Market Preview Week Of Feb 6-10: SPG UBER & PYPL

Thankfully, next week will slow down from last week’s epic pace so that perhaps we can catch our breath. Nevertheless, there are a few earnings reports that I’ll be focusing on: Simon Property (SPG), Uber (UBER) and PayPal (PYPL). The first is a large owner of malls in the US and the latter two are important companies in the secular trend toward a digital economy.

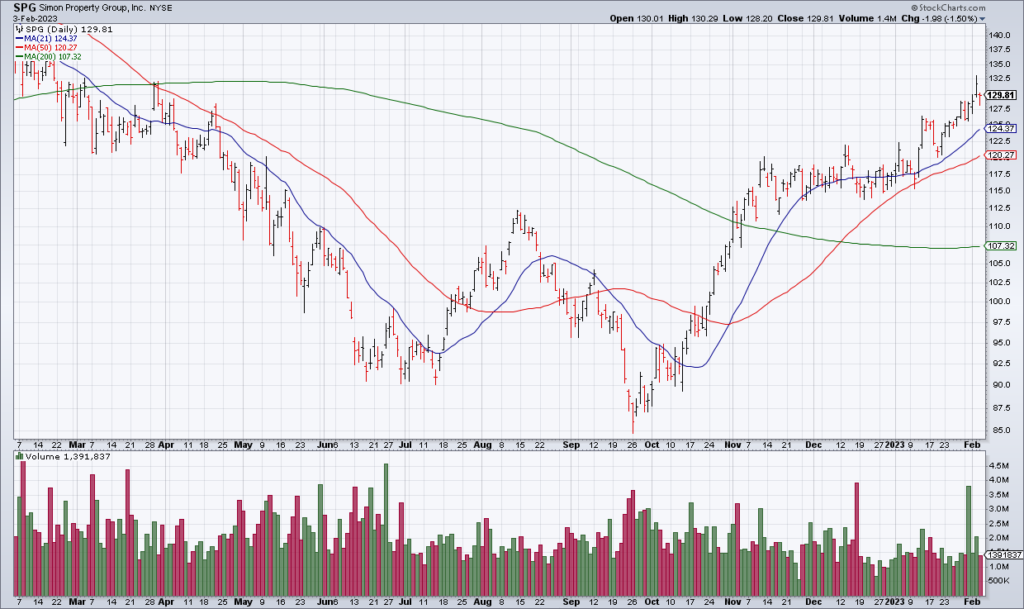

SPG reports on Monday afternoon. As you can see in the chart above, the stock has been essentially straight up for the last four months, a more than 50% move. Mall rents are very sensitive to economic activity – however – and my concern is that SPG shares are pricing in an imaginary economic recovery. Any unexpected weakness in their results could result in a selloff after such a big move.

Let’s start with UBER which reports on Wednesday morning. After UBER’s last quarter, I was so impressed that I actually bought a small position (“UBER Is Turning The Corner”, Top Gun Financial, November 1, 2022). However, the stock has continued to run up during this incredible rally we’ve had to start 2023 and I no longer have a position.

Still, I’m impressed with what UBER is doing. Last quarter they guided 4Q22 Gross Bookings to +23%-+27% in constant currency to $30-$31 billion and Adjusted EBITDA of $600-$630. As I wrote last quarter, I can now see a path to profitability for UBER and I think the company will be a long term winner. I’m interested to see if UBER can meet its lofty guidance and will be keeping an eye on the stocks reaction.

Next, I’m interested in PYPL’s report Thursday afternoon. PYPL has been annihilated during the bear market but its fundamentals give me no reason not to believe that it will be an important player in the digital economy for a long, long time. (see “PYPL: Blood In The Streets”, Top Gun Financial, November 4, 2022). As a growth stock, the most important metric for PYPL is the amount of business transacted through its various platforms (PayPal, Venmo, etc..) or Total Payment Volume (TPV). PYPL stock also ran up in this rally to start the year so I don’t want to be long going into earnings but I’ll be paying attention to the results and the reaction.

In conclusion, both UBER and PYPL are long term winners IMO and stocks that I want to own but maybe not just yet.