ~$3.5 trillion and the ECB ~€3 trillion into financial markets since COVID.

It is no surprise that such a large infusion of newly created money into the financial system should result in a massive increase in prices. And, in fact, that is what has primarily caused the boom in financial markets we have experienced since the March 2020 lows, not the beginning of an economic boom based on economic fundamentals. It is incredible to me how little understood this is.

So what? The problem with this is that the boom in financial markets we are experiencing is, therefore, a mirage. It is not the result of real economic growth. And it cannot last. That’s because it is going to result in nasty side effects, like most powerful drugs. In this case, that side effect will be inflation. In fact, inflation is already here and will only accelerate with economic reopening.

To apply Henry Hazlitt’s quote from above, the short term consequence of the massive QE undertaken by the Fed and ECB has been to boost financial markets and create the appearance of an economic boom. However, this is just a mirage and the long term effect will be massive inflation that will wreak havoc on the economy. This is, indeed, the bubble of all bubbles.

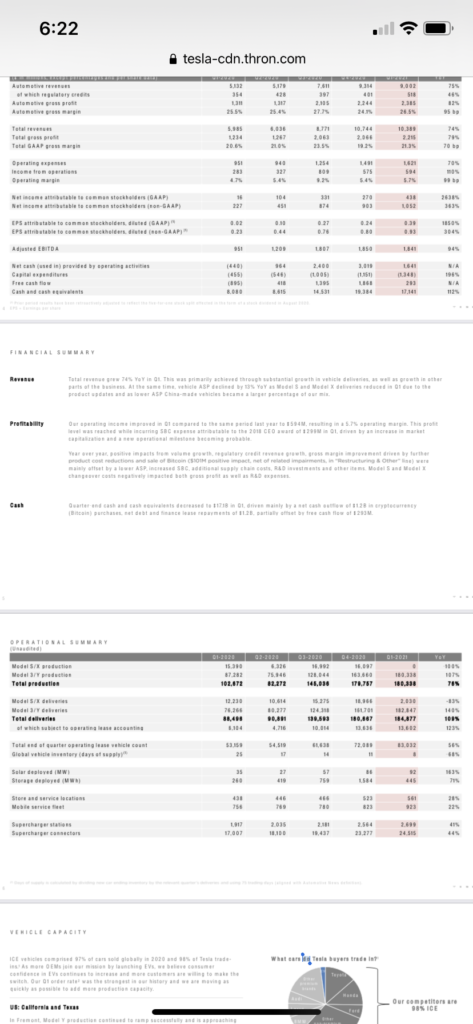

If we’re going to talk about the bubble, we should talk Tesla (TSLA), the bubble stock du jour, which reported 1Q21 Earnings Monday afternoon. If you look closely at the section titled “Profitablity” in the excerpt from TSLA’s 1Q21 Earnings Release above you will see that $101 million of TSLA’s 1Q21 profit came from speculation in Bitcoin.

Fundamental analysts have long criticized the quality of TSLA earnings due to the large component consisting of sales of Automotive Regulatory Credits rather than selling cars. Well, with $101 million profit from speculation in Bitcoin in 1Q21, there is another reason to dig deeper into TSLA’s financials to understand just how much money they make from their core business of selling cars.

In the 1Q21, TSLA’s Non-GAAP Net Income was $1,067 million (Earnings Release, pg. 27). $518 million of that came from selling Automotive Regulatory Credits (pg. 4) and $101 million from Bitcoin speculation (pg. 5). If I am correct that the contribution from Automotive Regulatory Credits and Bitcoin are after tax, TSLA’s Non-GAAP Net Income from the sale of cars was $448 million or 40 cents/share versus the 93 cents/share they reported. Neither is very significant for a stock that closed Monday at $738.20.