Looking Ahead: Jobs Report, CPI And The Fed

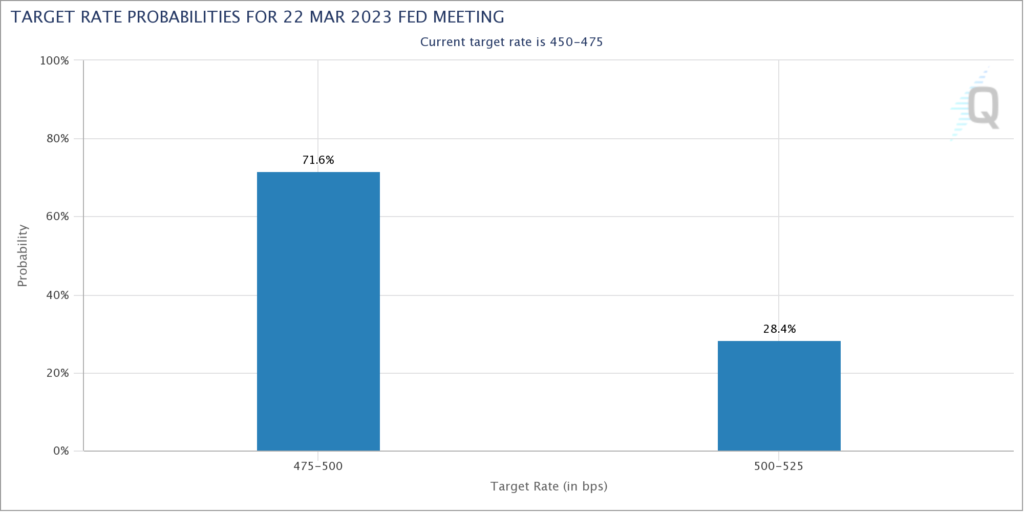

I have been writing a lot about individual stocks in recent weeks but for the next few weeks macro will take center stage leading up to the Fed Decision on Wednesday March 22. As you can see in the chart above, Fed Futures markets are assigning a 72% probability of a 25 basis point hike and a 28% probability of a 50 basis point hike – and expectations for the latter have increased dramatically over the last month (for reasons discussed below in the section on Jason Furman’s WSJ Op-Ed). In other words, there is a good deal of uncertainty heading into the next Fed Decision and which decision they make may be decisive for short term market direction.

There are two key reports in the next two weeks that will likely determine what the Fed does. First: On Friday March 10 is the February Jobs Report. Then on Tuesday March 14 is the February CPI Report. While I have no clue what those reports will say, obviously stocks would prefer dovish data and a 25 basis point hike.

Harvard Economist and Obama’s Chair of The Council of Economic Advisors Jason Furman argued for a 50 point hike in a piece in The Wall Street Journal on Friday. His argument is that the most recent economic data shows that inflation remains persistently high and if the Fed is truly data dependent it should now raise by 50 basis points. The problem with his argument is that it depends on lagging economic reports – rather than real world prices. If you look at real time prices – and what else really matters when we’re talking about inflation? – they are all rolling over. Nevertheless, I’m sure his position holds sway with many economists and analysts who focus on the economic reports rather than market prices – and this kind of thinking will weigh into the Fed’s deliberations. (Furman has been very active on Twitter since his WSJ piece so you can further explore his thinking on his feed if you like).

Meanwhile the price action continues to lean bullish as the major indexes bounced off their respective 200 DMAs Thursday and Friday.

The most important level in my opinion is 4% on the 10 year treasury. If yields start to breakaway to the upside, that will tighten financial conditions and put a lid on stocks. If – however – they can stay below 4% I think stocks could be okay in the short term. Which way they go will depend on the Jobs Report, the CPI Report and The Fed.