“Digestion” Day, Excluding Tech Market Looks Strong, ORCL Earnings

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

Wednesday was what the great short term trader and technician Scott Redler likes to call a “Digestion” Day. That’s because while the indexes didn’t do much, they digested the huge gains from Tuesday. You also frequently hear these kinds of days described as “Consolidation” Days. At any rate, they are bullish because previous gains are “digested” or “consolidated” despite the lack of movement and set the stage for the next leg higher which we may see today with the S&P Futures +0.74% and the NASDAQ Futures +1.81% as of 1:08am PST.

The S&P was +0.60%, the NASDAQ -0.04% and the Russell +1.81%. The NASDAQ had the biggest up day on Tuesday and has been getting hit by the rotation from Growth to Value so its action was quite bullish in my opinion despite being flat.

Scanning out, the NASDAQ’S 50 DMA is very much in play today. I’m a seller at that level but a close above does add weight to the bulls’ contention that the previous three weeks were just a correction within a bull market, not the beginning of a bear market.

Tech has been the leader of the bull market since 2009 so the rotation from Growth to Value, which looks durable, suggests to me the end of the bull market since Growth, the biggest part of which is Tech, is so much larger than Value, which can’t carry the market higher on its own. Nevertheless, it’s worth pointing out that the market is holding up quite well outside of tech.

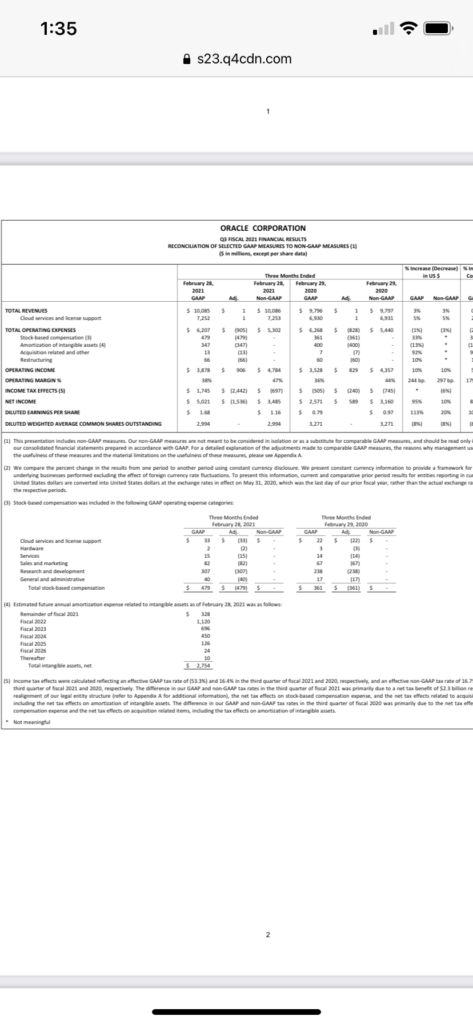

Lastly, I’d like to comment on Oracle (ORCL, Market Cap $207 Billion) earnings from yesterday afternoon. As I wrote in Wednesday morning’s “ORCL Earnings Preview“, ORCL was the “hottest tech stock around” in the words of the WSJ’s Dan Gallagher heading into the report. With the stock up almost 20% in thirteen days in the wake of Eric Savitz’s masterful Barron’s Cover Story on ORCL as a cheap cloud play, the expectations bar had risen according to Gallagher.

Moving to the report, the quarter was solid with Revenue +3% and Non-GAAP Net Income +10% but the stock is off almost 5% in the premarket after the big runup. Again, as I wrote yesterday morning, I’m a buyer at the 21 DMA ~$65. I may even nibble a couple dollars higher today.