Fade The Rally

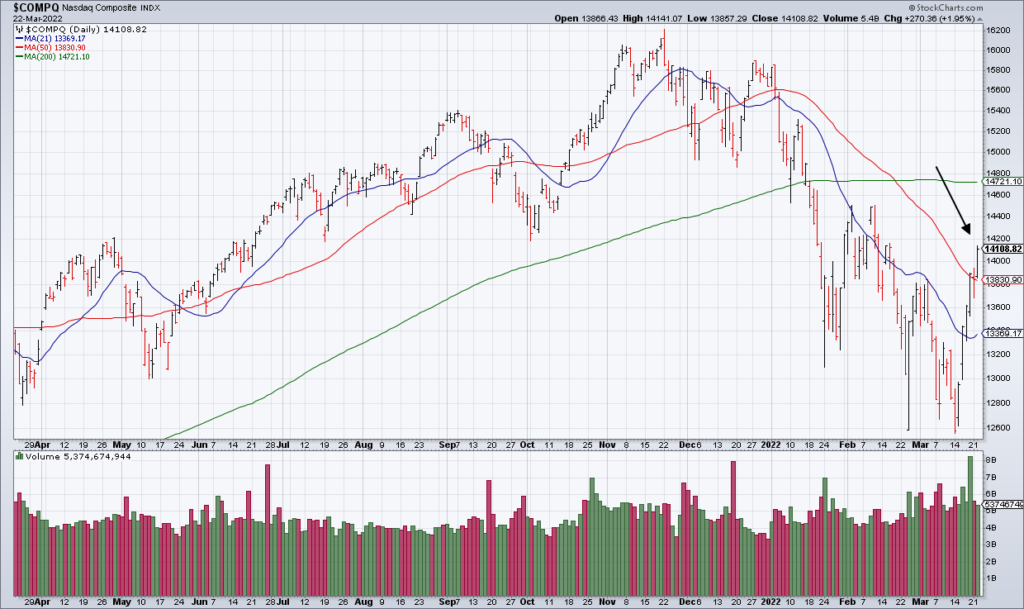

Monday after the close I suggested that the NASDAQ’s rally off last week’s lows might be petering out due to rising interest rates and resistance at the 50 DMA. Tuesday’s 1.95% rise in the NASDAQ combined with the continued rise in interest rates only makes this a juicier selling opportunity in my opinion.

The NASDAQ is now the highest above its 50 DMA since the first trading day of 2022 and interest rates are in clear breakout mode. I explained on Monday why these two facts are in tension with each other. While it’s extremely psychologically difficult to fade this kind of price action and bullish sentiment, I believe it’s the right move.

Sentiment is a pendulum that follows price. As price goes down, sentiment turns more bearish; as it goes up, sentiment turns more bullish. At a certain point, markets frequently overshoot in one direction or the other. The explosiveness of the current rally shows that we overshot to the downside previously. My sense is that we’ve now overshot to the upside.

The short squeezes in Gamestop (GME) and AMC Tuesday were reminiscent of early 2021 and a tell that retail may be leaning a bit too bullish.

While I don’t recommend all or nothing trades because timing the market perfectly is impossible, I do recommend fading extreme moves in either direction.