Hard Assets > Digital Assets: Understanding The New Macro Regime

For more than 15 years, the best strategy which would have made you a fortune was simply to buy and hold The Magnificent 7. It was that easy. My premise is that that regime is now over and we are entering a new one with a new set of winners.

Let’s start with the tape. Over the last 14 1/2 weeks (since Wednesday October 29, 2025), The Magnificent 7 have badly underperformed (-7.69%) while the rest of the S&P 500 has performed superbly (RSP: +6.20%). The net result for the S&P as a whole has essentially been flat (+0.60%). I have also included the performance of The Dollar (UUP: -3.05%), The S&P Metals & Mining Sector (XME: +24.62%) and The S&P Consumer Staples Sector (XLP: +12.13%) in the chart above.

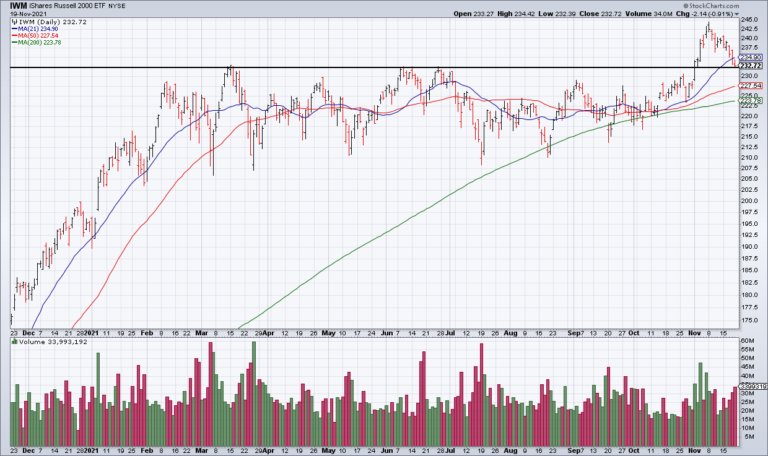

While bulls are celebrating the large number of 52-week highs and low number of 52-week lows, those are smaller stocks with small weightings in the S&P. It will be difficult for the market cap weighted S&P to go much higher without The Magnificent 7 participating because they make up ~35% of its market cap.

It’s also interesting to note the enormous dispersion of returns between the different sectors of the S&P since October 29. Tech, Communications Services (top two holdings: GOOG/GOOGL & META) and Consumer Discretionary (top two holdings: AMZN & TSLA) have notably underperformed while Energy, Industrials and Consumer Staples (and Health Care) have led.

What does it all mean?

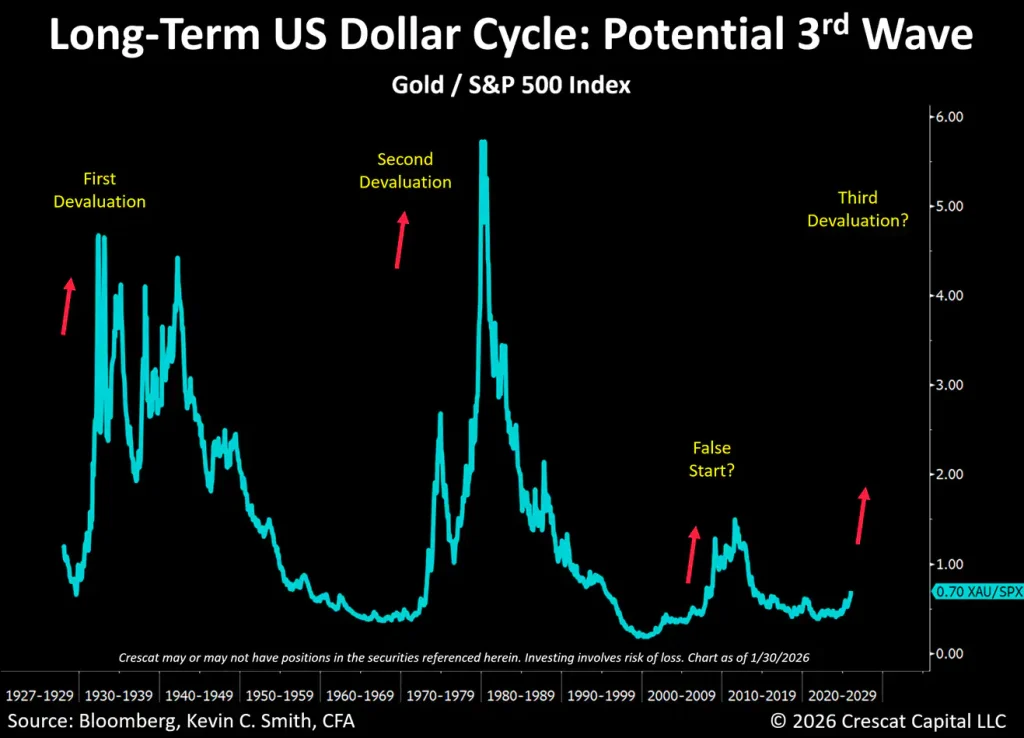

I think Kevin Smith, CEO of Crescat Capital – one of the best performing hedge funds in the world at the moment – nailed it in his January 31 letter:

We believe we are on the cusp of the third devaluation wave of the long-term US dollar cycle. The first wave was during the Great Depression, when President Franklin D. Roosevelt issued Executive Order 6102 on April 5, 1933, requiring Americans to surrender most of their privately held gold to the Federal Reserve by May 1, 1933. He then officially devalued the dollar by raising the gold price from $20.67 to $35 per ounce on January 31, 1934. The second major wave began on August 15, 1971. That was when President Richard Nixon announced the closing of the “gold window”, which ended both the direct convertibility of the U.S. dollar to gold for foreign governments as well as the Bretton Woods system of fixed exchange rates.

This thesis integrates all of the performance data summarized at the start of this blog. As we noted, the dollar (UUP) is -3.05% while The S&P Metals and Mining Sector is +24.62% while Technology (XLK), Communications Services (XLC) and Consumer Discretionary (XLY) underperform. In other words, investors are rotating out of digital assets into hard assets as the dollar comes under pressure as the global fiat monetary order that has existed since Nixon removed the last link to the gold standard on August 15, 1971 unravels. In this new regime, the old formula (MAGS) is being replaced by a new one: Hard Assets > Digital Assets.

The outperformance of Energy, Industrials, Consumer Staples and Health Care also fits nicely into this framework. Energy is a hard asset and you need Industrials to get the hard assets out of the earth and turn them into the infrastructure that makes the world go. Consumer Staples and Health Care are defensive sectors that investors are rotating into as well during this transitionary period.

I would be remiss if I didn’t mention the outperformance of everything by the precious metals which also fits into the framework. Historically, gold and silver backed paper money and we are now in the process of reverting back to that conception of money. You can see this in the increasing proportion of gold and decreasing proportion of the dollar comprising central bank reserves.

The days of achieving significant outperformance by buying and holding The Magnificent 7 are over. Artificial Intelligence is an important vector going forward but the dominant one is the unraveling of the fiat money based global economic order. Most investors are stuck in the previous paradigm while few understand the new one. Those who do will make the real money in the years ahead while the rest will be left behind.