The Failure Of Post Modern Economics

Post Modernism in philosophy can best be defined as the rejection of an objective reality. The argument is that human thought is inherently subjective and there is no objective arbiter of truth. Therefore, there is only the clash of opinions. While abstract, the acceptance of such a view by a culture has disastrous consequences – and we in the West are currently in the midst of experiencing them. In this blog I want to discuss the rise of Post Modern Economics and how it will result in The Second Great Depression.

The basic problem of economics is scarcity. Human beings have unlimited wants but reality presents us with scarce resources. Constructive economics addresses the problem of scarcity by showing us how to maximize production in order to best satisfy our wants. Post Modern Economics simply denies scarcity as a “narrative” as Stephanie Kelton put it in her best selling Post Modern Economics book The Deficit Myth. The problem with denial is that it doesn’t change the facts. Reality always has the last word.

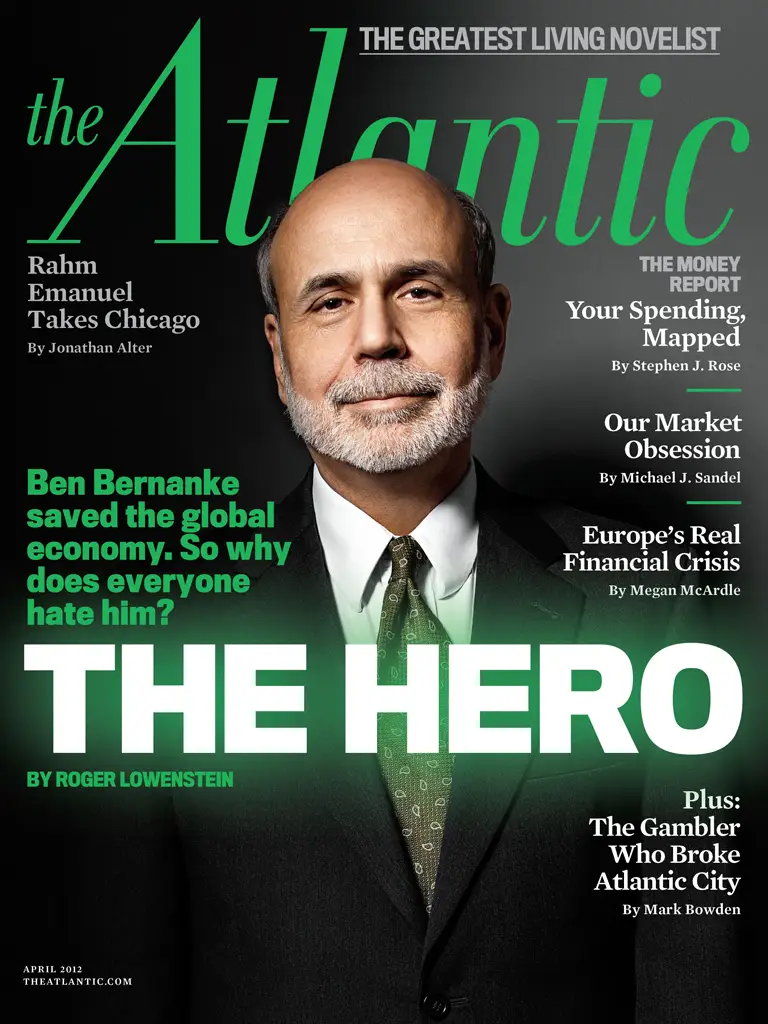

The origin of Post Modern Economics can probably best be dated to Ben Bernanke’s “helicopter money” speech on November 21, 2002. The idea is that deflation can always be countered by the creation of more money. It’s no surprise that Bernanke was the originator of Quantitative Easing (QE) – effectively the same thing as helicopter money – when he was Fed Chair in 2008. Obviously creating money out of thin air does nothing to deal with scarcity – though the rising prices it causes creates the illusion of prosperity. QE saved the economy from a Depression in 2008 but only by injecting the patient with more drugs. More classically oriented economic thinkers like myself expected QE to cause inflation but – for whatever reason – it didn’t. Until now.

When Jerome Powell faced a locked down economy and crashing stock market in the wake of COVID-19 in March 2020 he decided to do “whatever it takes” – to borrow a phrase from former European Central Bank Head Jean-Claude Trichet. And while the creation of trillions of dollars of new money did pull us out of the COVID Crash for a minute, it finally resulted in inflation.

And so we are now facing the consequences of the bad economics of the last 15 years. The Fed is trapped between rising inflation and an imploding asset bubble. The right thing for it to do is to tackle inflation at whatever the cost because it is the greater threat to the long term health of the economic system. However, in my opinion, The Fed is likely to be reactive, that is, alternating between tackling inflation and propping up the asset bubble depending on whichever concern is more pronounced at the moment. The result will be failure on both fronts and a Second Great Depression.